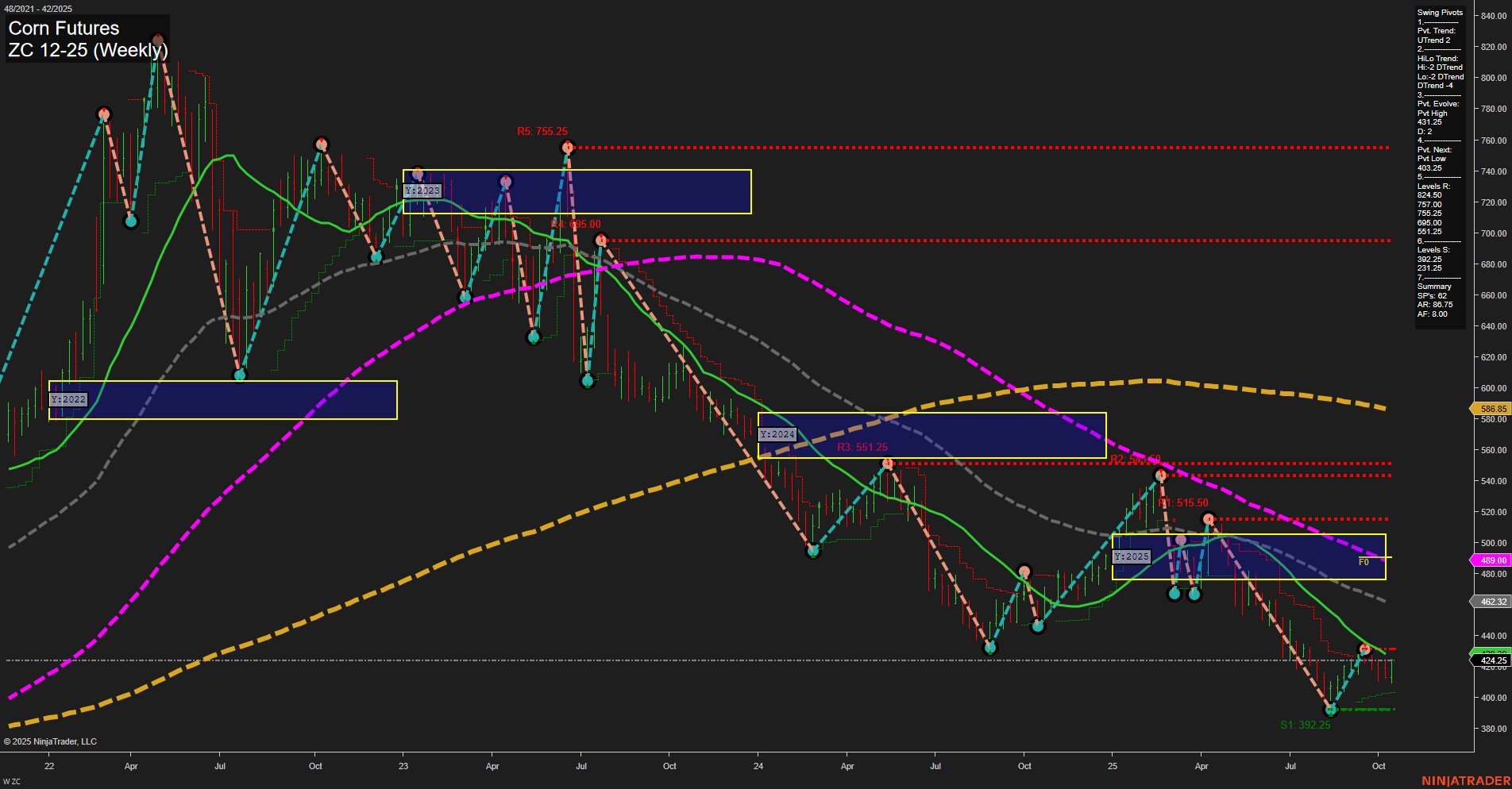

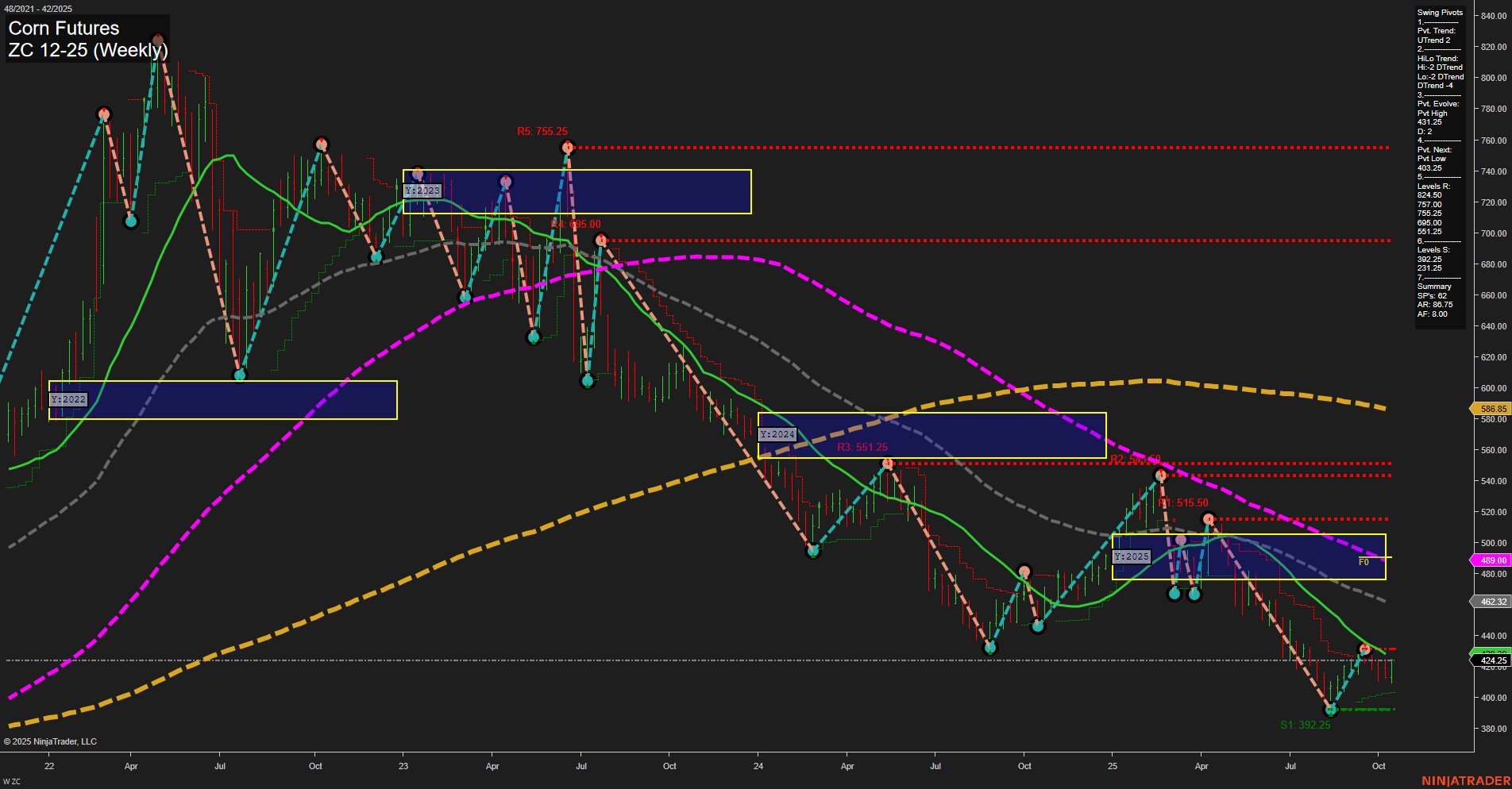

ZC Corn Futures Weekly Chart Analysis: 2025-Oct-17 07:23 CT

Price Action

- Last: 424.25,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 98%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 34%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -46%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 424.25,

- 4. Pvt. Next: Pvt low 392.25,

- 5. Levels R: 515.50, 551.25, 695.00, 755.25,

- 6. Levels S: 392.25, 421.25, 462.32.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 424.25 Up Trend,

- (Intermediate-Term) 10 Week: 424.25 Up Trend,

- (Long-Term) 20 Week: 462.32 Down Trend,

- (Long-Term) 55 Week: 499.99 Down Trend,

- (Long-Term) 100 Week: 586.85 Down Trend,

- (Long-Term) 200 Week: 800.00 Down Trend.

Recent Trade Signals

- 16 Oct 2025: Long ZC 12-25 @ 419.5 Signals.USAR-MSFG

- 15 Oct 2025: Long ZC 12-25 @ 417.5 Signals.USAR.TR120

- 15 Oct 2025: Long ZC 12-25 @ 415 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Corn futures have recently shown a shift in short-term momentum, with price action stabilizing above key short-term and intermediate-term Fibonacci grid levels. The current weekly and monthly session trends are up, supported by recent long trade signals and upward movement in the 5- and 10-week moving averages. However, the long-term trend remains decisively bearish, as indicated by the yearly session grid, lower swing highs, and all major long-term moving averages trending down. Resistance is clustered above at 462.32 and 515.50, while support is established at 392.25. The market appears to be in a recovery phase from a prolonged downtrend, with a potential for further short-term upside, but faces significant overhead resistance and remains structurally weak on a long-term basis. This setup suggests a market in transition, with short-term bullishness countered by persistent long-term bearish pressure.

Chart Analysis ATS AI Generated: 2025-10-17 07:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.