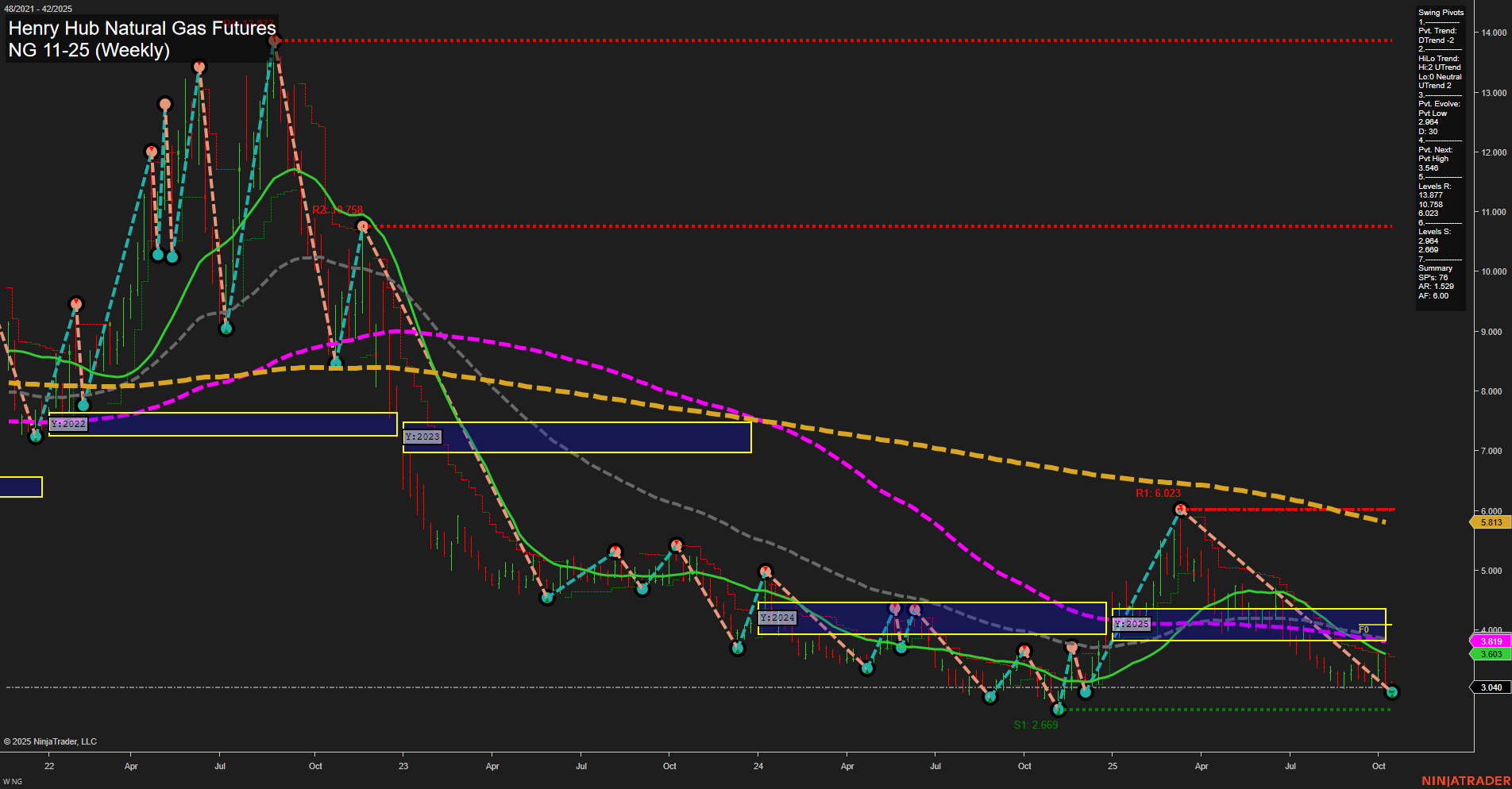

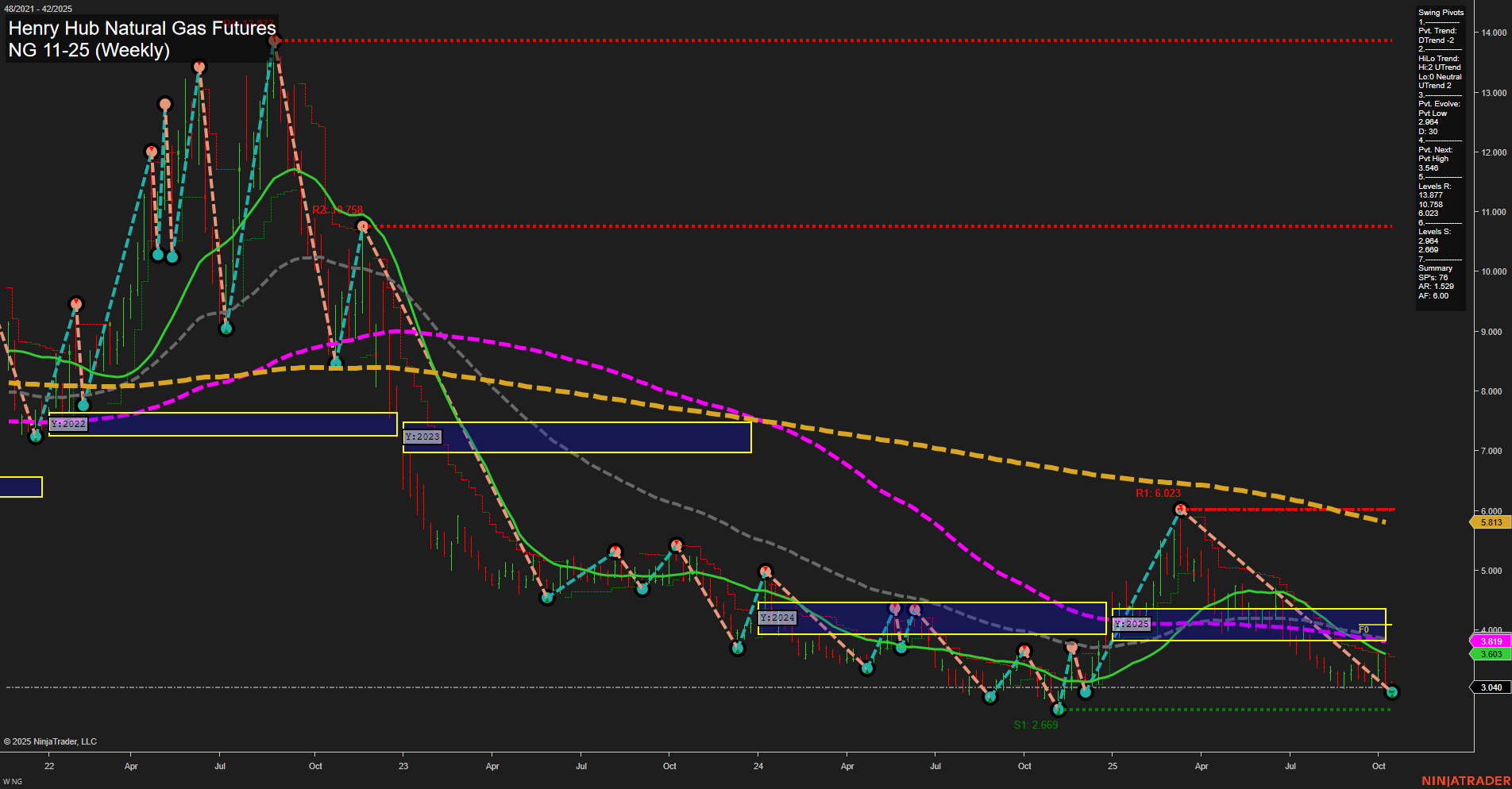

NG Henry Hub Natural Gas Futures Weekly Chart Analysis: 2025-Oct-16 07:12 CT

Price Action

- Last: 3.040,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 2.094,

- 4. Pvt. Next: Pvt high 3.846,

- 5. Levels R: 13.677, 10.738, 6.023,

- 6. Levels S: 2.094, 2.669, 3.040.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3.819 Down Trend,

- (Intermediate-Term) 10 Week: 3.693 Down Trend,

- (Long-Term) 20 Week: 3.819 Down Trend,

- (Long-Term) 55 Week: 5.813 Down Trend,

- (Long-Term) 100 Week: 6.023 Down Trend,

- (Long-Term) 200 Week: 10.738 Down Trend.

Recent Trade Signals

- 14 Oct 2025: Short NG 11-25 @ 3.038 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Natural gas futures have been under sustained pressure, with the last price at 3.040 and momentum remaining slow. The short-term swing pivot trend is down, confirmed by a series of lower highs and lower lows, while the intermediate-term HiLo trend is showing some signs of upward movement, suggesting a possible base or pause in the decline. All key moving averages (5, 10, 20, 55, 100, and 200 week) are trending down, reinforcing the dominant bearish sentiment across all timeframes. The most recent trade signal was a short entry, aligning with the prevailing downtrend. Price is currently near a significant support cluster (2.094–3.040), with resistance levels much higher, indicating that any bounce may face strong overhead supply. The market is consolidating near multi-year lows, and while the intermediate-term trend is neutral, the overall structure remains weak, with no clear signs of a reversal. This environment is characterized by choppy, range-bound action with a bearish bias, and any rallies are likely to be met with selling pressure unless a significant catalyst emerges.

Chart Analysis ATS AI Generated: 2025-10-16 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.