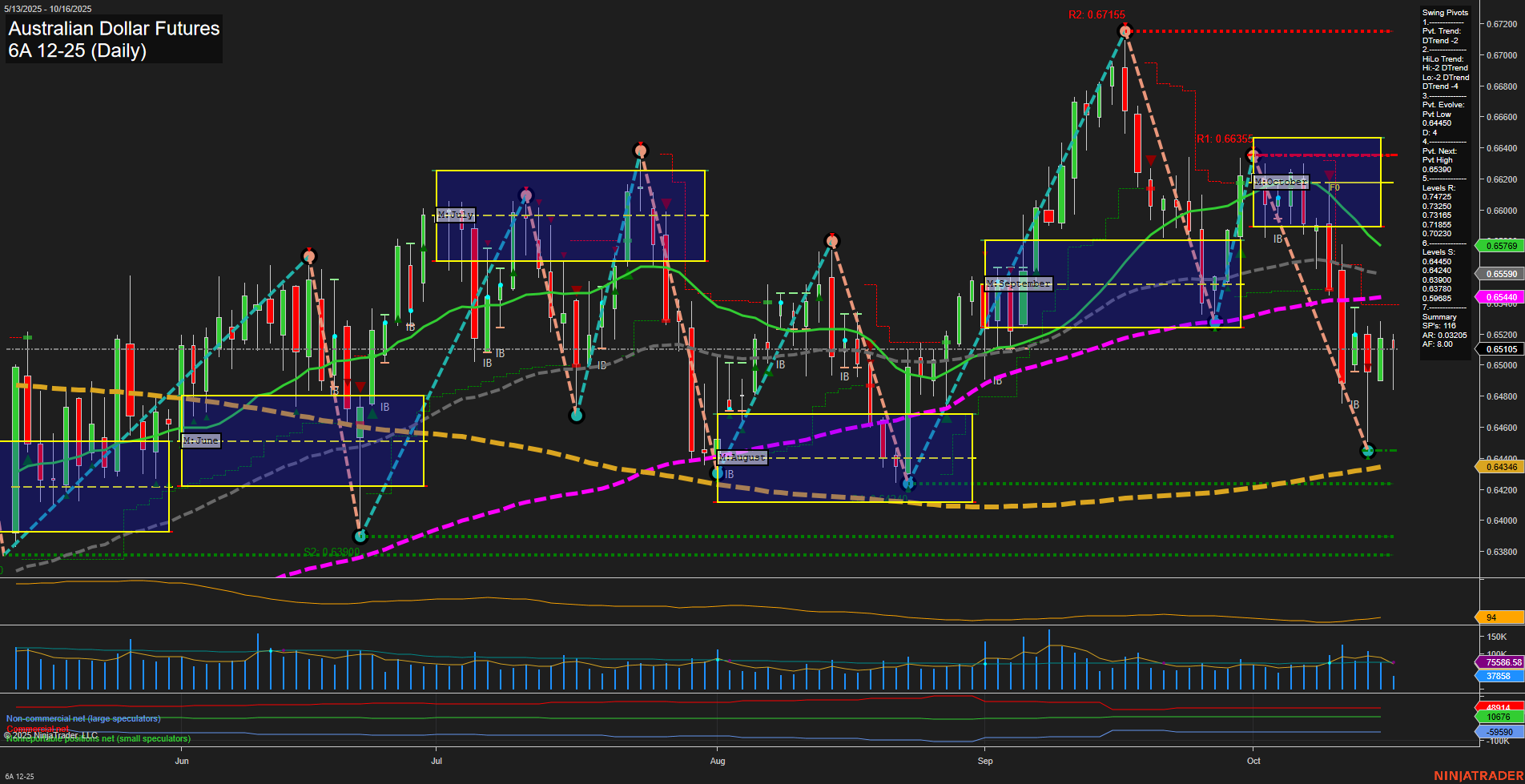

The Australian Dollar Futures (6A) daily chart shows a market in a corrective phase, with price action recently forming a swing low at 0.65105 after a pronounced downtrend from the early October highs. Both short-term and intermediate-term swing pivot trends are down, and all key moving averages (5, 10, 20, 55, 100-day) are trending lower, reinforcing the prevailing bearish sentiment. The 200-day moving average, however, remains in an uptrend, suggesting that the longer-term structure is still intact and the current move may be a retracement within a broader range. Price is currently consolidating just above a significant support level at 0.64346, with resistance levels overhead at 0.65536, 0.66356, and 0.67155. The slow momentum and medium-sized bars indicate a lack of strong directional conviction, and the neutral readings from the session fib grids (weekly, monthly, yearly) suggest the market is in a pause or transition phase. Recent long trade signals hint at a potential attempt to base or bounce from current levels, but the overall technical structure remains weak until a reversal pivot is confirmed above resistance. Volatility (ATR) is moderate, and volume metrics are steady, indicating neither panic selling nor aggressive accumulation. The chart reflects a market that is digesting recent losses, with traders watching for either a continuation lower toward the 200-day average or a reversal if buyers step in at support.