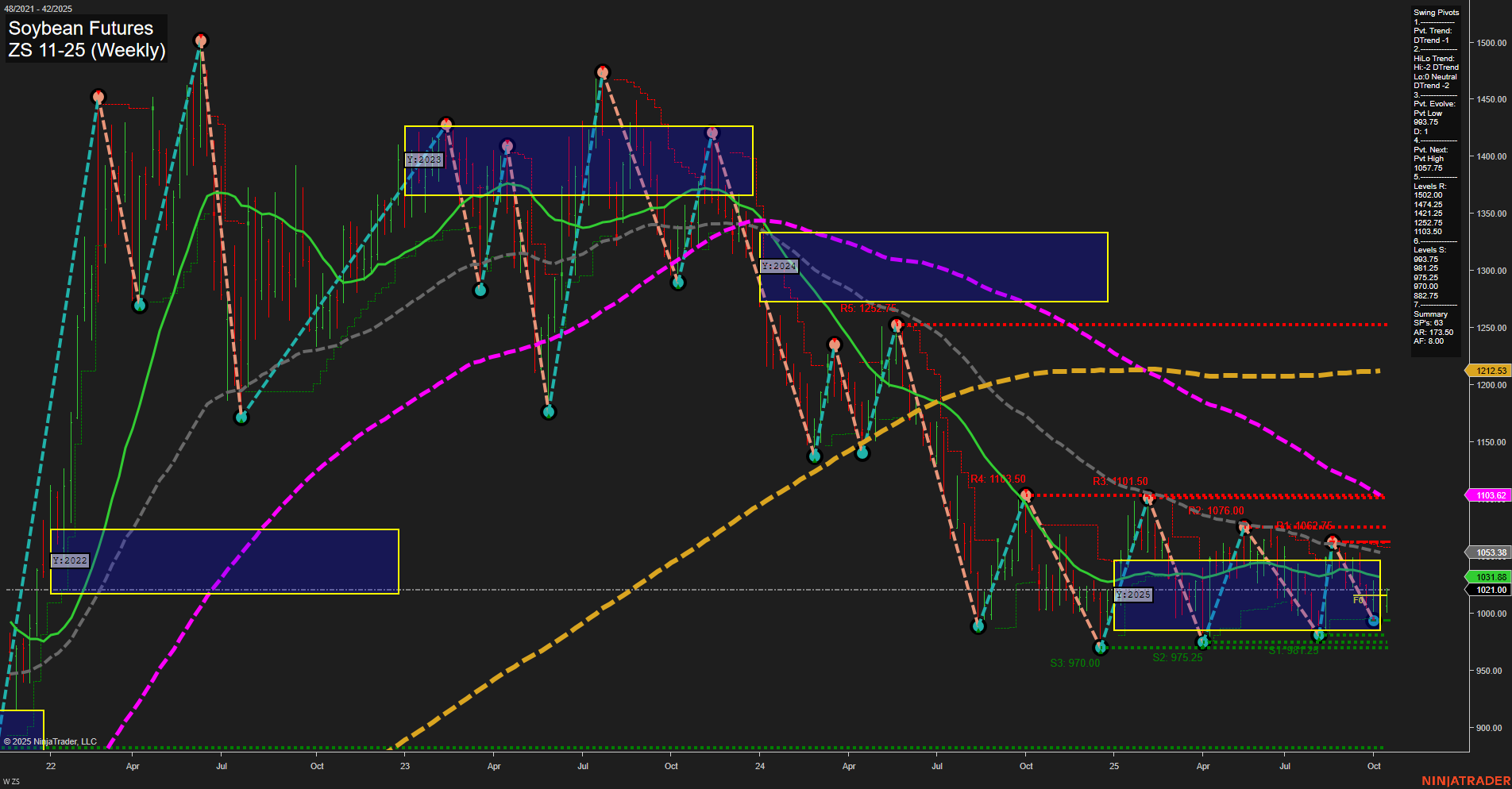

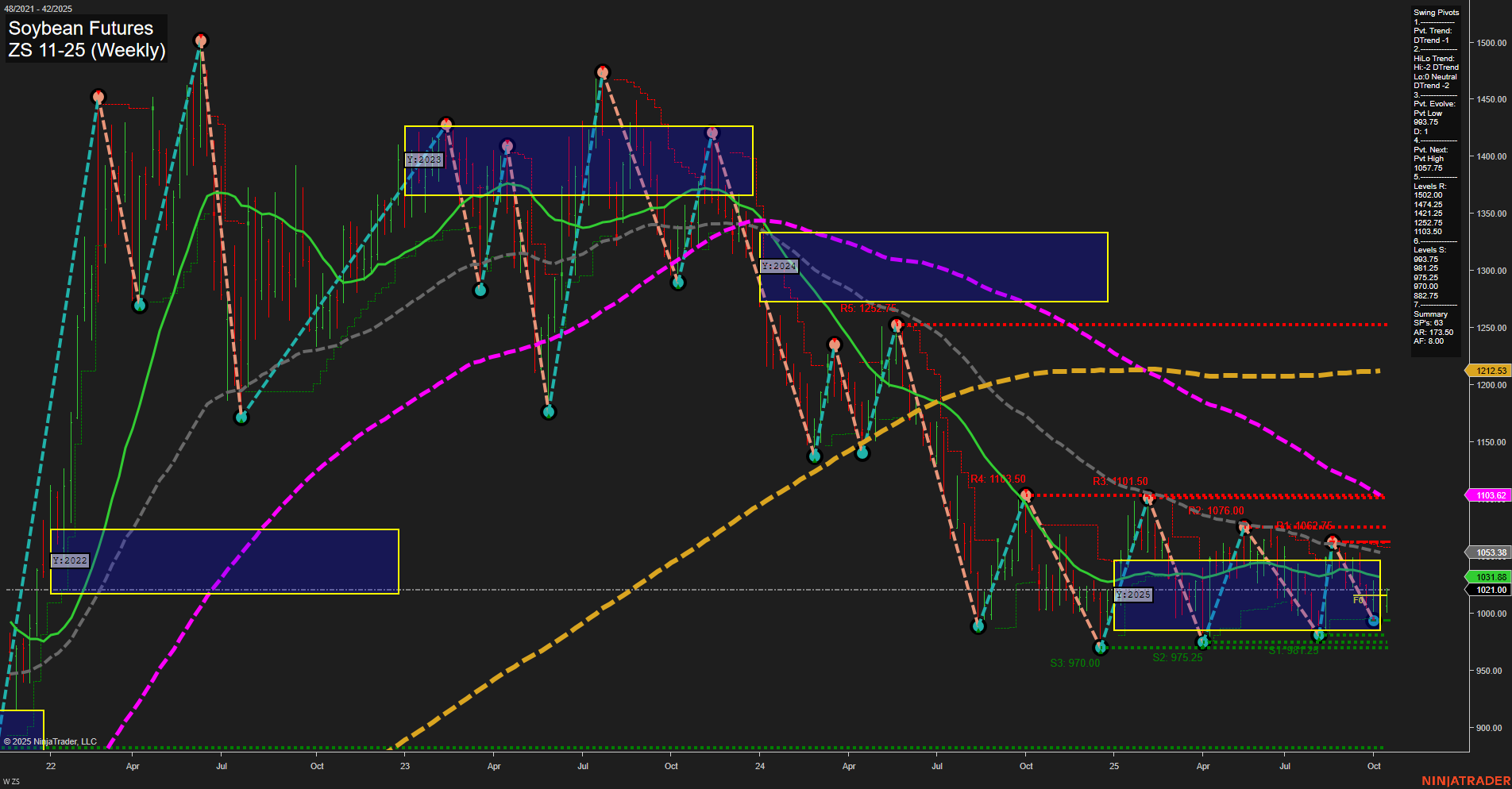

ZS Soybean Futures Weekly Chart Analysis: 2025-Oct-19 18:19 CT

Price Action

- Last: 1031.88,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 53%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 39%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 963.75,

- 4. Pvt. Next: Pvt high 1076.00,

- 5. Levels R: 1252.75, 1207.75, 1142.25, 1115.50, 1076.00, 1062.75, 1011.50,

- 6. Levels S: 981.75, 975.25, 970.00, 870.00, 822.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1035.38 Down Trend,

- (Intermediate-Term) 10 Week: 1053.38 Down Trend,

- (Long-Term) 20 Week: 1103.62 Down Trend,

- (Long-Term) 55 Week: 1212.53 Down Trend,

- (Long-Term) 100 Week: 1103.62 Down Trend,

- (Long-Term) 200 Week: 1212.53 Down Trend.

Recent Trade Signals

- 17 Oct 2025: Long ZS 11-25 @ 1012 Signals.USAR-WSFG

- 16 Oct 2025: Long ZS 11-25 @ 1013 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Soybean futures are currently trading in a consolidation phase, with price action showing slow momentum and medium-sized bars. Despite the recent short-term long signals, the prevailing swing pivot trends remain down for both short- and intermediate-term, indicating that rallies have been met with resistance and sellers are still in control. The price is above the NTZ center on all session fib grids, suggesting some underlying support, but all major moving averages (5, 10, 20, 55, 100, 200 week) are trending down, reinforcing a bearish bias for the intermediate and long-term outlooks. Key resistance levels are stacked above, with the nearest at 1011.50 and 1062.75, while support is found at 981.75 and 975.25. The market is likely in a basing or bottoming process, but until a clear breakout above the pivot high at 1076.00 or a sustained move above the 20-week MA, the broader trend remains pressured. Volatility is subdued, and the market is likely to remain choppy unless a catalyst emerges to drive a decisive move.

Chart Analysis ATS AI Generated: 2025-10-19 18:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.