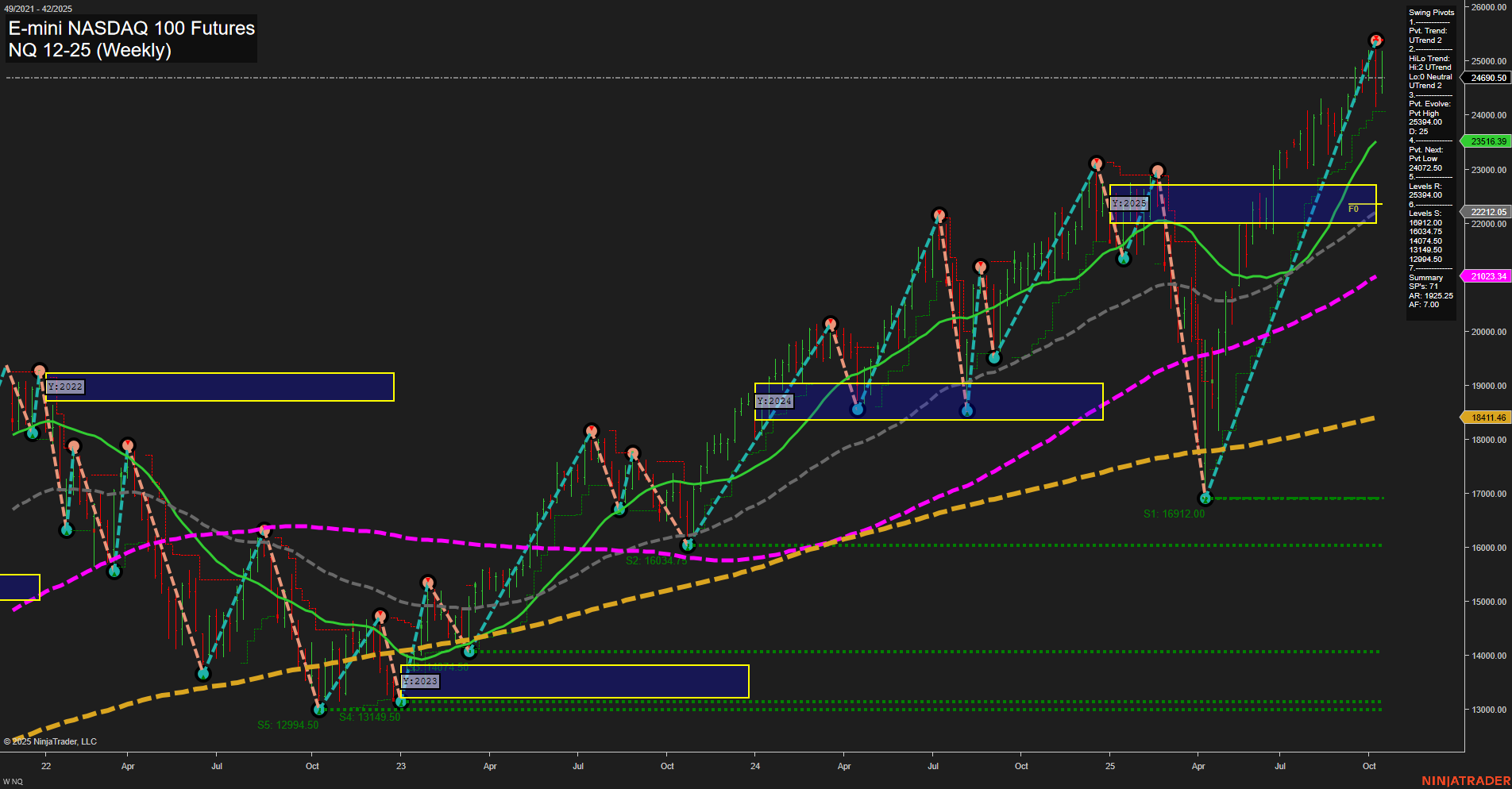

The NQ E-mini NASDAQ 100 Futures weekly chart shows a strong bullish trend in both the short- and long-term perspectives, with price action making new highs and momentum accelerating. The current bar is large, reflecting heightened volatility and strong directional conviction. The WSFG (Weekly Session Fib Grid) and YSFG (Yearly Session Fib Grid) both indicate price is well above their respective NTZ (neutral zones), confirming the uptrend. However, the MSFG (Monthly Session Fib Grid) is showing a short-term pullback or retracement, with price below the monthly NTZ and a downtrend bias for October, suggesting some intermediate-term consolidation or corrective action. Swing pivots confirm the prevailing uptrend, with the most recent pivot high at current levels and the next significant support at 23040.00. All major moving averages are trending upward, reinforcing the underlying strength of the market. Recent trade signals have triggered short entries, indicating potential for a short-term countertrend move or profit-taking phase, but the broader structure remains bullish. The market is currently in a phase of strong upward momentum, but with some signs of short-term exhaustion or mean reversion as seen in the intermediate-term signals. Overall, the chart reflects a market in a strong uptrend with possible short-term volatility and pullbacks, but with higher lows and higher highs dominating the longer-term structure.