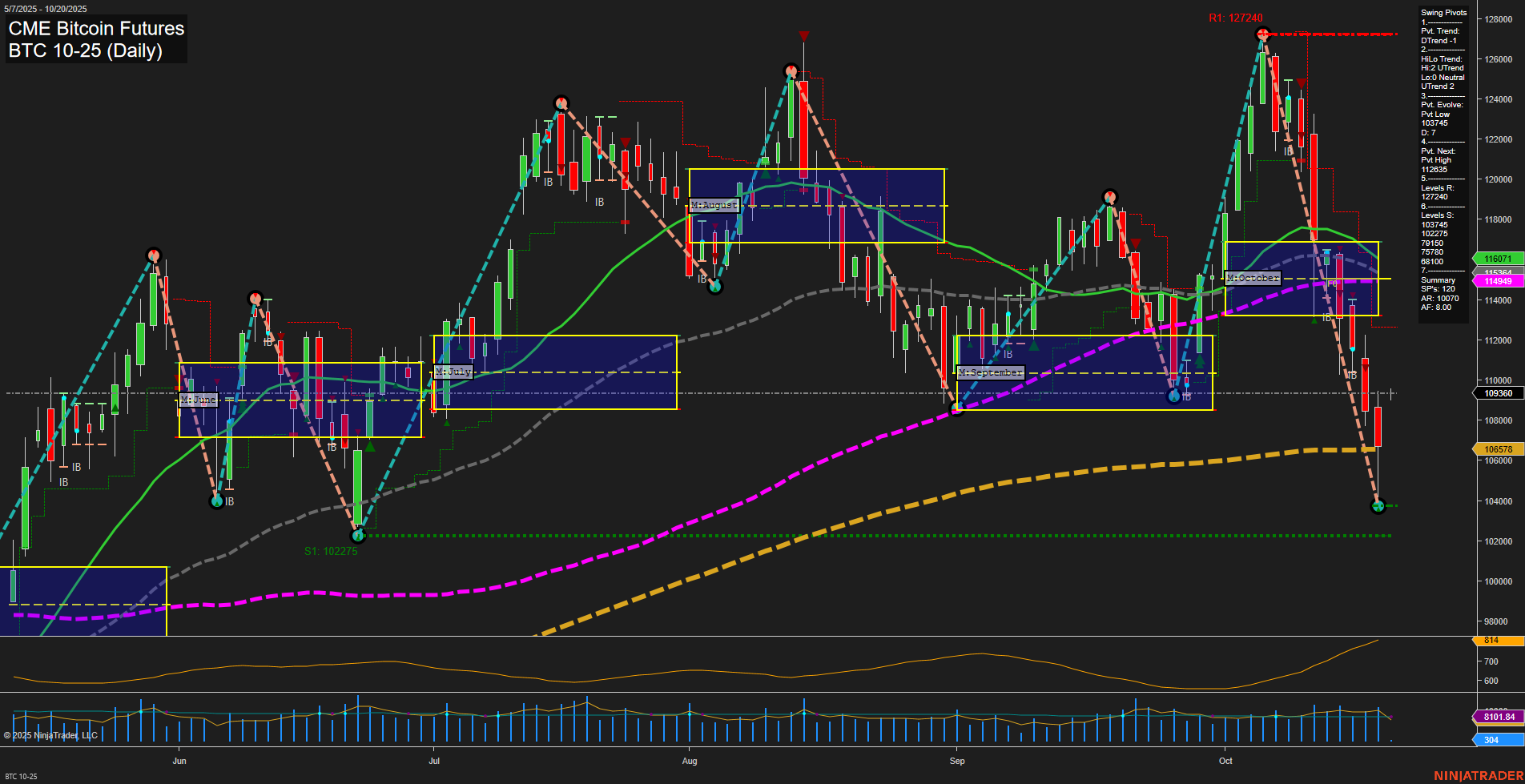

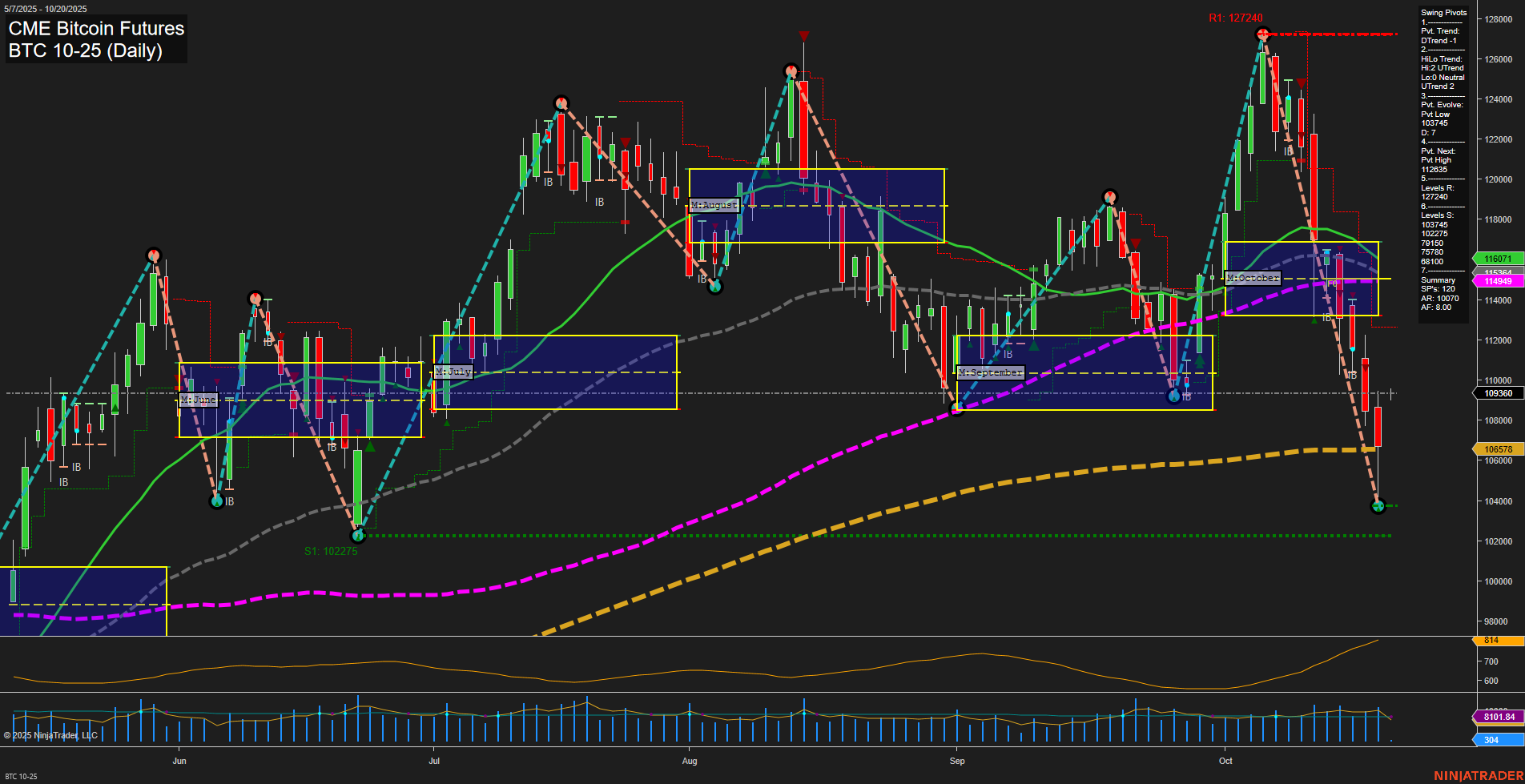

BTC CME Bitcoin Futures Daily Chart Analysis: 2025-Oct-19 18:02 CT

Price Action

- Last: 109360,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -40%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 34%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 105578,

- 4. Pvt. Next: Pvt high 112835,

- 5. Levels R: 127240, 123825, 118715, 112835, 109715,

- 6. Levels S: 105578, 102275.

Daily Benchmarks

- (Short-Term) 5 Day: 111491 Down Trend,

- (Short-Term) 10 Day: 114949 Down Trend,

- (Intermediate-Term) 20 Day: 116071 Down Trend,

- (Intermediate-Term) 55 Day: 114949 Down Trend,

- (Long-Term) 100 Day: 119494 Down Trend,

- (Long-Term) 200 Day: 106578 Up Trend.

Additional Metrics

Recent Trade Signals

- 13 Oct 2025: Short BTC 10-25 @ 114625 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

BTC CME Bitcoin Futures have experienced a sharp sell-off, with large, fast-moving bars driving price action decisively lower. The short-term and intermediate-term trends are both down, as confirmed by the swing pivot structure and all key moving averages (5, 10, 20, 55, 100-day) trending lower. The most recent swing pivot has established a new low at 105578, with resistance levels stacked above and support at 102275. Despite the current bearish momentum, the long-term trend remains up, supported by the 200-day moving average and the yearly session fib grid. Volatility is elevated (ATR 1025), and volume remains robust. The recent short trade signal aligns with the prevailing short-term and intermediate-term downtrends. The market is in a corrective phase within a broader bullish context, with potential for further downside before any significant recovery or trend reversal.

Chart Analysis ATS AI Generated: 2025-10-19 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.