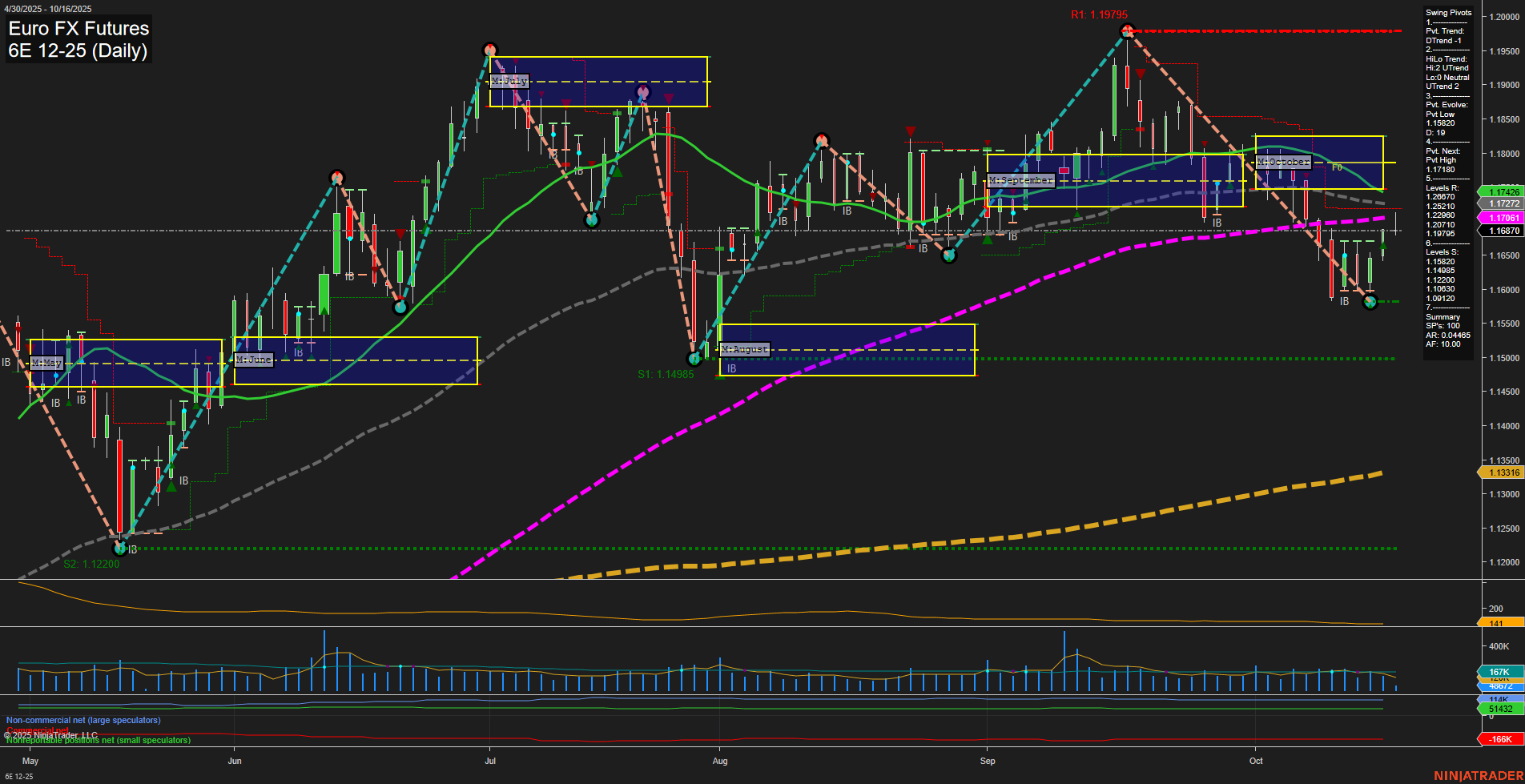

The 6E Euro FX Futures daily chart currently reflects a market in transition. Short-term and intermediate-term trends are both bearish, as indicated by the downward direction of all key moving averages (5, 10, 20, 55, and 100 day) and the swing pivot structure, which shows a dominant downtrend with the most recent pivot low at 1.1620 and resistance at 1.1718. Price is trading below the monthly session fib grid (MSFG) NTZ, reinforcing the intermediate-term bearish bias, while the weekly session fib grid (WSFG) remains positive, suggesting some short-term support above the weekly NTZ. Despite the prevailing bearish momentum in the short and intermediate timeframes, the long-term trend remains bullish, with the yearly session fib grid (YSFG) and the 200-day moving average both trending up. This divergence highlights a market that may be experiencing a corrective phase within a broader uptrend. Volatility, as measured by ATR, is moderate, and volume remains steady, indicating no extreme market conditions. Recent trade signals show mixed activity, with both long and short entries triggered in the past week, reflecting the choppy and potentially range-bound nature of the current price action. The market is likely in a retracement or consolidation phase after a significant move, with traders watching for a potential reversal or continuation at key support (1.14985, 1.12200) and resistance (1.17180, 1.19795) levels. The overall environment suggests caution, as the market could either resume its long-term uptrend or continue to correct lower in the near term.