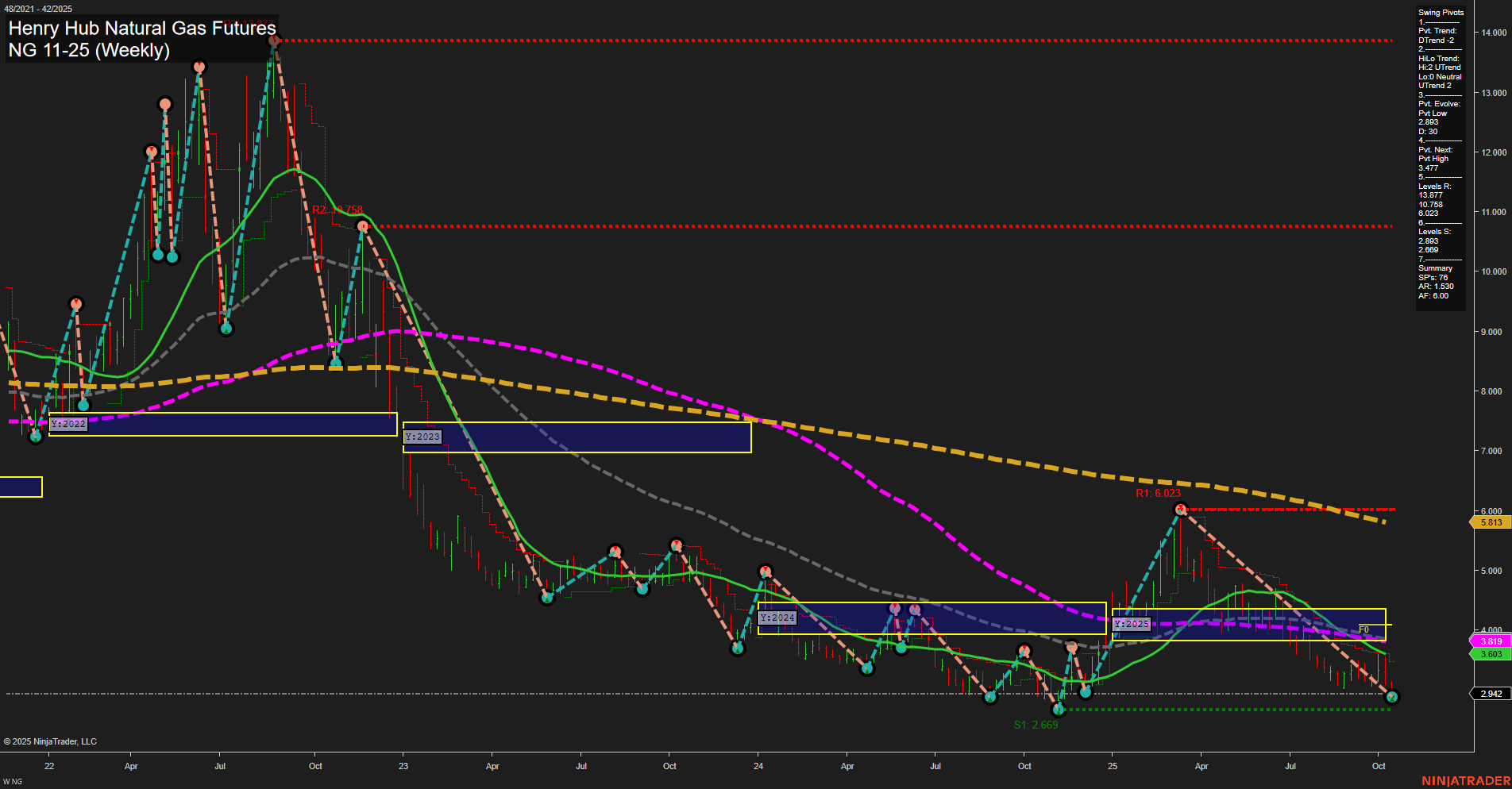

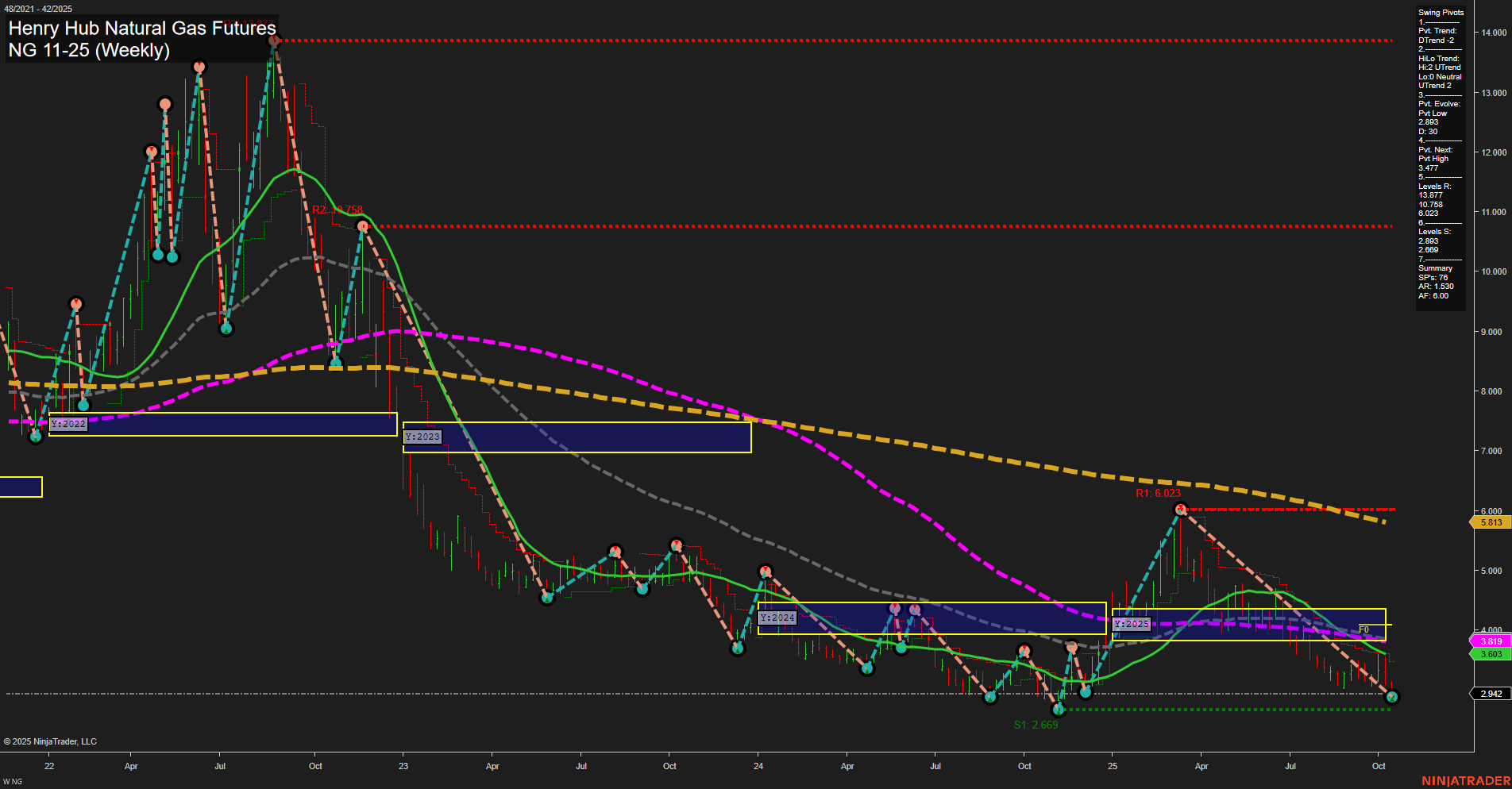

NG Henry Hub Natural Gas Futures Weekly Chart Analysis: 2025-Oct-17 07:12 CT

Price Action

- Last: 2.942,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 2.942,

- 4. Pvt. Next: Pvt high 3.477,

- 5. Levels R: 13.677, 10.758, 6.023,

- 6. Levels S: 2.803, 2.669, 2.009.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3.693 Down Trend,

- (Intermediate-Term) 10 Week: 3.819 Down Trend,

- (Long-Term) 20 Week: 3.819 Down Trend,

- (Long-Term) 55 Week: 4.758 Down Trend,

- (Long-Term) 100 Week: 5.811 Down Trend,

- (Long-Term) 200 Week: 6.023 Down Trend.

Recent Trade Signals

- 14 Oct 2025: Short NG 11-25 @ 3.038 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Natural gas futures are exhibiting a clear bearish bias in the short term, with price action making new swing lows and momentum remaining slow. The most recent swing pivot is a low at 2.942, with the next potential resistance at 3.477. All benchmark moving averages from short to long term are trending down, reinforcing the prevailing downward pressure. The intermediate-term HiLo trend is showing some upward movement, suggesting a possible attempt at stabilization or a minor retracement, but this is not yet confirmed by price structure or moving averages. Major resistance levels remain far above current price, while support is clustered just below, indicating a market that is testing lower boundaries. The recent short signal aligns with the overall bearish structure. The market is consolidating near multi-year lows, and volatility appears subdued, with no clear signs of reversal or breakout. The overall environment remains challenging for bulls, with sellers maintaining control and any rallies likely to face significant resistance overhead.

Chart Analysis ATS AI Generated: 2025-10-17 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.