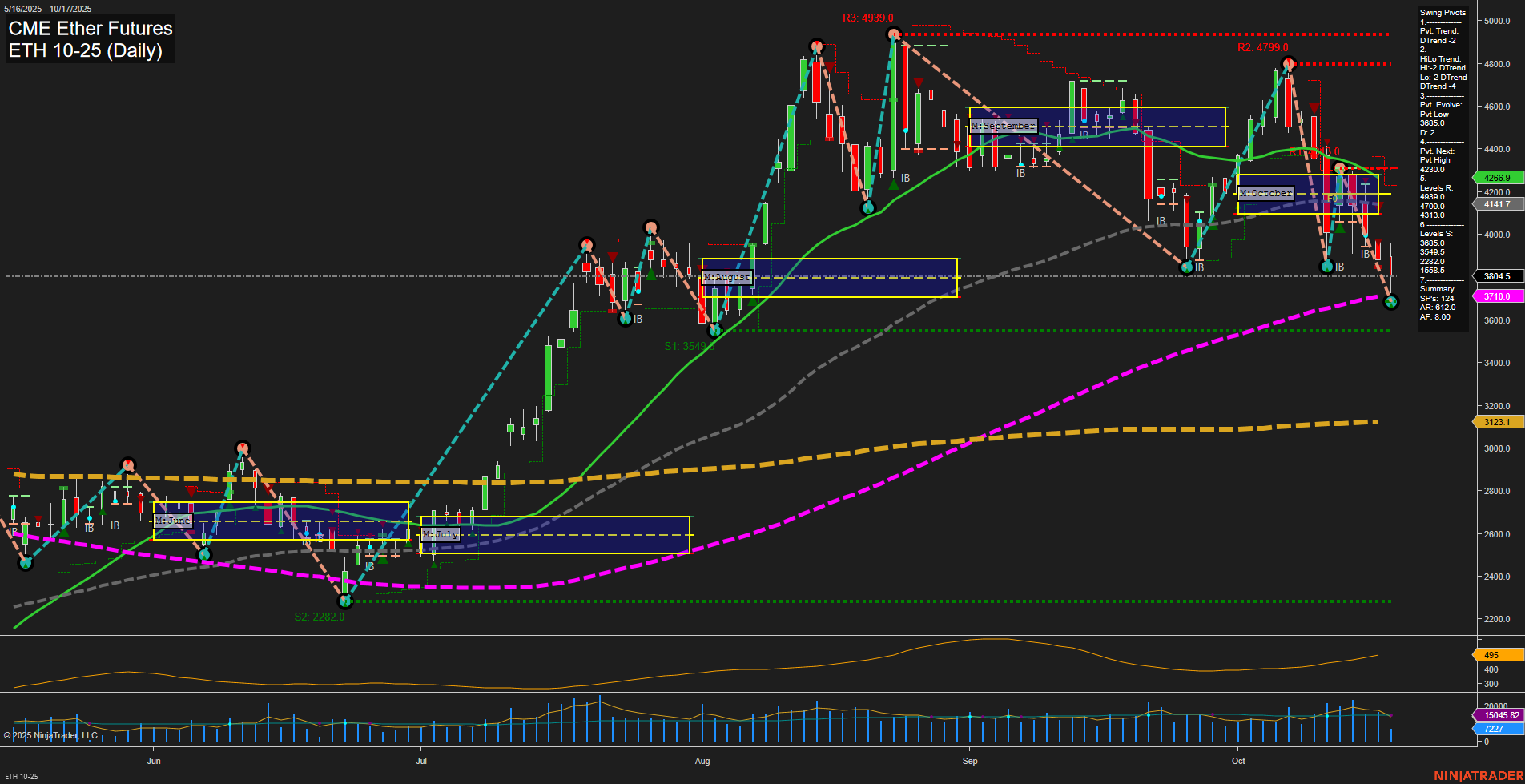

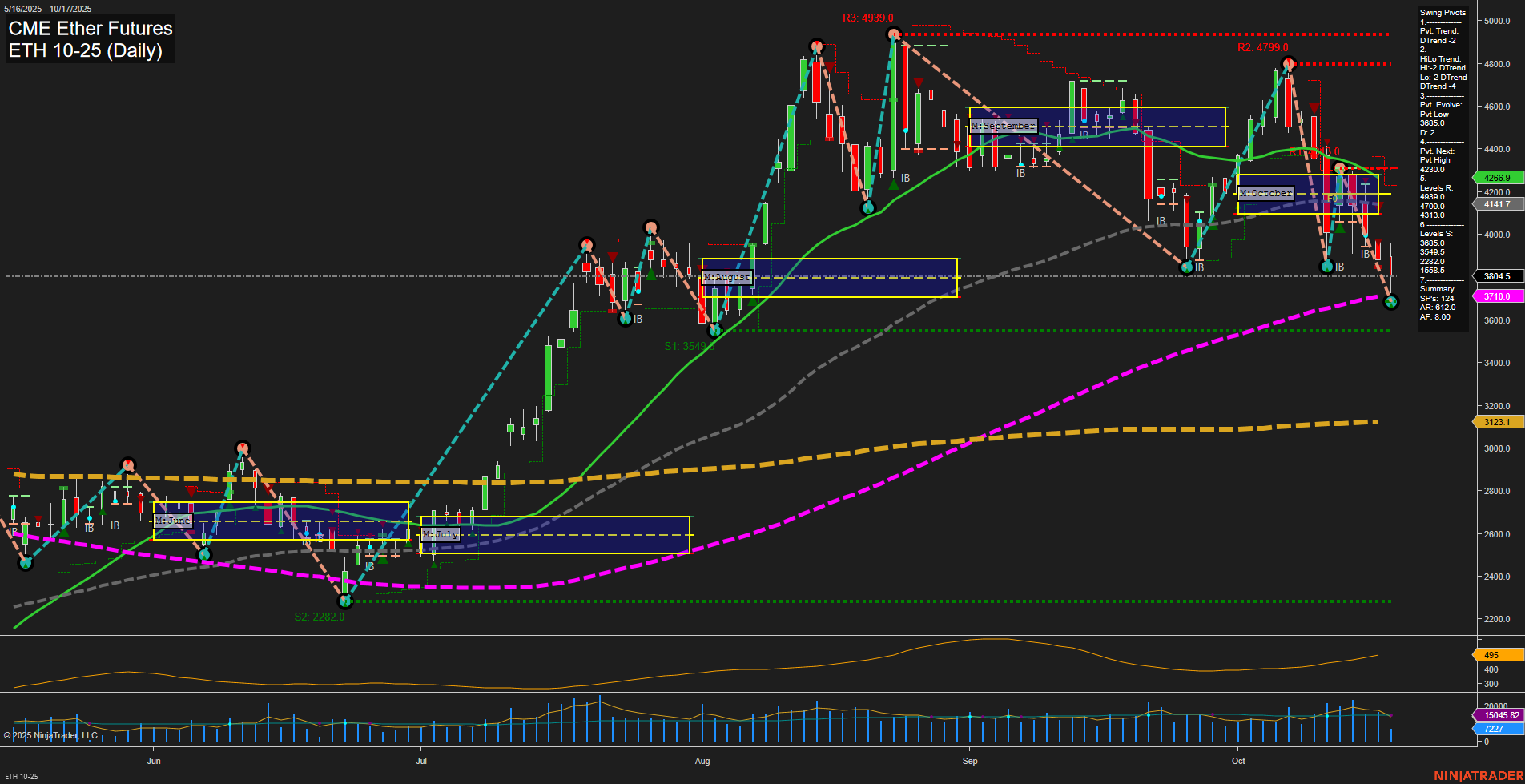

ETH CME Ether Futures Daily Chart Analysis: 2025-Oct-17 07:07 CT

Price Action

- Last: 3804.5,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -58%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -35%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 3804.5,

- 4. Pvt. Next: Pvt high 4230.0,

- 5. Levels R: 4793.0, 4693.0, 4230.0, 4141.7,

- 6. Levels S: 3710.0, 3549.0, 2282.0.

Daily Benchmarks

- (Short-Term) 5 Day: 4015.5 Down Trend,

- (Short-Term) 10 Day: 4026 Down Trend,

- (Intermediate-Term) 20 Day: 4266.9 Down Trend,

- (Intermediate-Term) 55 Day: 4141.7 Down Trend,

- (Long-Term) 100 Day: 3710.0 Up Trend,

- (Long-Term) 200 Day: 3123.1 Up Trend.

Additional Metrics

Recent Trade Signals

- 16 Oct 2025: Short ETH 10-25 @ 4015.5 Signals.USAR-MSFG

- 14 Oct 2025: Short ETH 10-25 @ 4026 Signals.USAR-WSFG

- 13 Oct 2025: Long ETH 10-25 @ 4217.5 Signals.USAR.TR120

- 10 Oct 2025: Short ETH 10-25 @ 4115.5 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The current ETH CME Ether Futures daily chart shows a pronounced short- and intermediate-term bearish trend, with price action breaking below key support levels and both the weekly and monthly session fib grids trending down. Large, fast-momentum bars indicate heightened volatility and strong directional conviction to the downside. Swing pivot analysis confirms a dominant downtrend, with the most recent pivot low at 3804.5 and the next potential reversal only above 4230.0. Resistance levels are stacked above, while support is now being tested near 3710.0. All short- and intermediate-term moving averages are trending down, reinforcing the bearish structure, while long-term averages remain in an uptrend, suggesting the broader bull cycle is intact but under pressure. Recent trade signals have favored the short side, aligning with the prevailing momentum. The market is experiencing a corrective phase within a larger uptrend, with volatility elevated and volume above average, indicating active participation. The setup reflects a classic swing cycle: a strong rally, followed by a sharp retracement, and now a test of major support. The next key development will be whether price can stabilize and form a higher low, or if further downside will challenge the long-term bullish structure.

Chart Analysis ATS AI Generated: 2025-10-17 07:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.