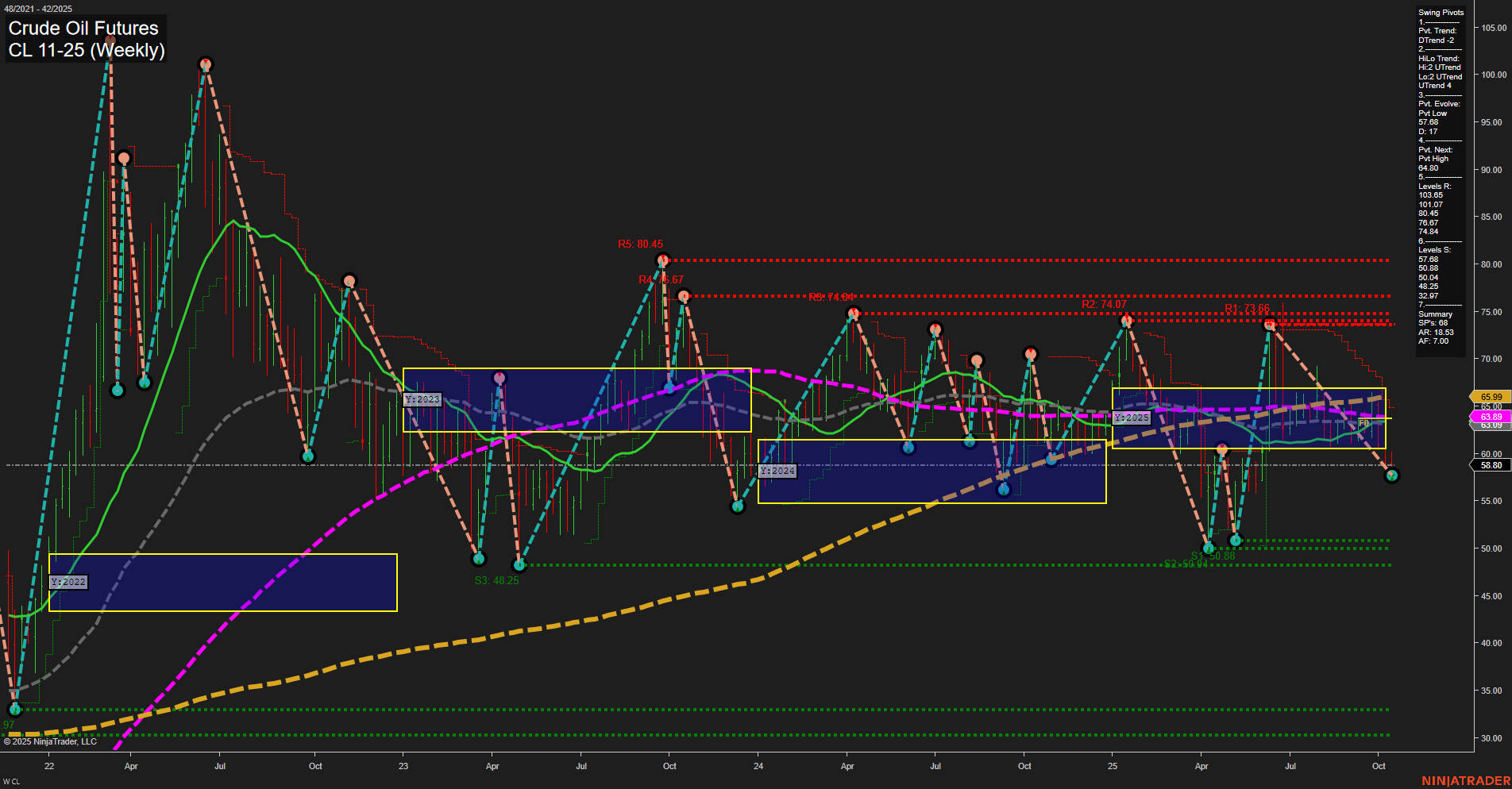

Crude oil futures are currently trading at 58.80, with medium-sized weekly bars and slow momentum, reflecting a market that is losing steam after recent declines. The short-term (WSFG) and long-term (YSFG) Fibonacci grid trends are both down, with price action consistently below key NTZ levels, indicating persistent bearish pressure. The intermediate-term (MSFG) is also trending down, though the HiLo swing pivot trend remains up, suggesting some underlying support or potential for a counter-trend bounce. Swing pivot analysis shows the most recent evolution at a pivot low (57.02), with the next significant resistance at 64.83 and multiple resistance levels stacked above, while support is clustered just below current prices, down to the low 40s. All major weekly moving averages (5, 10, 20, 55, 100) are in downtrends and positioned above the last price, reinforcing the overall bearish structure, though the 200-week MA remains in an uptrend and well below current price, acting as a distant long-term support. Recent trade signals have been mixed, with a new long signal at 58.84 following two short signals in the low 61s, reflecting choppy, indecisive price action and possible short-term mean reversion attempts within a broader downtrend. The market is currently in a corrective or consolidation phase, with lower highs and lower lows dominating the chart, and volatility contained within a well-defined range. The technical landscape suggests a market under pressure, with rallies likely to face resistance and downside tests of support levels probable unless a significant reversal develops.