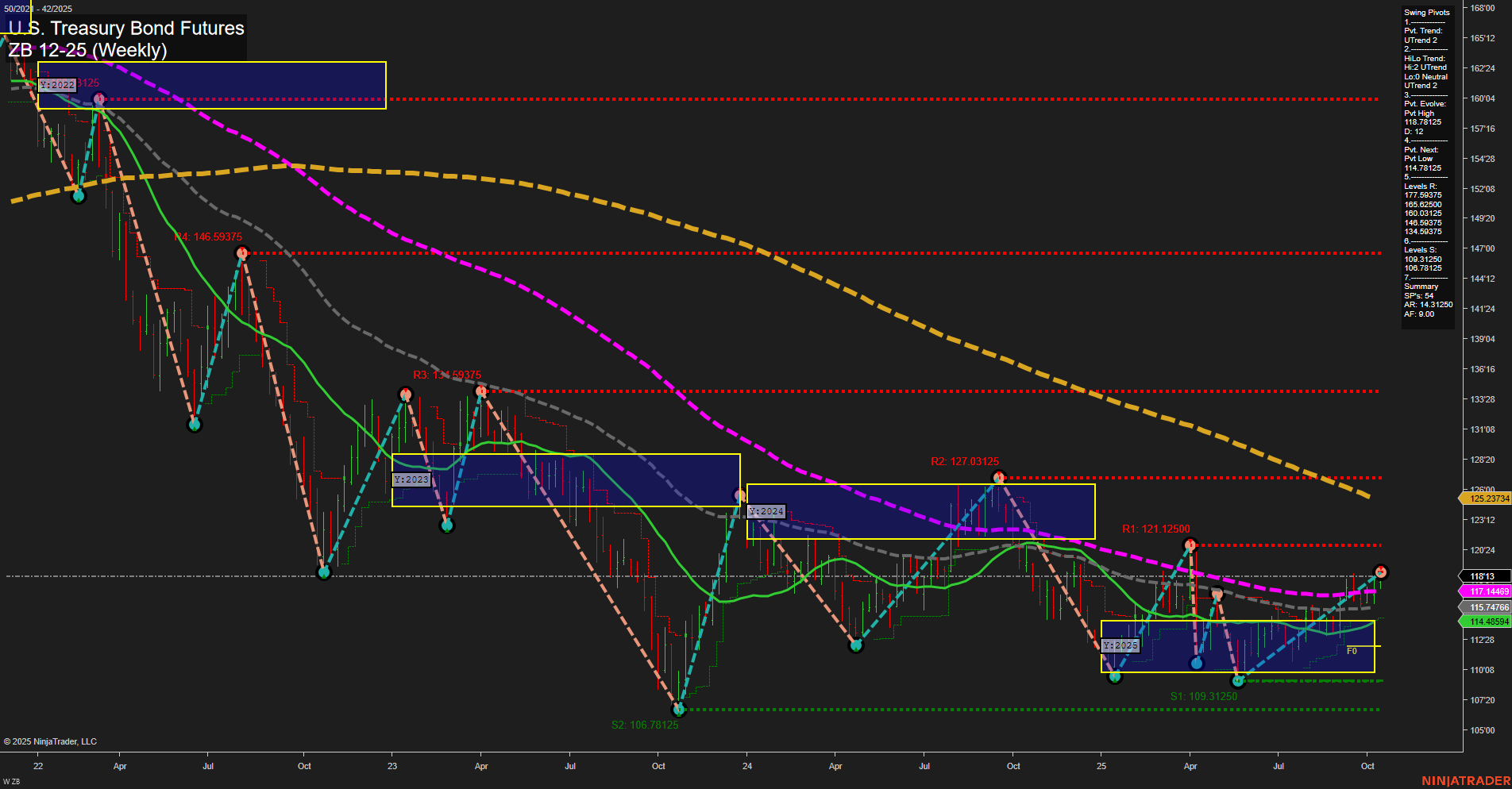

The ZB U.S. Treasury Bond Futures weekly chart shows a notable shift in sentiment, with both short-term and intermediate-term trends turning upward, as indicated by the swing pivot trends and the alignment of all visible moving averages in an uptrend. Price has recently moved above key intermediate resistance levels, and the most recent swing high is well above the prior pivot low, suggesting a series of higher lows and higher highs—a classic bullish structure. However, the long-term trend remains neutral, as the price is still well below the major long-term resistance levels and the 100- and 200-week moving averages are not active, indicating that the broader downtrend from previous years has not yet fully reversed. The current price action is characterized by medium-sized bars and average momentum, reflecting a steady but not explosive move higher. The market is consolidating above the NTZ (neutral zone) and is testing the upper boundaries of the recent range, with significant resistance overhead. This environment suggests a transition phase, where the market is attempting to build a base for a potential longer-term reversal, but confirmation from higher timeframes is still lacking. Volatility appears moderate, and the structure hints at a possible continuation of the current rally if resistance levels are decisively broken.