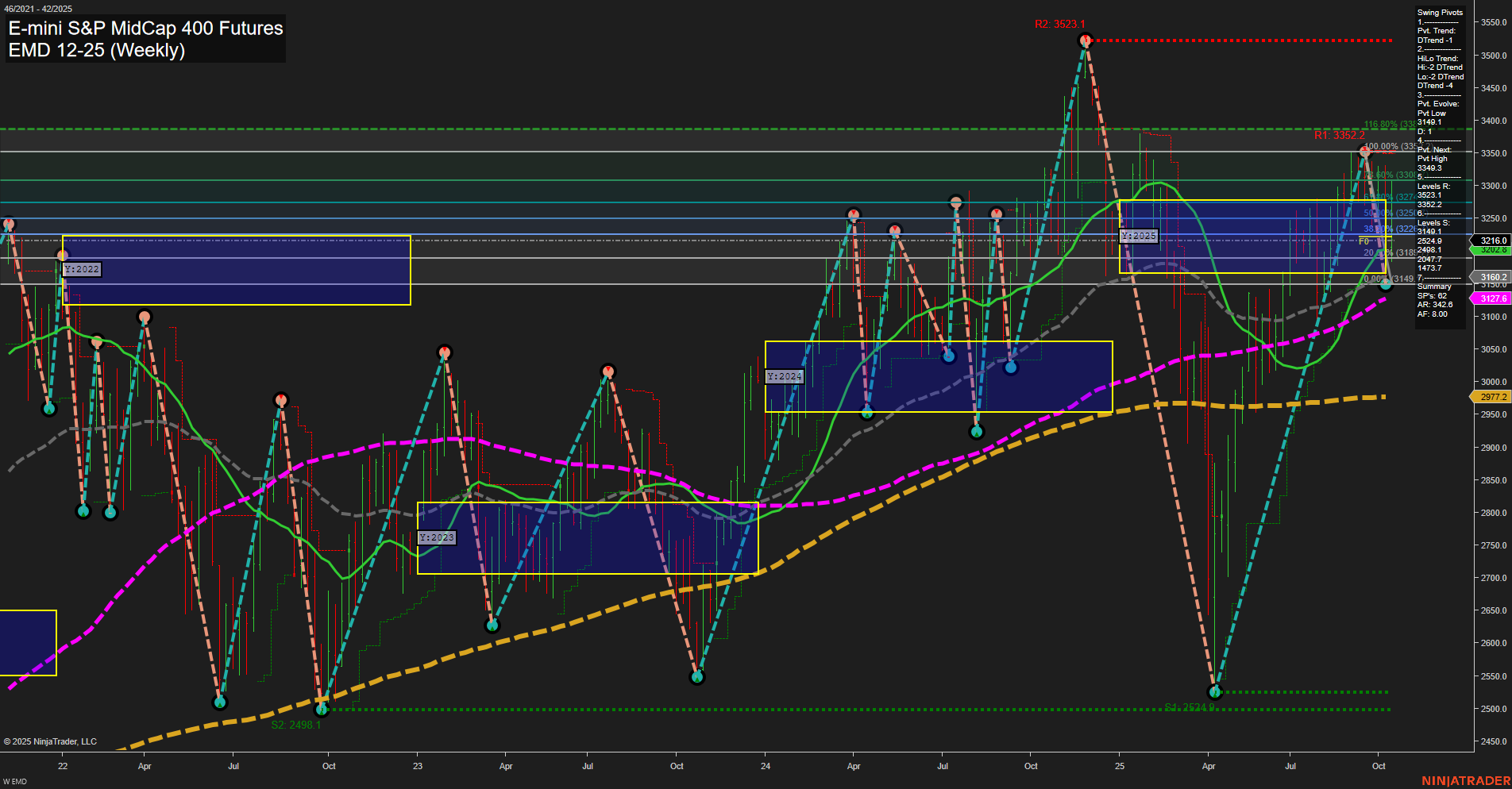

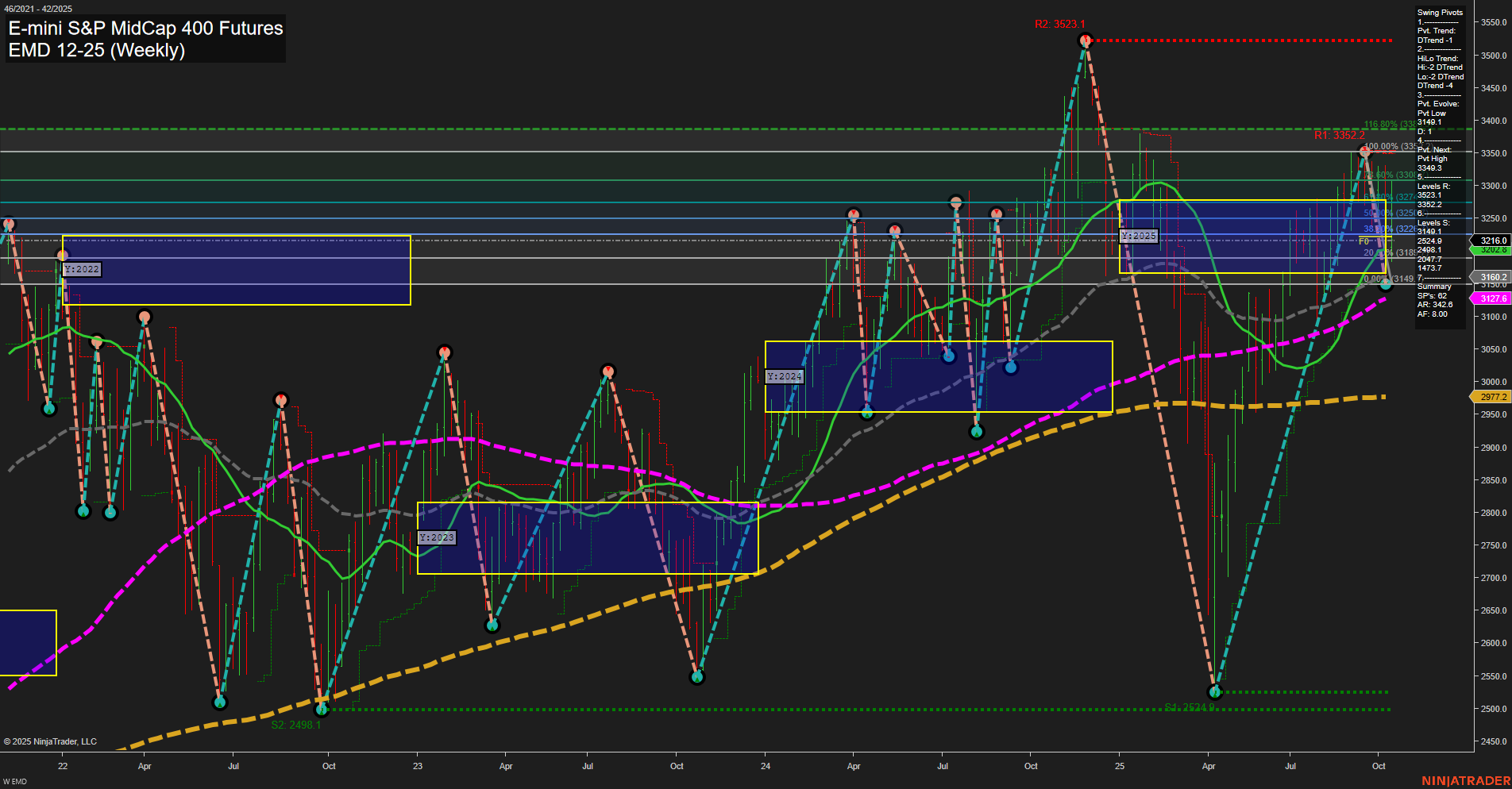

EMD E-mini S&P MidCap 400 Futures Weekly Chart Analysis: 2025-Oct-17 07:06 CT

Price Action

- Last: 3216.0,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -29%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 3149.0,

- 4. Pvt. Next: Pvt high 3349.3,

- 5. Levels R: 3523.1, 3352.2, 3349.3, 3240.7,

- 6. Levels S: 3149.0, 2524.9.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3242.6 Down Trend,

- (Intermediate-Term) 10 Week: 3262.8 Down Trend,

- (Long-Term) 20 Week: 3216.0 Down Trend,

- (Long-Term) 55 Week: 3160.2 Up Trend,

- (Long-Term) 100 Week: 3172.6 Up Trend,

- (Long-Term) 200 Week: 2977.2 Up Trend.

Recent Trade Signals

- 16 Oct 2025: Short EMD 12-25 @ 3232.5 Signals.USAR.TR120

- 16 Oct 2025: Short EMD 12-25 @ 3240.7 Signals.USAR-MSFG

- 13 Oct 2025: Long EMD 12-25 @ 3217.2 Signals.USAR-WSFG

- 10 Oct 2025: Short EMD 12-25 @ 3213.1 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral

- Intermediate-Term: Bearish

- Long-Term: Neutral

Key Insights Summary

The EMD futures weekly chart shows a market in transition, with mixed signals across timeframes. Short-term price action is neutral, as the WSFG trend is up but momentum is slow and recent bars are medium-sized, indicating a lack of strong conviction. The intermediate-term outlook is bearish, with both the MSFG trend and swing pivot trends pointing down, and the 5- and 10-week moving averages confirming a downward bias. Long-term signals are neutral, as the yearly fib grid and major moving averages (55, 100, 200 week) are either flat or slightly up, suggesting the broader trend is stabilizing after recent volatility. Resistance is clustered near 3350–3520, while support is found at 3149 and much lower at 2524, highlighting a wide trading range. Recent trade signals reflect this indecision, with both long and short entries triggered in the past week. Overall, the market is consolidating after a pullback, with no clear directional bias in the short or long term, while the intermediate-term remains under pressure.

Chart Analysis ATS AI Generated: 2025-10-17 07:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.