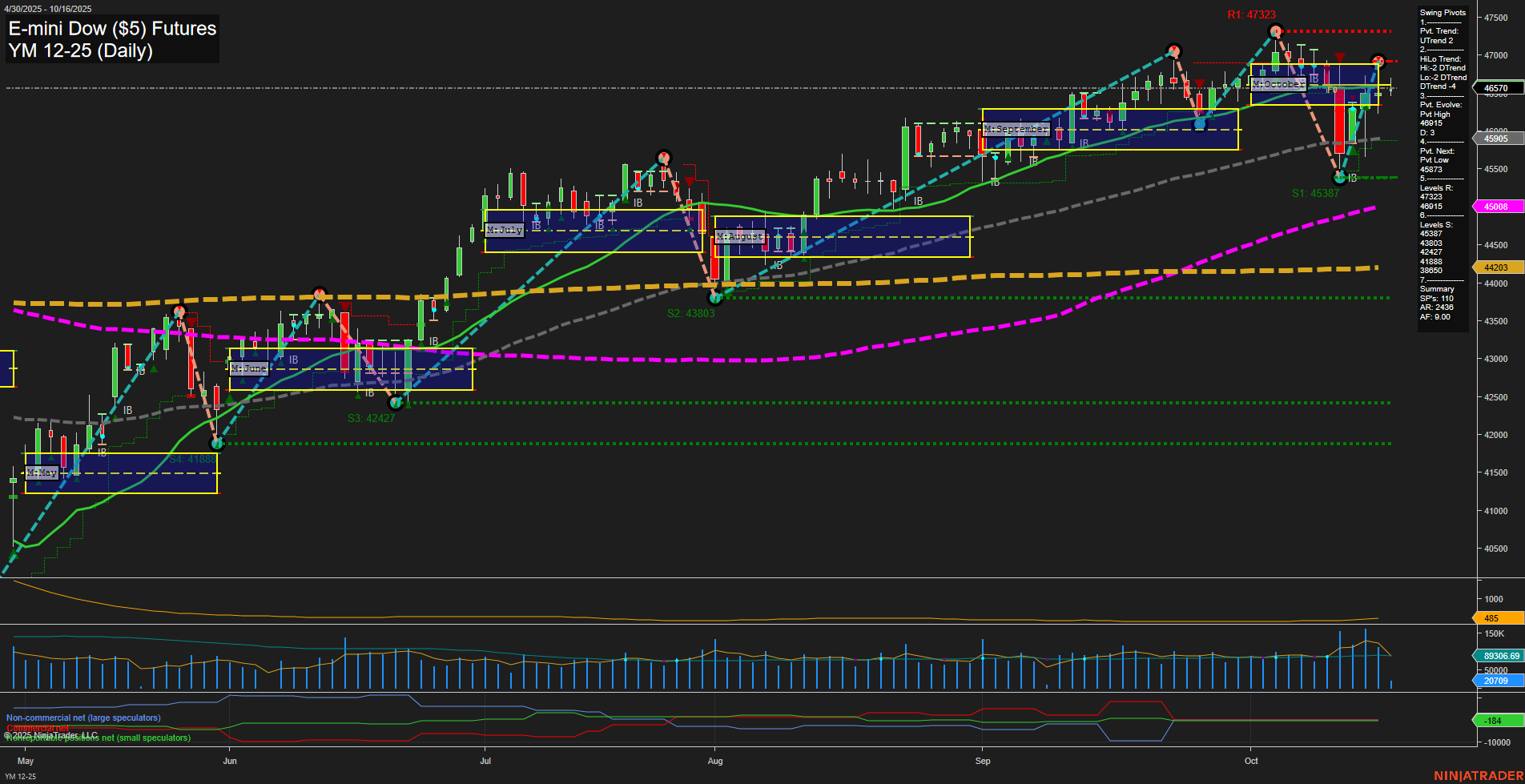

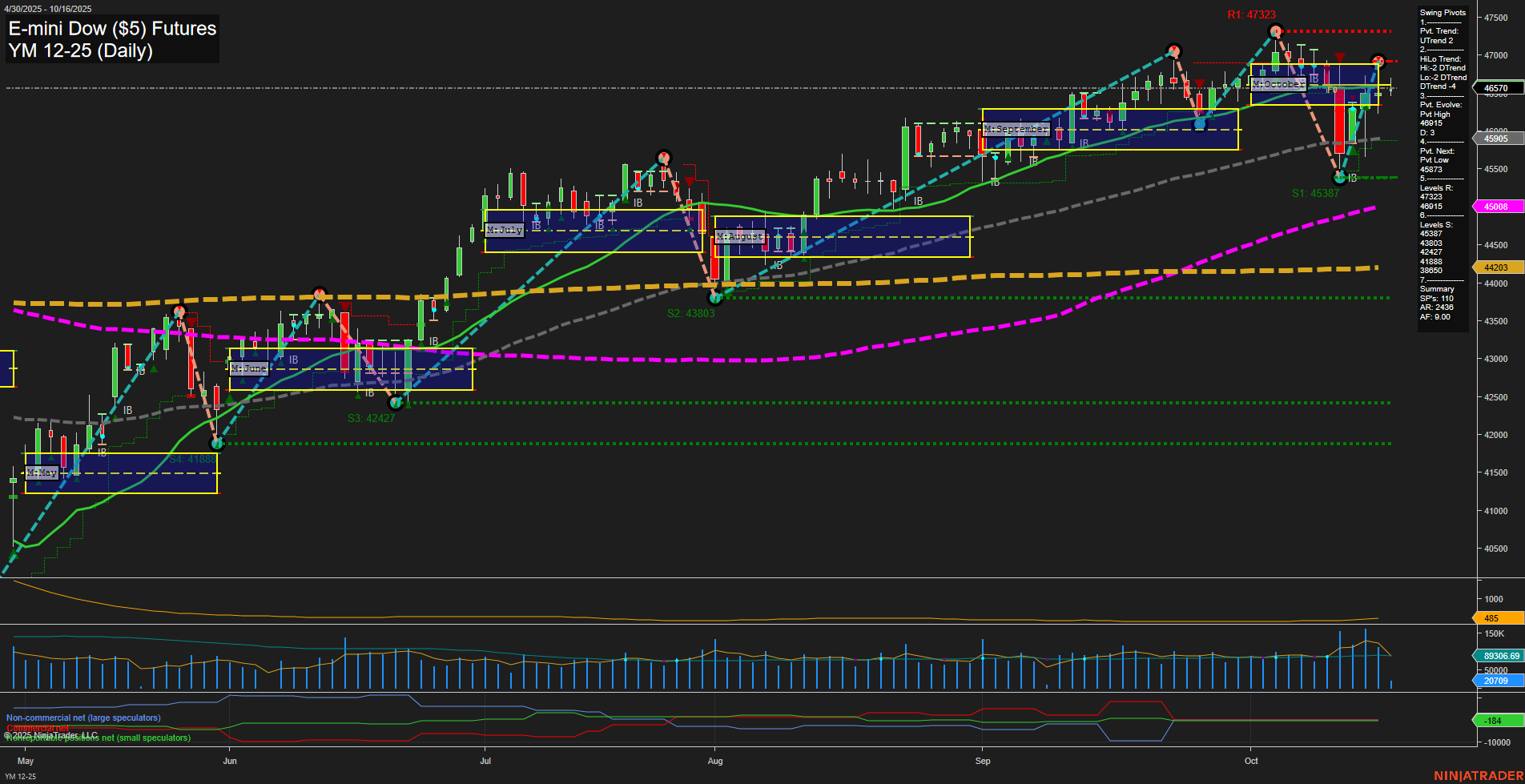

YM E-mini Dow ($5) Futures Daily Chart Analysis: 2025-Oct-16 07:20 CT

Price Action

- Last: 46570,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 67%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 5%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 36%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 46919,

- 4. Pvt. Next: Pvt Low 45905,

- 5. Levels R: 47323, 46919, 46573,

- 6. Levels S: 45905, 45387, 43803, 42427, 41881, 38860.

Daily Benchmarks

- (Short-Term) 5 Day: 46373 Up Trend,

- (Short-Term) 10 Day: 46115 Up Trend,

- (Intermediate-Term) 20 Day: 46019 Up Trend,

- (Intermediate-Term) 55 Day: 45008 Up Trend,

- (Long-Term) 100 Day: 44203 Up Trend,

- (Long-Term) 200 Day: 44203 Up Trend.

Additional Metrics

Recent Trade Signals

- 15 Oct 2025: Long YM 12-25 @ 46724 Signals.USAR-MSFG

- 10 Oct 2025: Short YM 12-25 @ 46092 Signals.USAR.TR720

- 08 Oct 2025: Short YM 12-25 @ 46896 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures daily chart shows a market that has recently regained upward momentum after a short-term pullback. Price is trading above all key moving averages, with the 5, 10, 20, 55, 100, and 200-day benchmarks all trending higher, confirming a strong underlying bullish structure. The current swing pivot trend is up, with the most recent pivot high at 46919 and next key support at 45905, suggesting the market is in a recovery phase after a recent dip. The WSFG and MSFG both indicate price is above their respective NTZ/F0% levels, reinforcing the bullish bias in both short and intermediate timeframes. However, the intermediate-term HiLo trend remains down, reflecting some residual weakness from the recent correction. Volatility (ATR) is moderate, and volume is healthy, supporting the current move. Recent trade signals show a mix of short and long entries, highlighting the choppy, rotational nature of the market over the past week, but the latest signal is long, in line with the prevailing trend. Overall, the market is in a bullish phase with strong support from moving averages and session fib grids, but traders should be aware of potential resistance near recent highs and the possibility of further consolidation before a sustained breakout.

Chart Analysis ATS AI Generated: 2025-10-16 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.