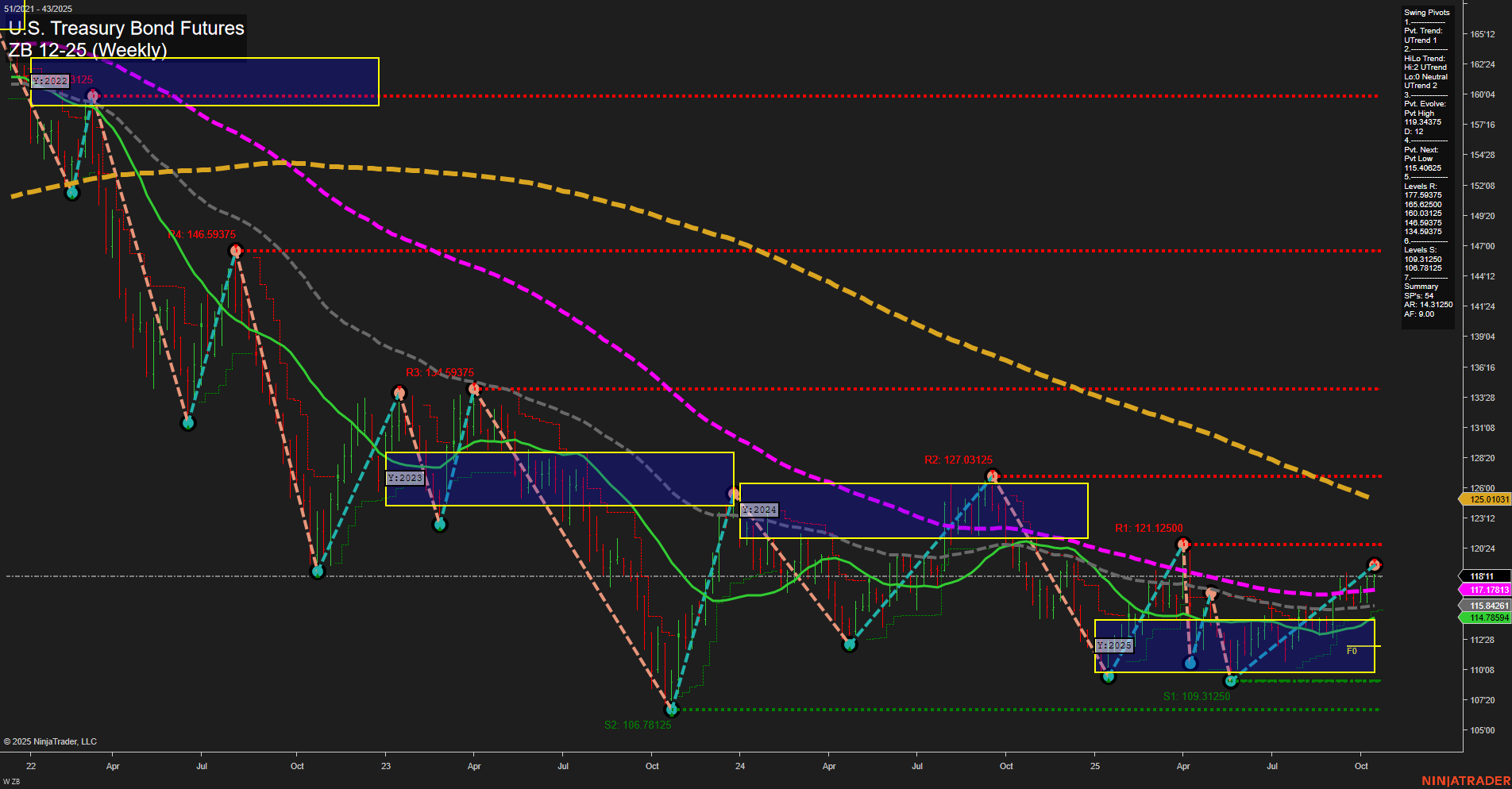

The ZB U.S. Treasury Bond Futures weekly chart shows a market in recovery mode, with a clear shift to an uptrend in both short- and intermediate-term swing pivots. Price has moved above key moving averages (5, 10, 20, and 55 week), all of which are trending upward, confirming the bullish momentum. The most recent swing high at 119.934375 and the next projected swing low at 115.40625 provide important reference points for potential retracements or pullbacks. Resistance levels are stacked above, with the nearest at 121.125 and 127.03125, while support is well-defined at 115.40625 and lower at 109.3125. The price is currently consolidating above the NTZ (neutral zone) and F0% grid, suggesting a pause or potential continuation after a strong rally. The long-term trend remains neutral, as price is still below the 100- and 200-week moving averages, indicating that while the recent rally is strong, it has not yet reversed the broader bearish structure from previous months. Overall, the chart reflects a bullish swing trading environment in the short- and intermediate-term, with the potential for further upside if resistance levels are broken, but with caution warranted as the long-term trend has yet to fully confirm a reversal.