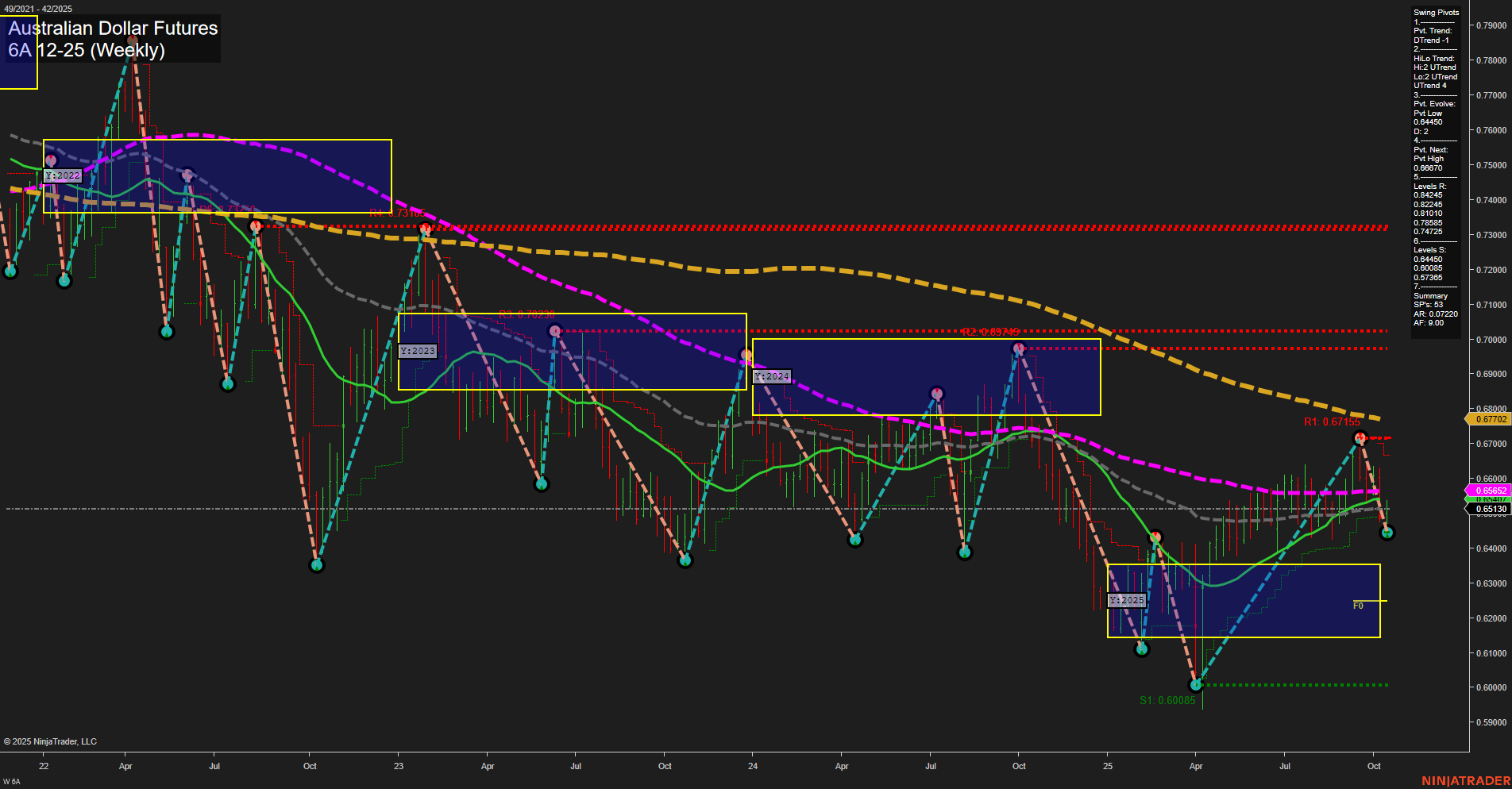

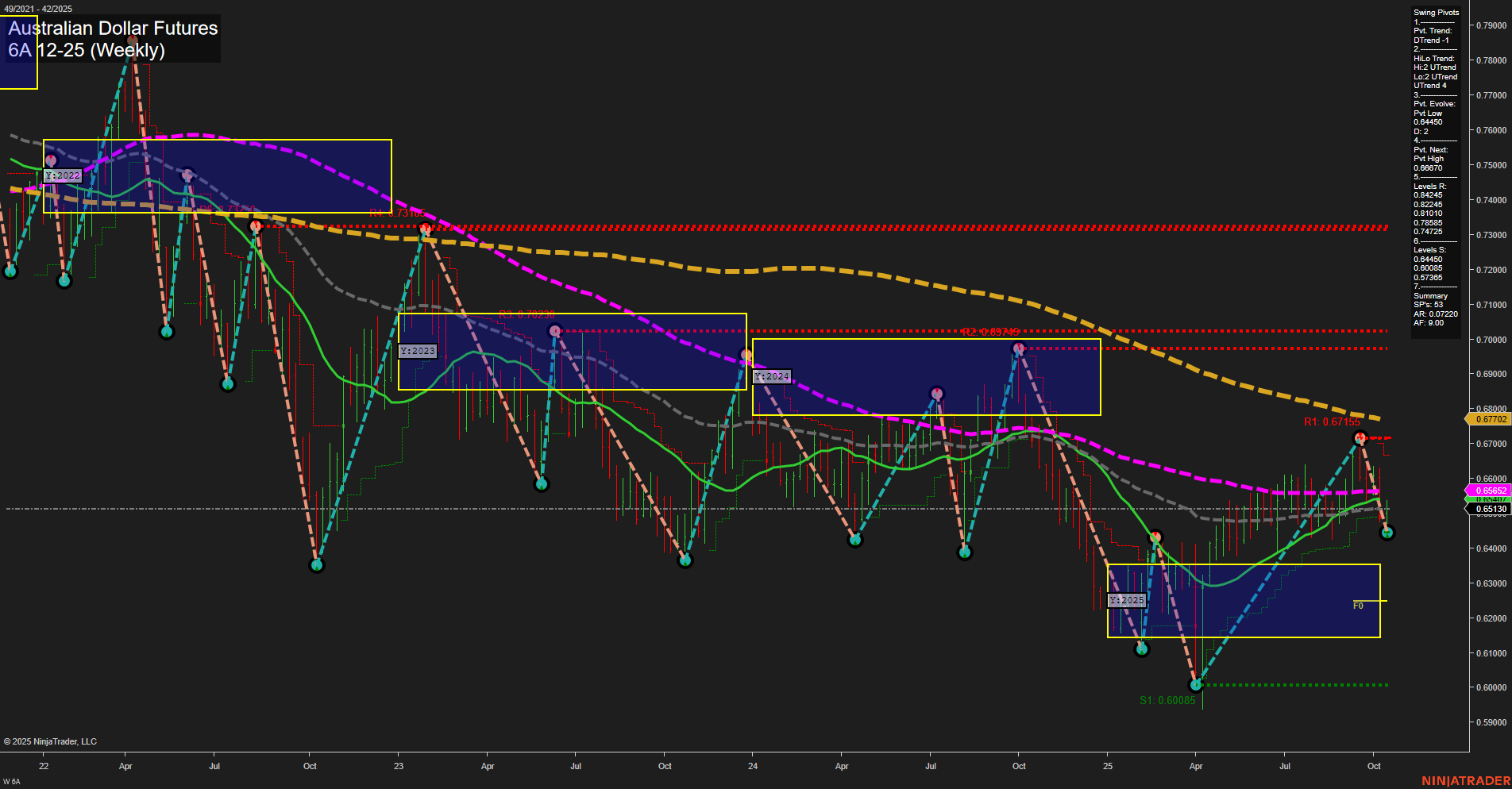

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Oct-16 07:00 CT

Price Action

- Last: 0.65139,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 0.64544,

- 4. Pvt. Next: Pvt High 0.66970,

- 5. Levels R: 0.67155, 0.66970, 0.66205, 0.65522, 0.64845,

- 6. Levels S: 0.60085, 0.57365.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65522 Down Trend,

- (Intermediate-Term) 10 Week: 0.64845 Up Trend,

- (Long-Term) 20 Week: 0.65557 Up Trend,

- (Long-Term) 55 Week: 0.67702 Down Trend,

- (Long-Term) 100 Week: 0.66502 Down Trend,

- (Long-Term) 200 Week: 0.68949 Down Trend.

Recent Trade Signals

- 15 Oct 2025: Long 6A 12-25 @ 0.6515 Signals.USAR-WSFG

- 15 Oct 2025: Long 6A 12-25 @ 0.6518 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a market in transition, with price currently at 0.65139 and recent bars reflecting medium size and average momentum. The short-term and intermediate-term session fib grid trends are neutral, indicating a lack of clear directional conviction. Swing pivot analysis reveals a short-term downtrend but an intermediate-term uptrend, suggesting mixed signals and potential for choppy price action. Key resistance levels are clustered between 0.64845 and 0.67155, while major support is much lower at 0.60085 and 0.57365, highlighting a wide trading range. The moving averages show a split: short and intermediate-term MAs are mixed, but all long-term benchmarks (55, 100, 200 week) remain in downtrends, reinforcing a bearish long-term structure. Recent trade signals have triggered long entries, reflecting attempts to capture a possible bounce or reversal, but the overall technical landscape remains indecisive in the short and intermediate term, with a bearish bias persisting on the long-term horizon. This environment is characterized by consolidation and potential volatility as the market tests key levels, with no clear breakout or breakdown yet established.

Chart Analysis ATS AI Generated: 2025-10-16 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.