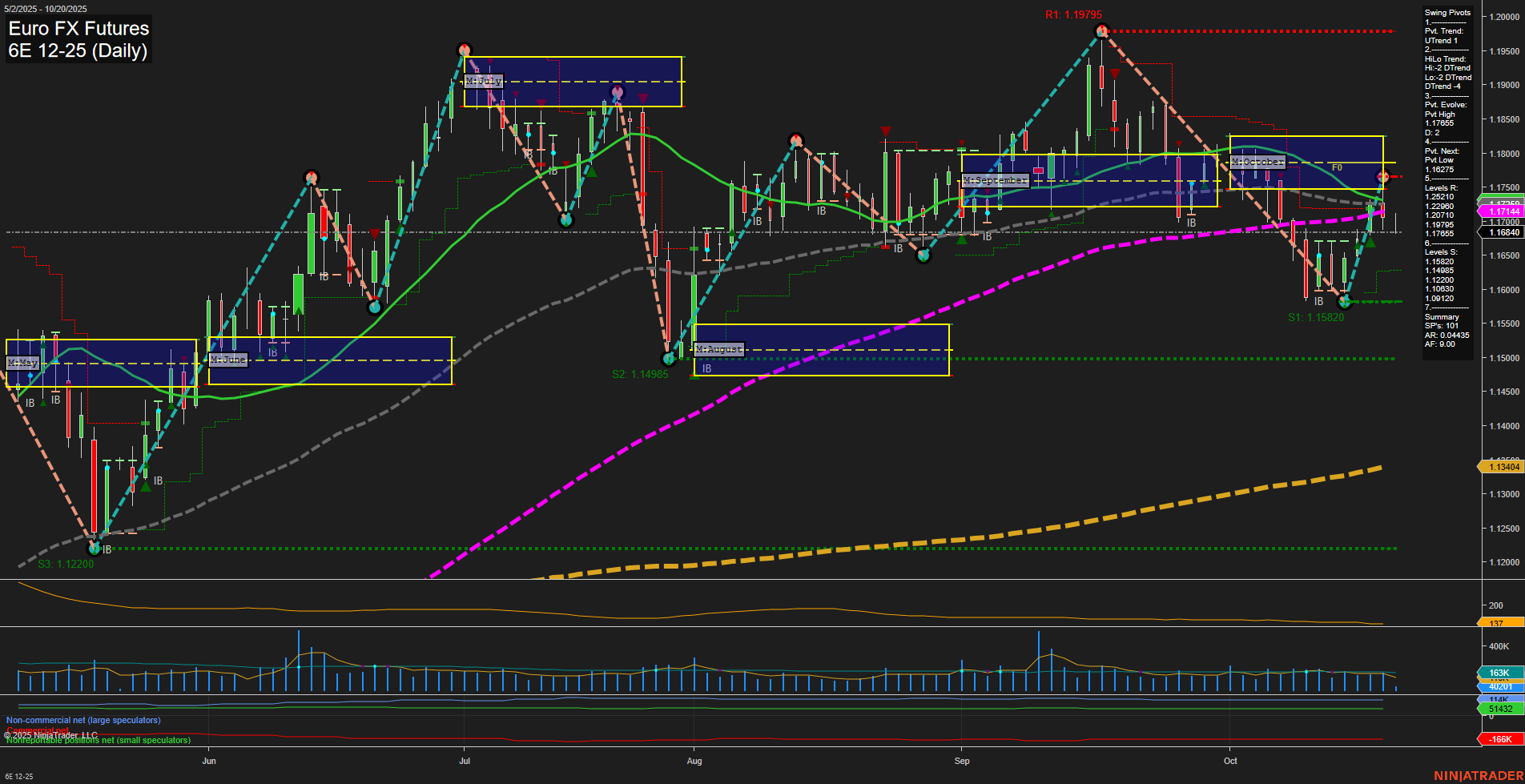

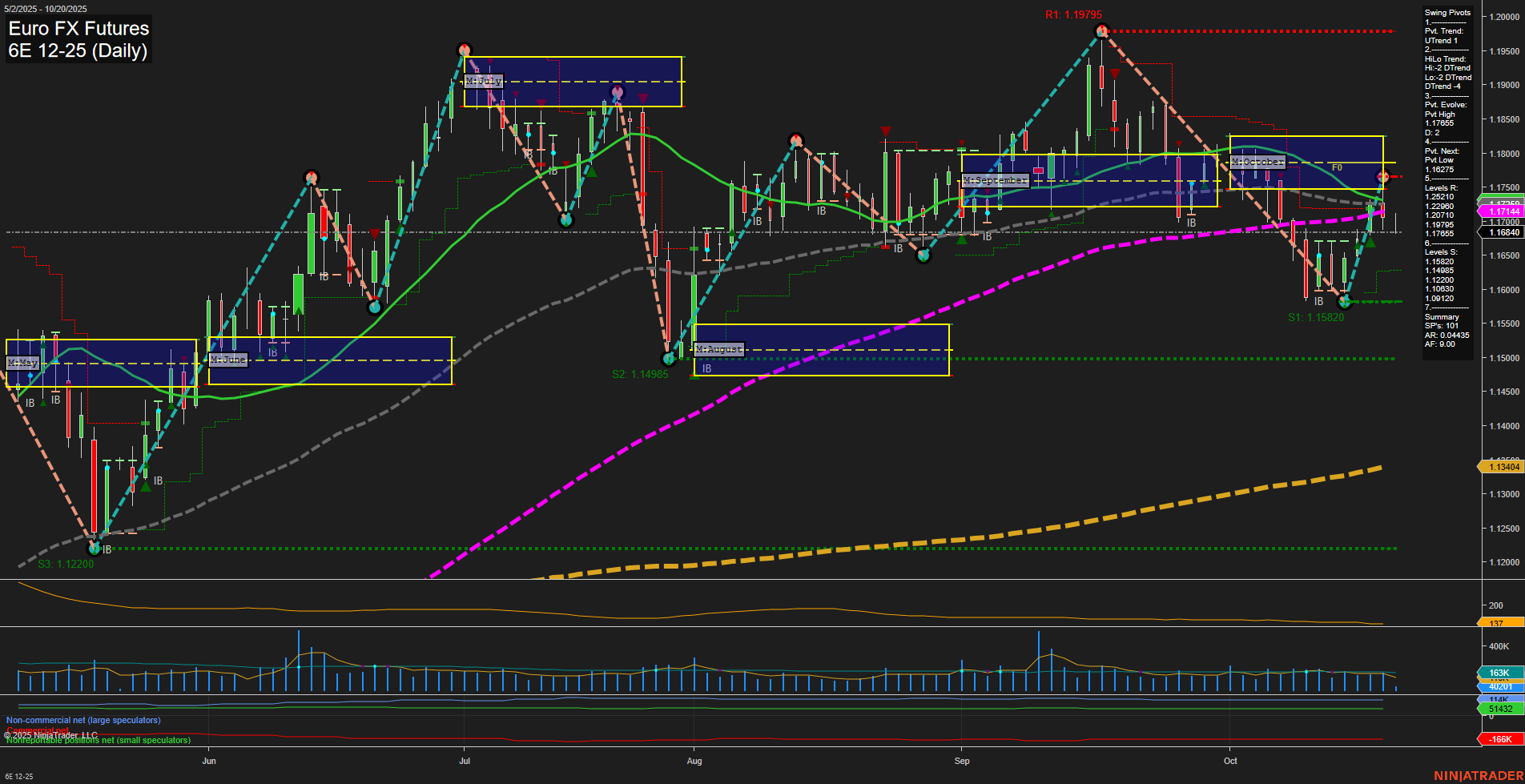

6E Euro FX Futures Daily Chart Analysis: 2025-Oct-20 07:01 CT

Price Action

- Last: 1.16840,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -27%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 82%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 1.15820,

- 4. Pvt. Next: Pvt High 1.17208,

- 5. Levels R: 1.19705, 1.17208, 1.16275,

- 6. Levels S: 1.15820, 1.14985, 1.12200.

Daily Benchmarks

- (Short-Term) 5 Day: 1.16685 Down Trend,

- (Short-Term) 10 Day: 1.17055 Down Trend,

- (Intermediate-Term) 20 Day: 1.17144 Down Trend,

- (Intermediate-Term) 55 Day: 1.17286 Down Trend,

- (Long-Term) 100 Day: 1.17695 Down Trend,

- (Long-Term) 200 Day: 1.13404 Up Trend.

Additional Metrics

Recent Trade Signals

- 15 Oct 2025: Long 6E 12-25 @ 1.1673 Signals.USAR-WSFG

- 13 Oct 2025: Short 6E 12-25 @ 1.1607 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures daily chart shows a market in transition. Short- and intermediate-term trends remain bearish, as confirmed by the downward direction of all key moving averages (5, 10, 20, 55, and 100 day) and the swing pivot structure, which is currently in a downtrend with the most recent pivot low at 1.15820. Price is trading below the monthly session fib grid (MSFG), reinforcing the intermediate-term bearish bias, while the weekly session fib grid (WSFG) is neutral, suggesting a pause or potential for short-term consolidation. However, the long-term trend remains bullish, with the yearly session fib grid (YSFG) showing price well above its F0% level and the 200-day moving average still trending up. Recent trade signals indicate both long and short activity, reflecting the choppy, two-way action typical of a market searching for direction after a significant move. Volatility (ATR) and volume (VOLMA) are moderate, supporting the view of a market in a corrective phase rather than a strong trending environment. Swing traders should note the potential for countertrend rallies, but the prevailing momentum and structure favor caution until a clear reversal or continuation pattern emerges.

Chart Analysis ATS AI Generated: 2025-10-20 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.