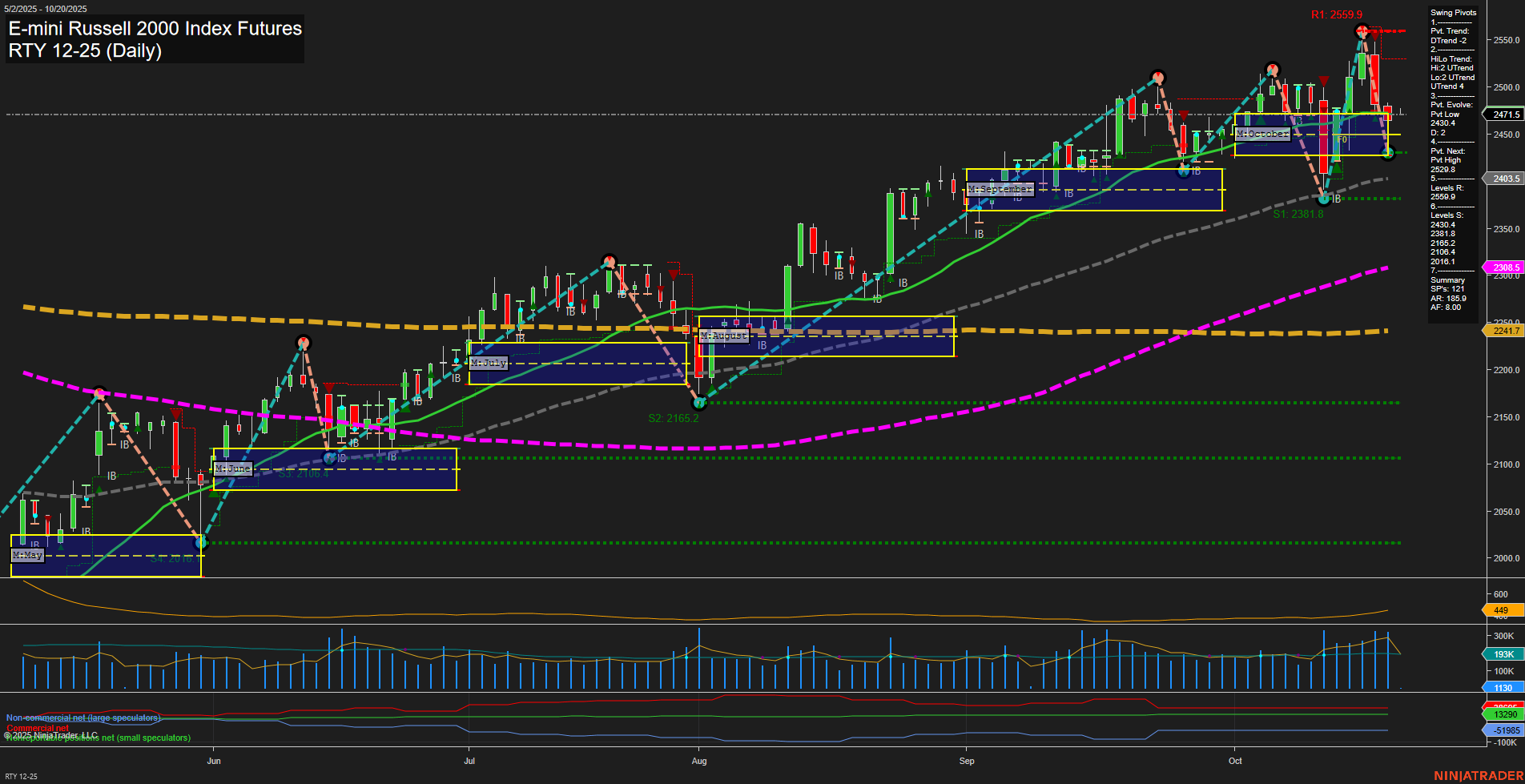

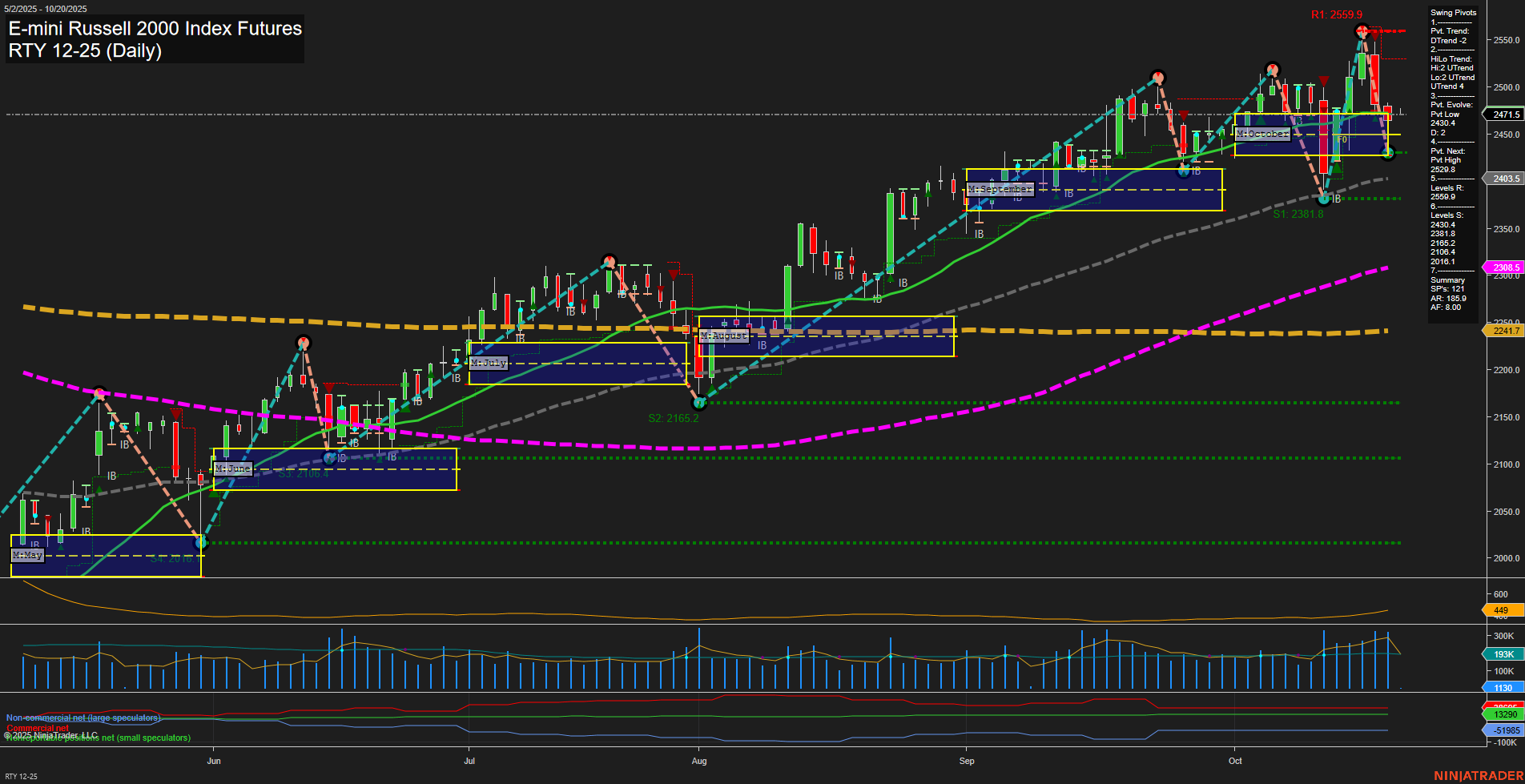

RTY E-mini Russell 2000 Index Futures Daily Chart Analysis: 2025-Oct-19 18:13 CT

Price Action

- Last: 2471.5,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 29%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 2381.8,

- 4. Pvt. Next: Pvt high 2520.8,

- 5. Levels R: 2659.9, 2520.8, 2491.6, 2481.4,

- 6. Levels S: 2381.8, 2165.2.

Daily Benchmarks

- (Short-Term) 5 Day: 2491.6 Down Trend,

- (Short-Term) 10 Day: 2500.0 Down Trend,

- (Intermediate-Term) 20 Day: 2430.5 Up Trend,

- (Intermediate-Term) 55 Day: 2308.5 Up Trend,

- (Long-Term) 100 Day: 2241.7 Up Trend,

- (Long-Term) 200 Day: 2308.5 Up Trend.

Additional Metrics

Recent Trade Signals

- 16 Oct 2025: Short RTY 12-25 @ 2481.8 Signals.USAR.TR120

- 15 Oct 2025: Long RTY 12-25 @ 2530.2 Signals.USAR.TR720

- 14 Oct 2025: Long RTY 12-25 @ 2461.2 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RTY E-mini Russell 2000 Index Futures daily chart shows a market that has recently experienced a sharp pullback after a strong rally, as evidenced by large bars and fast momentum. Price remains above all major session fib grid levels (weekly, monthly, yearly), indicating underlying strength in the broader trend. However, the short-term swing pivot trend has shifted to a downtrend, with the most recent pivot low at 2381.8 and resistance levels stacking above current price. Short-term moving averages (5 and 10 day) have turned down, confirming the short-term bearish tone, while intermediate and long-term moving averages remain in solid uptrends, supporting a bullish outlook for swing and position traders. The ATR is elevated, reflecting increased volatility, and volume remains robust. Recent trade signals show both long and short entries, highlighting a choppy, two-way environment with potential for both trend continuation and sharp countertrend moves. Overall, the market is in a corrective phase within a larger uptrend, with short-term weakness but intermediate and long-term bullish structure intact.

Chart Analysis ATS AI Generated: 2025-10-19 18:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.