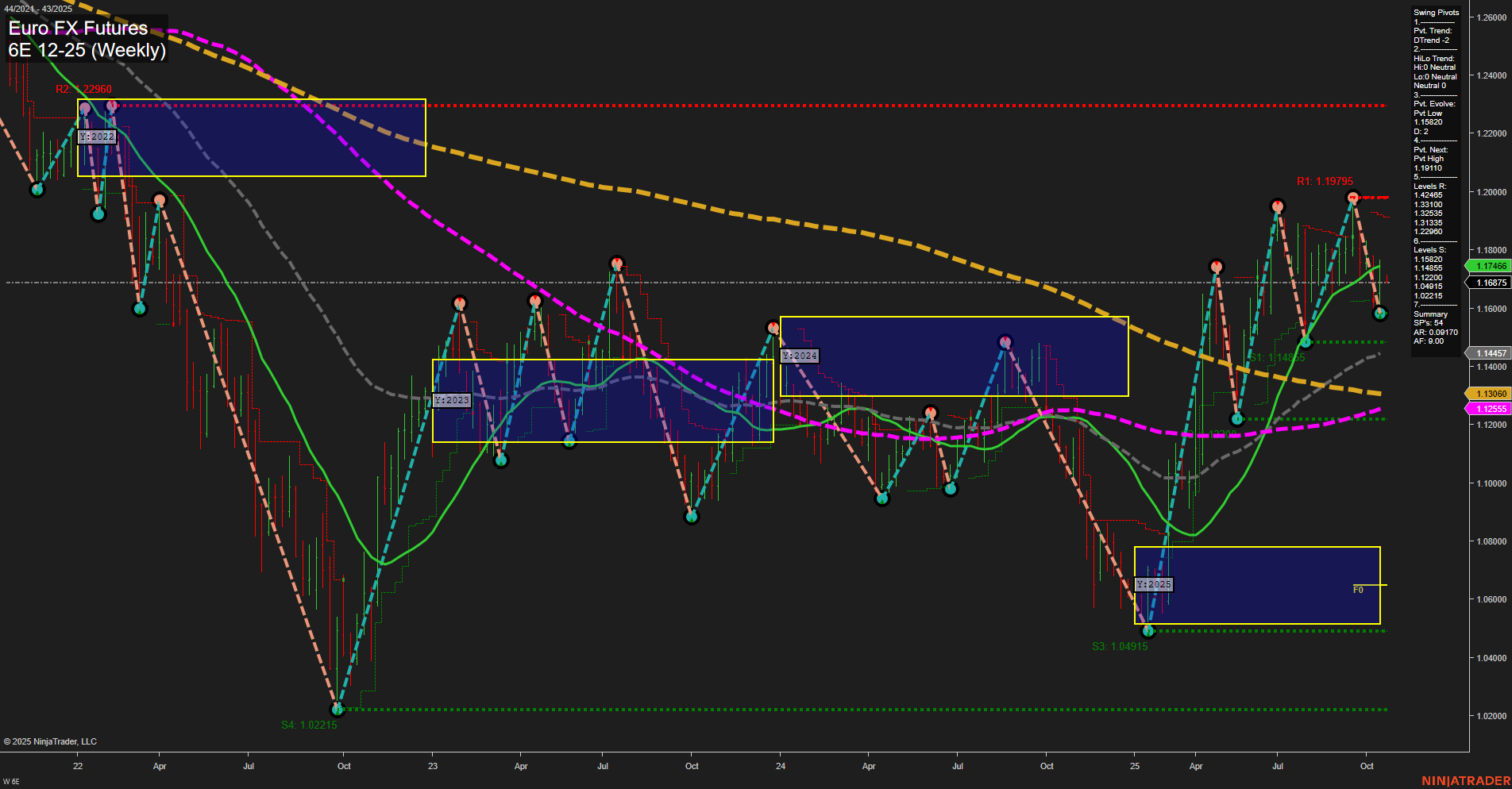

The 6E Euro FX Futures weekly chart shows a market in transition. Price action is currently consolidating near the 1.1675 level, with medium-sized bars and average momentum, reflecting a pause after recent directional moves. The short-term WSFG is neutral, indicating indecision and a lack of clear bias at the weekly session level. Intermediate-term MSFG is trending down, with price below the monthly session grid, suggesting some underlying weakness or corrective action. However, the long-term YSFG remains firmly bullish, with price well above the yearly grid and an uptrend in place. Swing pivots highlight an upward trend in both short- and intermediate-term structures, with the most recent pivot low at 1.1445 and the next resistance pivot high at 1.1979. Key resistance levels are clustered above, while support is established at 1.1445 and lower at 1.1360 and 1.0491, providing a clear framework for potential retracements or breakouts. Benchmark moving averages across all but the 200-week are in uptrends, reinforcing the longer-term bullish structure, though the 200-week MA remains in a downtrend, hinting at residual overhead pressure from the broader cycle. Recent trade signals show mixed short-term activity, with both long and short entries triggered in close succession, further supporting the neutral short-term outlook. Overall, the market is consolidating after a strong recovery, with long-term bullish momentum intact but short- and intermediate-term trends showing signs of pause and potential retracement. The setup suggests a market in a digestion phase, with traders watching for a breakout above resistance or a pullback to test support before the next directional move.