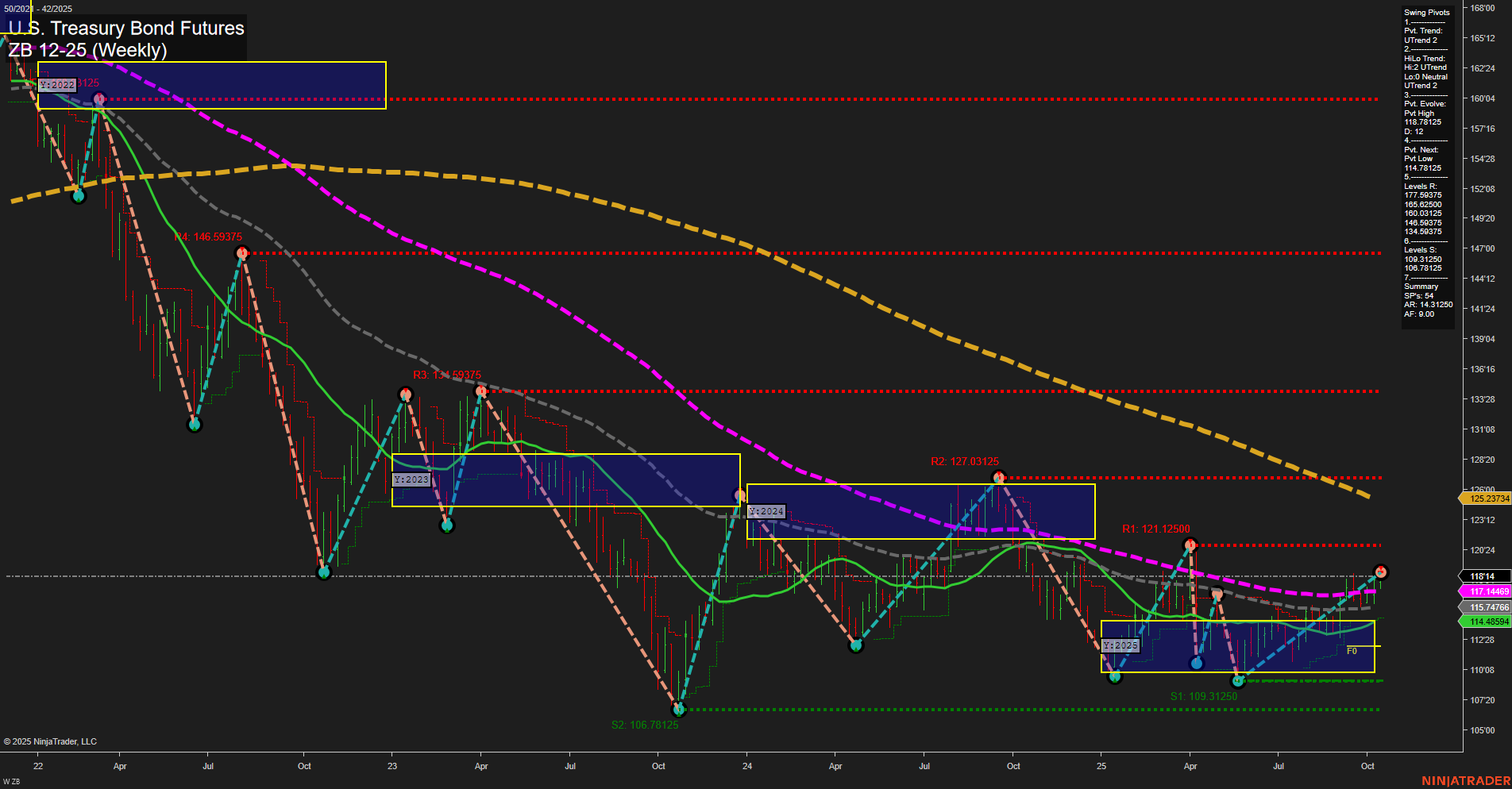

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has shifted to an average momentum with medium-sized bars, indicating a steady but not explosive move. Both short-term and intermediate-term swing pivot trends have turned upward, supported by a series of higher lows and a recent pivot high at 118.7125. The price is currently above the 5, 10, and 20-week moving averages, all of which are trending up, reinforcing the bullish tone in the short and intermediate timeframes. However, the longer-term moving averages (55, 100, and 200 weeks) remain in a downtrend, and price is still below these key resistance levels, suggesting the broader trend is still bearish. The market is consolidating within a neutral zone on the session fib grids, with no clear breakout above or below the NTZ/F0% levels. Resistance is layered above at 127.03125 and 121.125, while support is found at 109.3125 and 106.78125. The overall structure hints at a possible base-building phase, with the potential for a trend reversal if price can sustain above intermediate resistance and the long-term moving averages begin to flatten or turn up. For now, the short and intermediate-term outlooks are bullish, but the long-term trend remains bearish until more significant resistance levels are overcome.