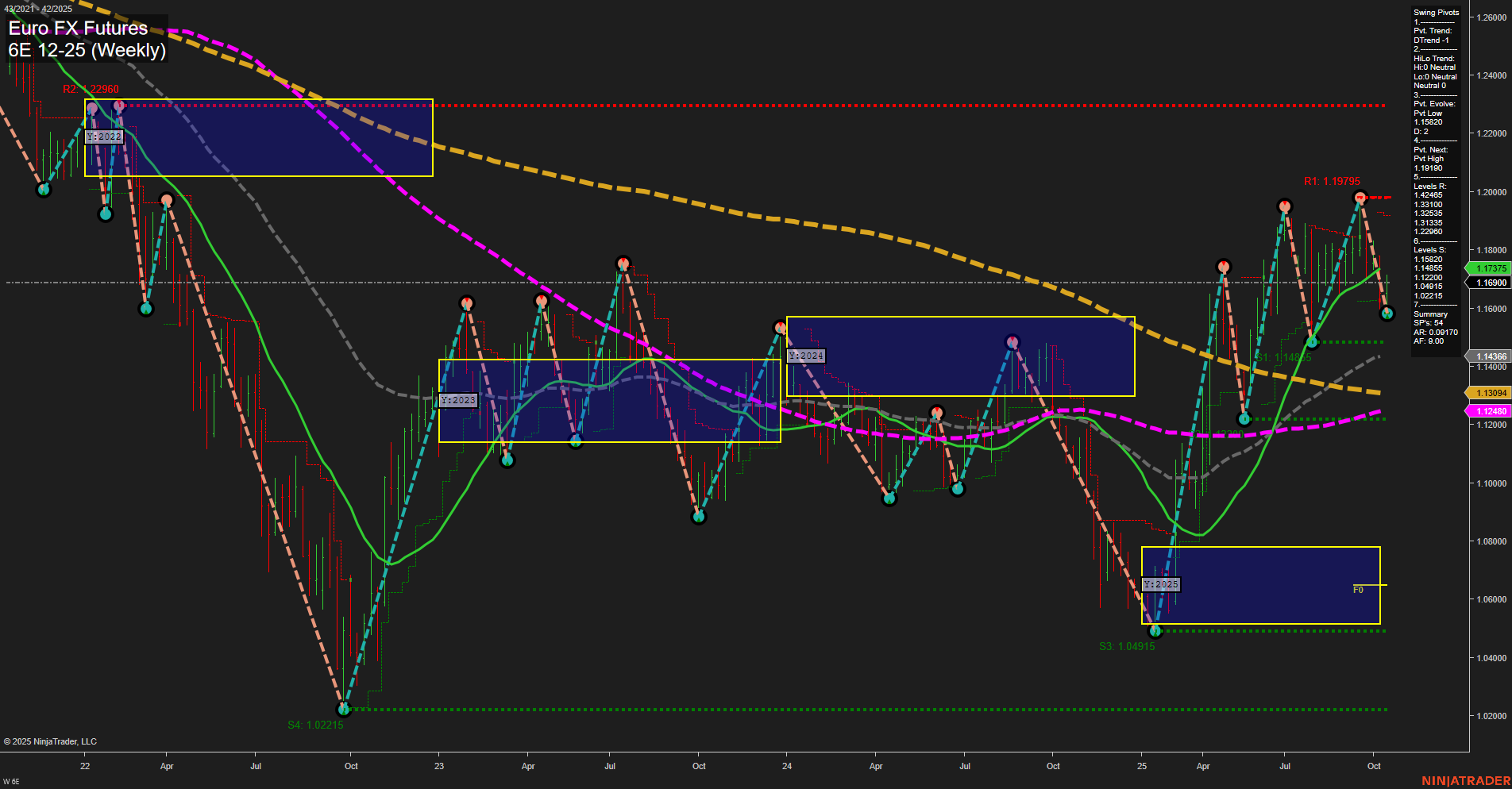

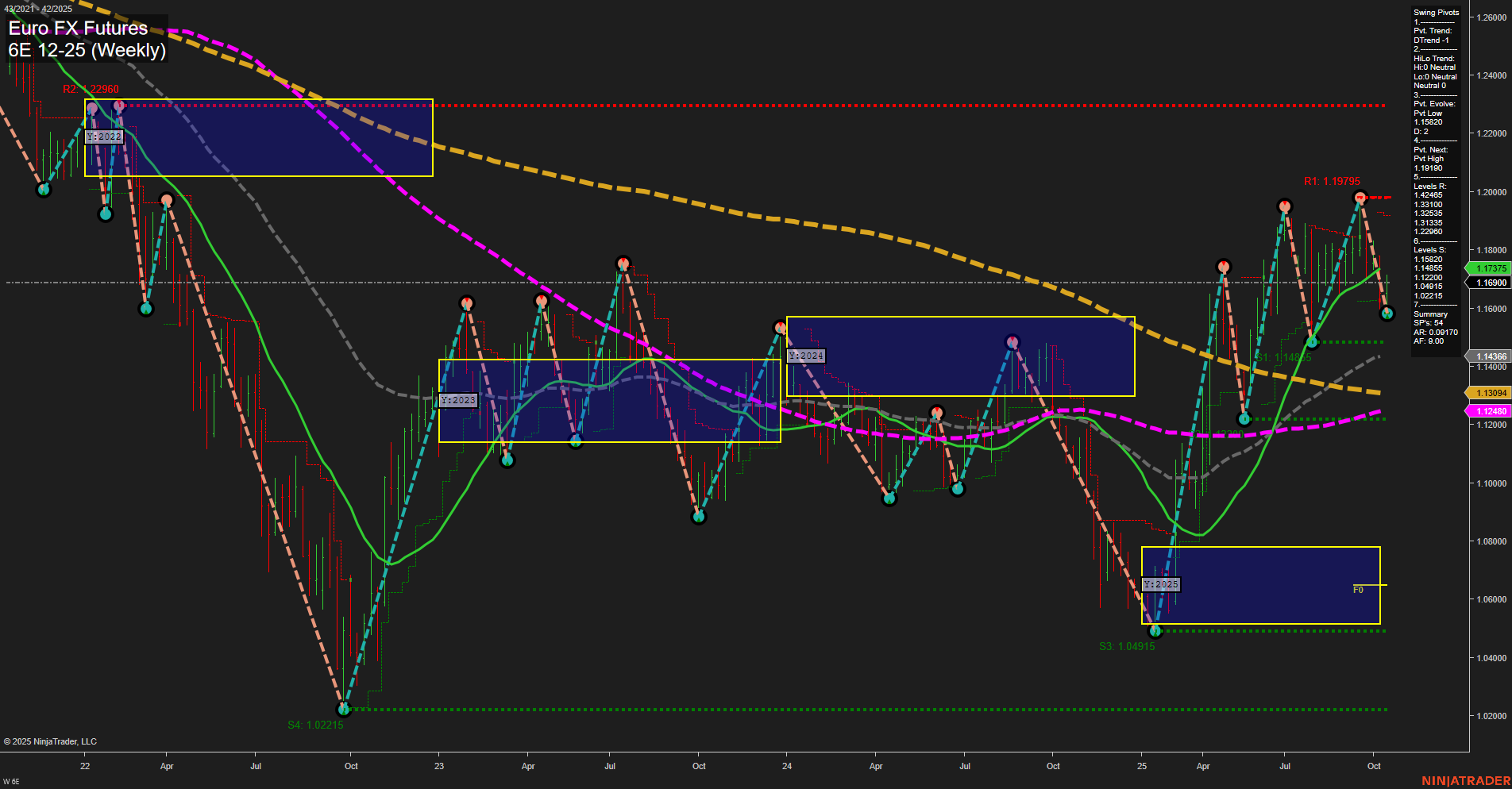

6E Euro FX Futures Weekly Chart Analysis: 2025-Oct-16 07:02 CT

Price Action

- Last: 1.17375,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 24%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -27%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 82%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt low 1.16900,

- 4. Pvt. Next: Pvt high 1.19105,

- 5. Levels R: 1.19105, 1.17995, 1.22960,

- 6. Levels S: 1.16900, 1.14495, 1.10215.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.17375 Up Trend,

- (Intermediate-Term) 10 Week: 1.16900 Up Trend,

- (Long-Term) 20 Week: 1.14366 Up Trend,

- (Long-Term) 55 Week: 1.13094 Up Trend,

- (Long-Term) 100 Week: 1.12480 Down Trend,

- (Long-Term) 200 Week: 1.14047 Down Trend.

Recent Trade Signals

- 15 Oct 2025: Long 6E 12-25 @ 1.1673 Signals.USAR-WSFG

- 13 Oct 2025: Short 6E 12-25 @ 1.1607 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a market in transition, with short-term and long-term bullish momentum, while the intermediate-term remains neutral. Price is currently above the key NTZ/F0% levels on both the weekly and yearly session fib grids, supporting the uptrend bias. The most recent swing pivot trend is up, with the next resistance at 1.19105 and support at 1.16900. Moving averages for the 5, 10, 20, and 55 weeks are all trending up, reinforcing the bullish structure, though the 100 and 200 week MAs still lag in a downtrend, reflecting the longer-term recovery from previous lows. Recent trade signals show both long and short activity, highlighting some short-term volatility and possible profit-taking or hedging. Overall, the chart suggests a market that has broken out of consolidation, with higher lows and a series of swing highs, but is now facing a test of resistance as it approaches previous highs. The environment is characterized by average momentum and medium-sized bars, indicating steady but not explosive movement. The neutral intermediate-term trend suggests the market could consolidate or retrace before the next directional move, while the broader context remains constructive for bulls.

Chart Analysis ATS AI Generated: 2025-10-16 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.