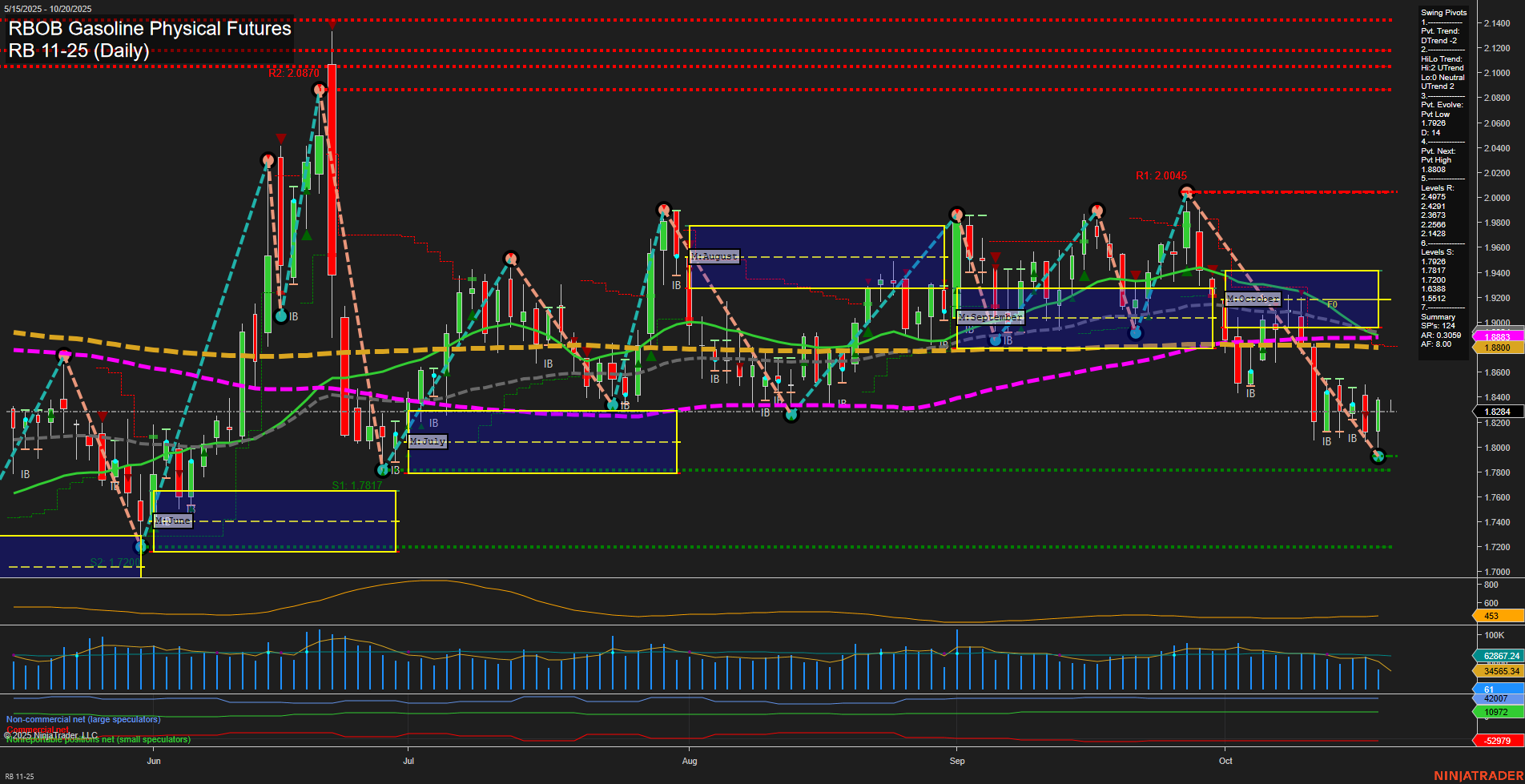

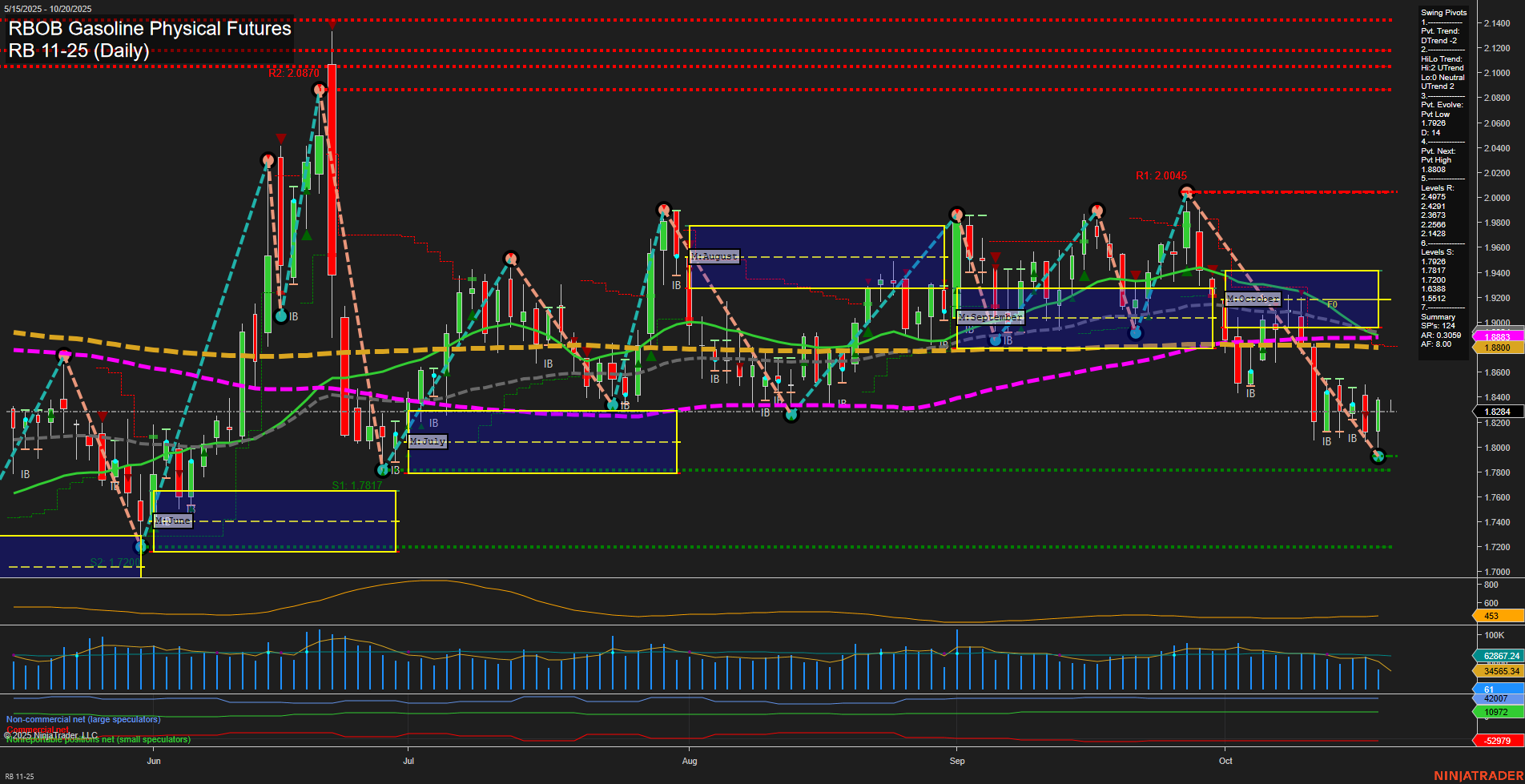

RB RBOB Gasoline Physical Futures Daily Chart Analysis: 2025-Oct-19 18:12 CT

Price Action

- Last: 1.8264,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -48%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -7%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.814,

- 4. Pvt. Next: Pvt high 1.888,

- 5. Levels R: 2.2045, 2.0687, 2.0491, 2.0291, 2.0205, 1.9631, 1.9287, 1.8883,

- 6. Levels S: 1.814, 1.7817, 1.7207.

Daily Benchmarks

- (Short-Term) 5 Day: 1.8388 Down Trend,

- (Short-Term) 10 Day: 1.8512 Down Trend,

- (Intermediate-Term) 20 Day: 1.8883 Down Trend,

- (Intermediate-Term) 55 Day: 1.9207 Down Trend,

- (Long-Term) 100 Day: 1.9451 Down Trend,

- (Long-Term) 200 Day: 1.9808 Down Trend.

Additional Metrics

Recent Trade Signals

- 17 Oct 2025: Long RB 11-25 @ 1.8265 Signals.USAR-WSFG

- 16 Oct 2025: Short RB 11-25 @ 1.8111 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The RBOB Gasoline futures market is exhibiting a clear bearish structure across all timeframes. Price action is below all major moving averages, with each benchmark MA trending down, confirming persistent downside momentum. The most recent swing pivots show a dominant downtrend, with the latest pivot low at 1.814 and the next potential reversal only at 1.888, indicating a significant gap before any meaningful resistance is tested. Both the weekly and monthly session fib grids reinforce the bearish bias, as price remains below the NTZ/F0% levels. Volatility, as measured by ATR, is moderate, and volume is steady but not elevated, suggesting the move is orderly rather than panic-driven. Recent trade signals show mixed short-term attempts, but the prevailing trend remains to the downside. The market is in a corrective or continuation phase after failing to hold above key support levels, with no immediate signs of reversal. This environment is characterized by lower highs and lower lows, with any rallies likely to face strong resistance at previous swing highs and moving averages.

Chart Analysis ATS AI Generated: 2025-10-19 18:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.