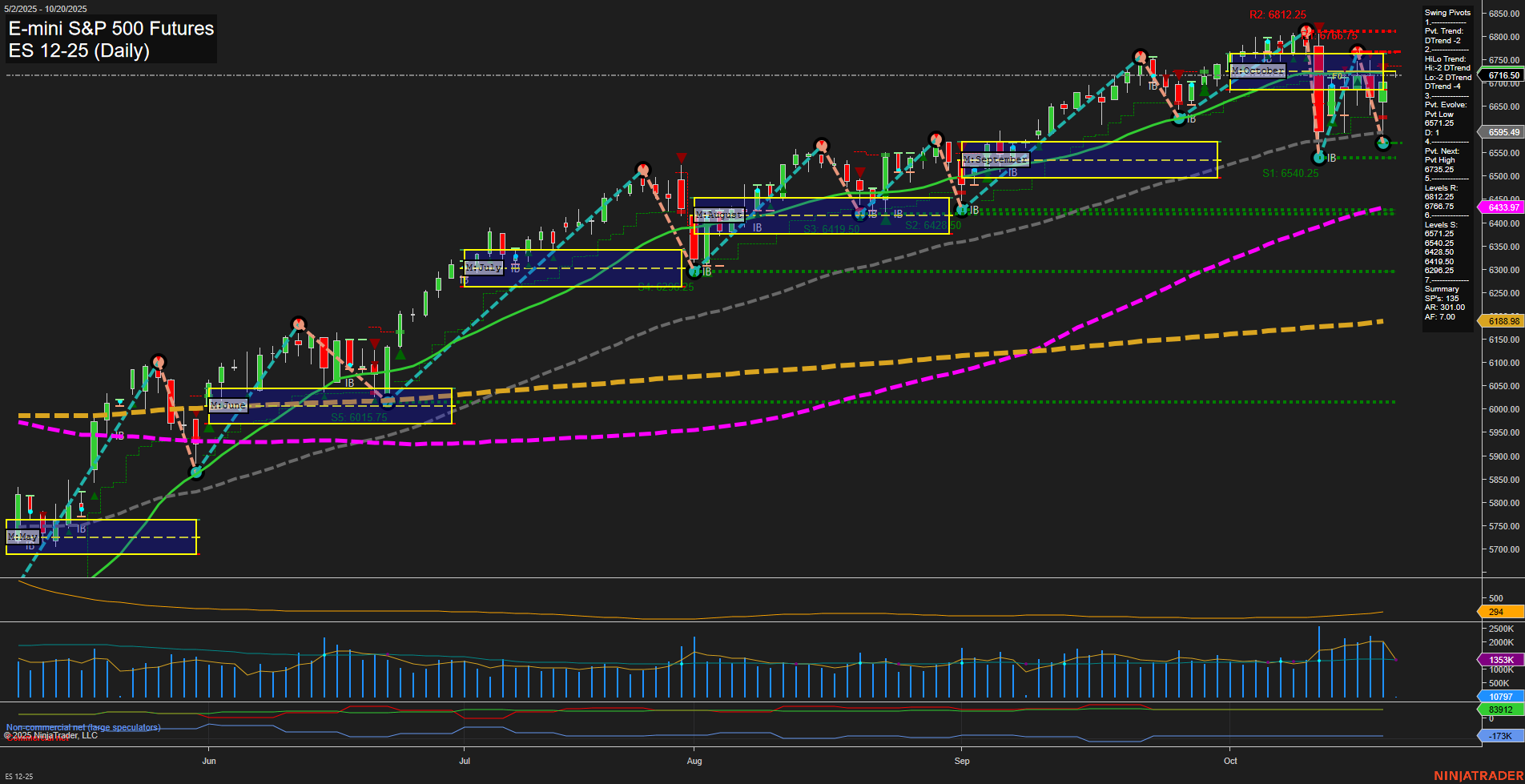

ES E-mini S&P 500 Futures Daily Chart Analysis: 2025-Oct-19 18:05 CT

Price Action

- Last: 6716.50,

- Bars: Large (recent wide-range bars, especially on the latest swing down and up),

- Mom: Momentum fast (notable acceleration in both selloff and bounce).

WSFG Weekly

- Short-Term

- WSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 61%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 6559.49,

- 4. Pvt. Next: Pvt high 6735.25,

- 5. Levels R: 6812.25, 6768.75, 6735.25,

- 6. Levels S: 6559.49, 6540.25, 6423.50.

Daily Benchmarks

- (Short-Term) 5 Day: 6615.25 Down Trend,

- (Short-Term) 10 Day: 6678.75 Down Trend,

- (Intermediate-Term) 20 Day: 6716.50 Down Trend,

- (Intermediate-Term) 55 Day: 6443.97 Up Trend,

- (Long-Term) 100 Day: 6188.98 Up Trend,

- (Long-Term) 200 Day: 6015.75 Up Trend.

Additional Metrics

- ATR: 319,

- VOLMA: 1611996.

Recent Trade Signals

- 17 Oct 2025: Long ES 12-25 @ 6703.75 Signals.USAR.TR120

- 17 Oct 2025: Long ES 12-25 @ 6658.25 Signals.USAR-WSFG

- 16 Oct 2025: Short ES 12-25 @ 6659.25 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral

- Intermediate-Term: Neutral

- Long-Term: Bullish

Key Insights Summary

The ES has experienced a sharp pullback from recent highs, with large daily bars reflecting heightened volatility and fast momentum. Both short-term and intermediate-term swing pivot trends have shifted to downtrends, confirmed by the most recent pivot low at 6559.49 and a potential reversal level at 6735.25. Despite this, price remains above all major session fib grid centers (weekly, monthly, yearly), and the long-term trend structure is intact, as shown by the 55, 100, and 200-day moving averages all trending upward and well below current price. The 5, 10, and 20-day moving averages are in downtrends, indicating short-term weakness or consolidation after the recent selloff. Recent trade signals show a mix of short and long entries, reflecting the choppy, two-way action typical of a market in transition or after a volatility spike. The market is currently testing resistance near 6735.25, with support at 6559.49 and 6540.25. Overall, the structure suggests a corrective phase within a broader uptrend, with the potential for further consolidation or a resumption of the uptrend if resistance is cleared. Volatility and volume remain elevated, supporting the view of an active, responsive market environment.

Chart Analysis ATS AI Generated: 2025-10-19 18:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.