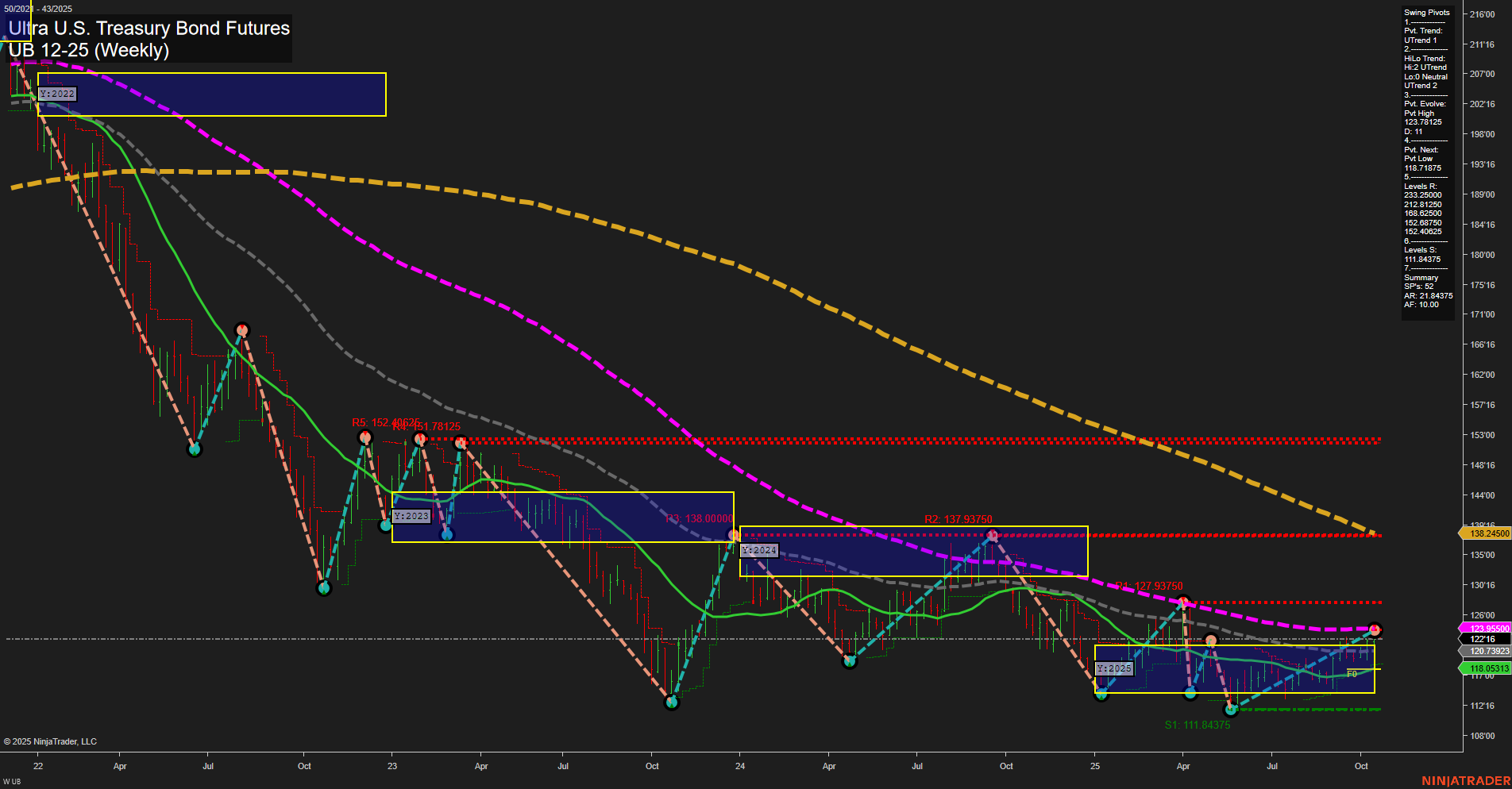

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has recently moved above key intermediate and long-term moving averages, with average momentum and medium-sized bars, suggesting a shift from prior weakness. The short-term WSFG trend remains down, with price just below the NTZ center, indicating some near-term resistance and a lack of clear breakout. However, both the intermediate and long-term session fib grid trends (MSFG and YSFG) are up, with price above their respective NTZ centers, reflecting a constructive bias for swing traders looking at multi-week to multi-month horizons. Swing pivot analysis highlights an evolving uptrend in both short- and intermediate-term trends, with the most recent pivot high at 123.78125 and next support at 118.78175. Resistance levels cluster above at 127.93750 and 138.24500, while support is well-defined at 118.05313 and 111.84375. The moving averages reinforce this mixed outlook: short- and intermediate-term MAs are trending up, but the longer-term 55, 100, and 200 week MAs remain in decline, capping rallies and reflecting the broader bearish structure. A recent long signal (16 Oct 2025) aligns with the intermediate-term uptrend, but the market faces significant overhead resistance and remains below major long-term averages. Overall, the chart suggests a market in the early stages of a potential recovery, with bullish momentum building in the intermediate term, but still constrained by long-term bearish forces. Swing traders may see opportunities in the developing uptrend, but should be mindful of the strong resistance zones and the need for further confirmation of a sustained reversal.