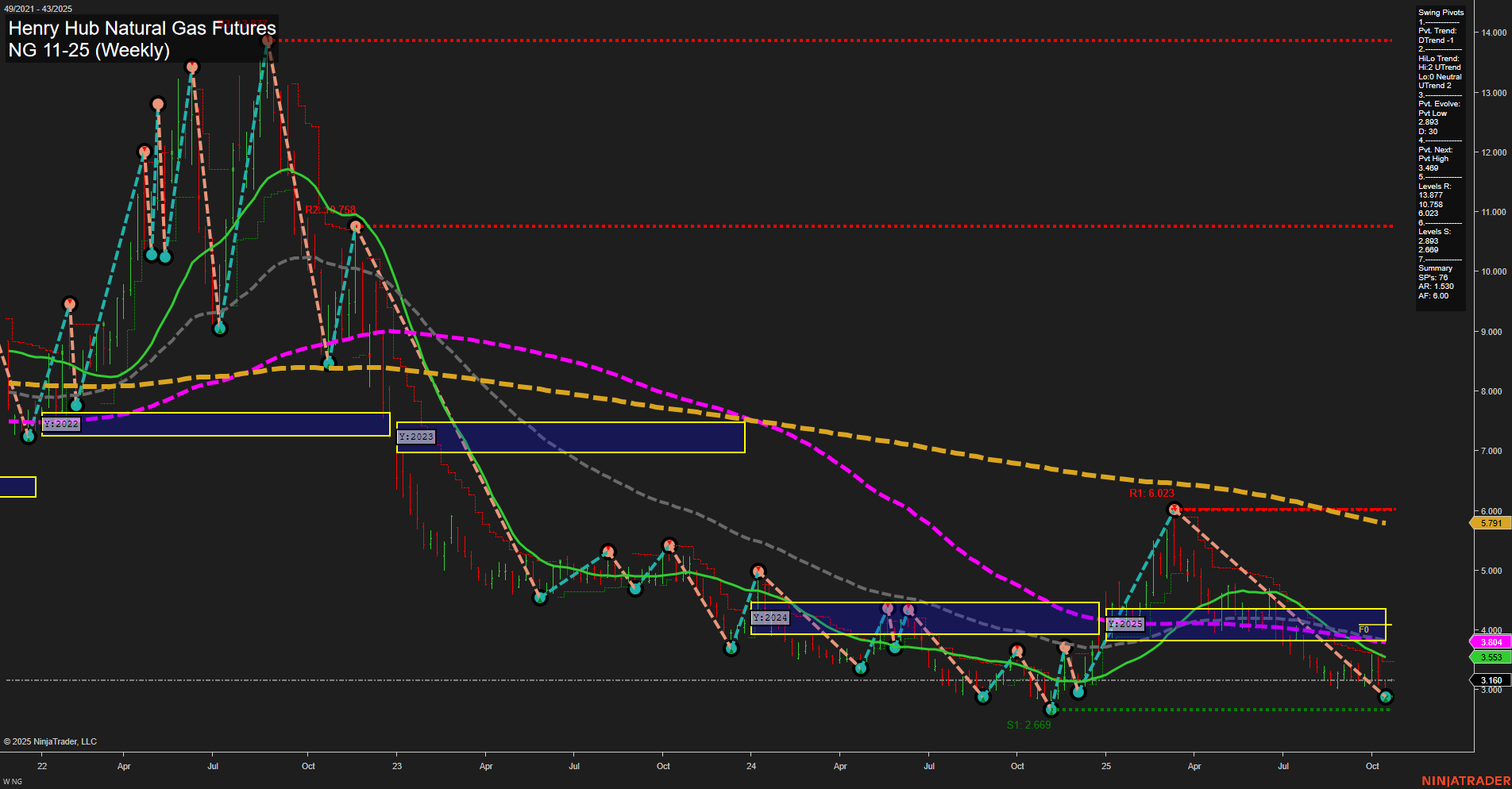

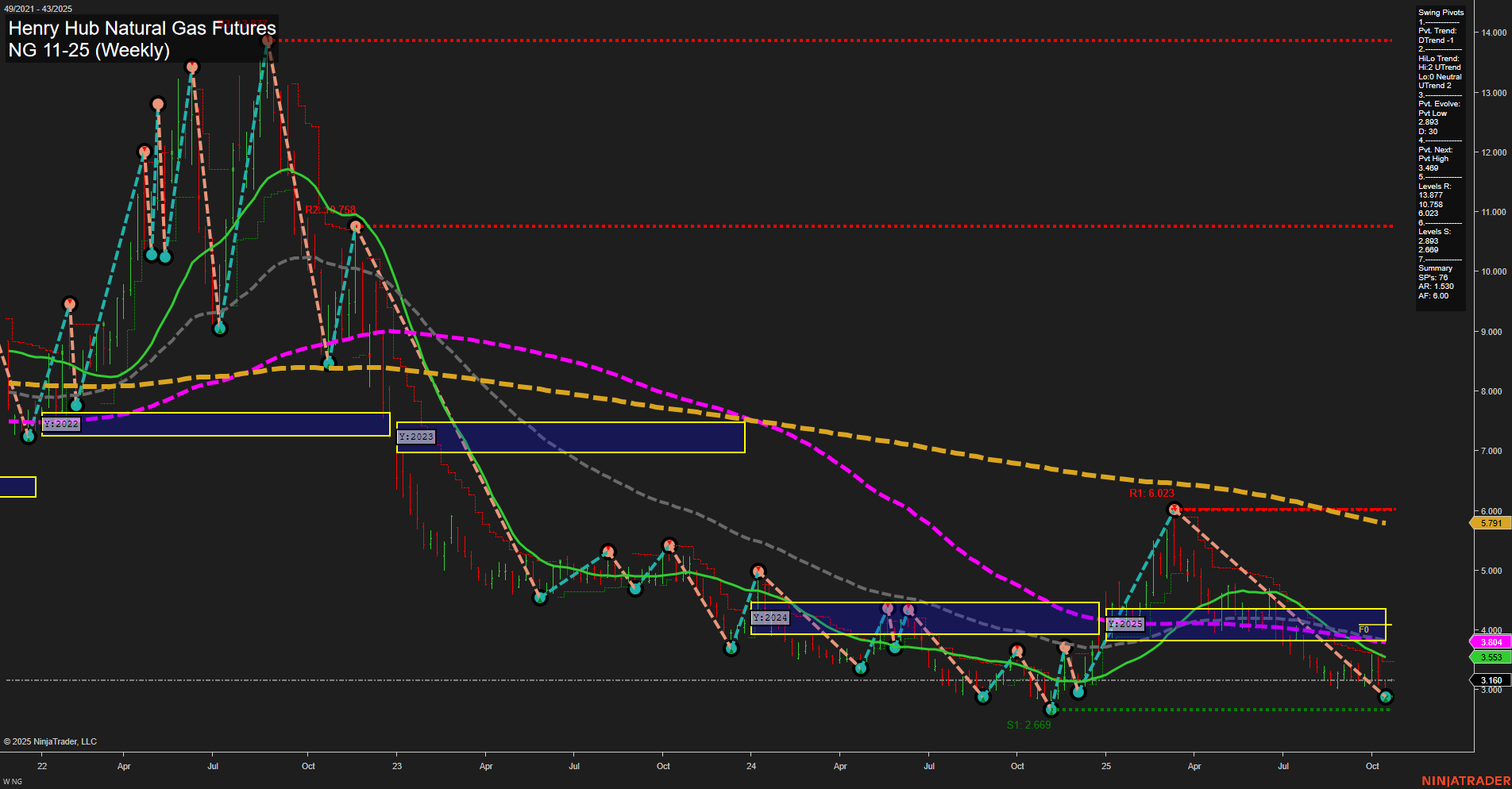

NG Henry Hub Natural Gas Futures Weekly Chart Analysis: 2025-Oct-19 18:10 CT

Price Action

- Last: 3.160,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 3.160,

- 4. Pvt. Next: Pvt high 3.469,

- 5. Levels R: 13.677, 10.738, 6.023,

- 6. Levels S: 2.669, 2.309, 2.309.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3.553 Down Trend,

- (Intermediate-Term) 10 Week: 3.804 Down Trend,

- (Long-Term) 20 Week: 3.904 Down Trend,

- (Long-Term) 55 Week: 5.791 Down Trend,

- (Long-Term) 100 Week: 6.304 Down Trend,

- (Long-Term) 200 Week: 7.130 Down Trend.

Recent Trade Signals

- 17 Oct 2025: Long NG 11-25 @ 2.999 Signals.USAR.TR120

- 14 Oct 2025: Short NG 11-25 @ 3.038 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The weekly chart for NG Henry Hub Natural Gas Futures as of October 19, 2025, shows a market in a prolonged downtrend, with price action currently consolidating near recent swing lows. The last price of 3.160 is below all major moving averages, which are aligned in a persistent downtrend across all timeframes, indicating sustained bearish pressure. Short-term swing pivots confirm a downward trend, while intermediate-term pivots show a slight upward bias, suggesting some stabilization or potential for a technical bounce. However, the overall structure remains weak, with resistance levels far above current price and support clustered just below. Recent trade signals reflect choppy, indecisive action, with both long and short entries triggered in close succession, highlighting a lack of clear directional conviction. The neutral bias in the session fib grids and the slow momentum further reinforce the view of a market in consolidation after a significant decline, with volatility subdued and no clear breakout or reversal pattern evident at this stage.

Chart Analysis ATS AI Generated: 2025-10-19 18:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.