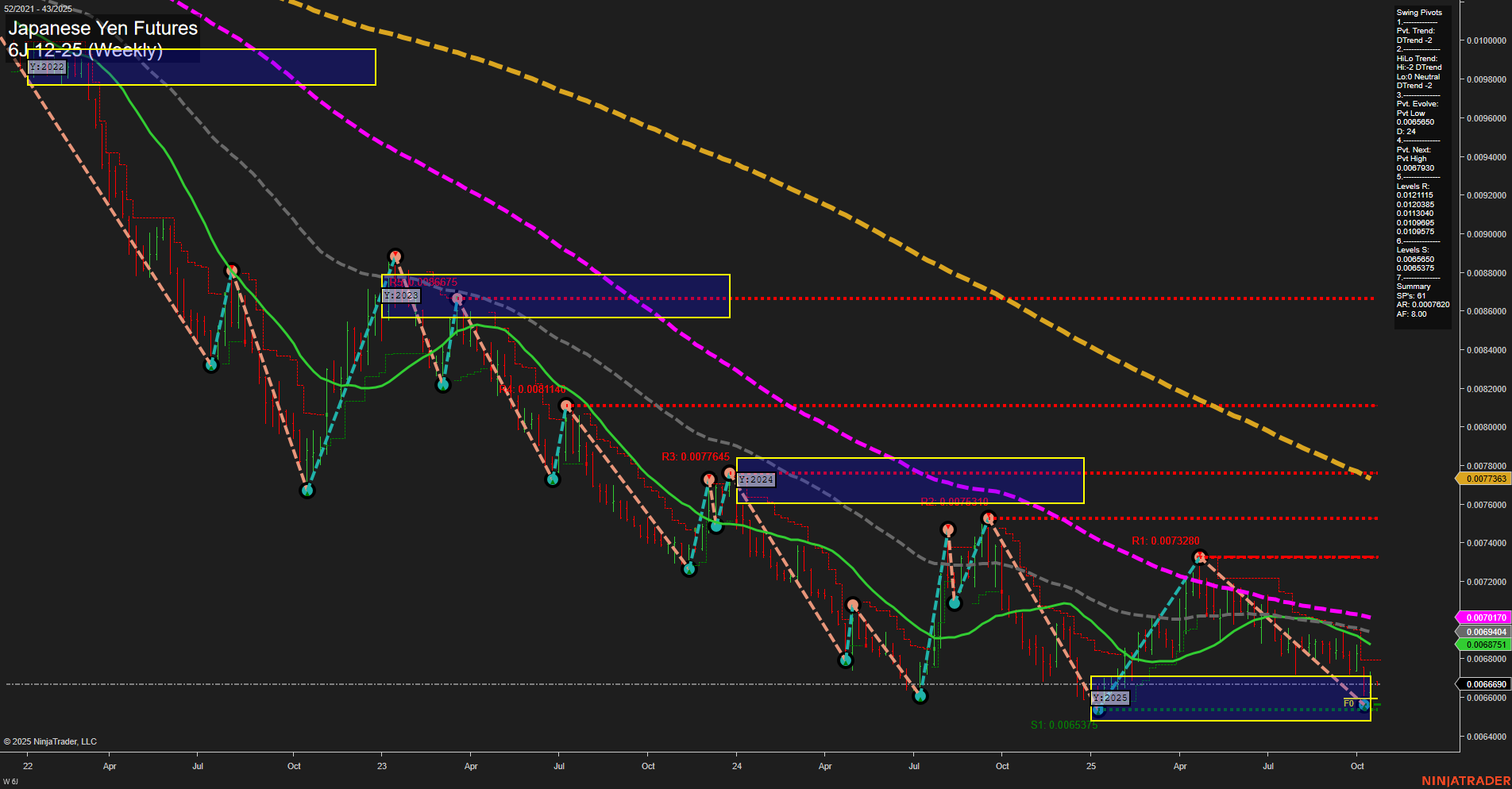

The 6J Japanese Yen Futures weekly chart shows a market under persistent downward pressure in both the short- and intermediate-term, as indicated by the WSFG and MSFG trends, both of which are down with price trading below their respective NTZ/F0% levels. The swing pivot structure confirms this, with both short-term and intermediate-term trends in a clear downtrend, and the most recent pivot evolving at a new low (0.0065375). Resistance levels are stacked above, with the nearest at 0.0069875 and more significant resistance at 0.0073280 and 0.0077645, while support is thin and close by at 0.0065805 and 0.0065375. Momentum is slow and price bars are medium-sized, suggesting a lack of strong conviction or volatility at this stage, possibly indicating a consolidation phase near recent lows. The long-term YSFG trend is up, with price still above the yearly NTZ/F0%, but this is not yet reflected in the moving averages, as the 55, 100, and 200 week benchmarks remain in downtrends, while only the 5 and 20 week MAs show a slight upward bias. A recent long signal (USAR-WSFG) was triggered near the lows, which may suggest a potential for a technical bounce or short-term retracement, but the overall structure remains bearish until a significant pivot high is established or resistance levels are broken. The market appears to be in a prolonged downtrend with occasional attempts at recovery, but these have so far failed to reverse the broader trend. The environment is characterized by lower highs and lower lows, with any rallies facing strong overhead resistance. The long-term outlook is neutral as the yearly trend is up, but confirmation from price action and moving averages is still lacking.