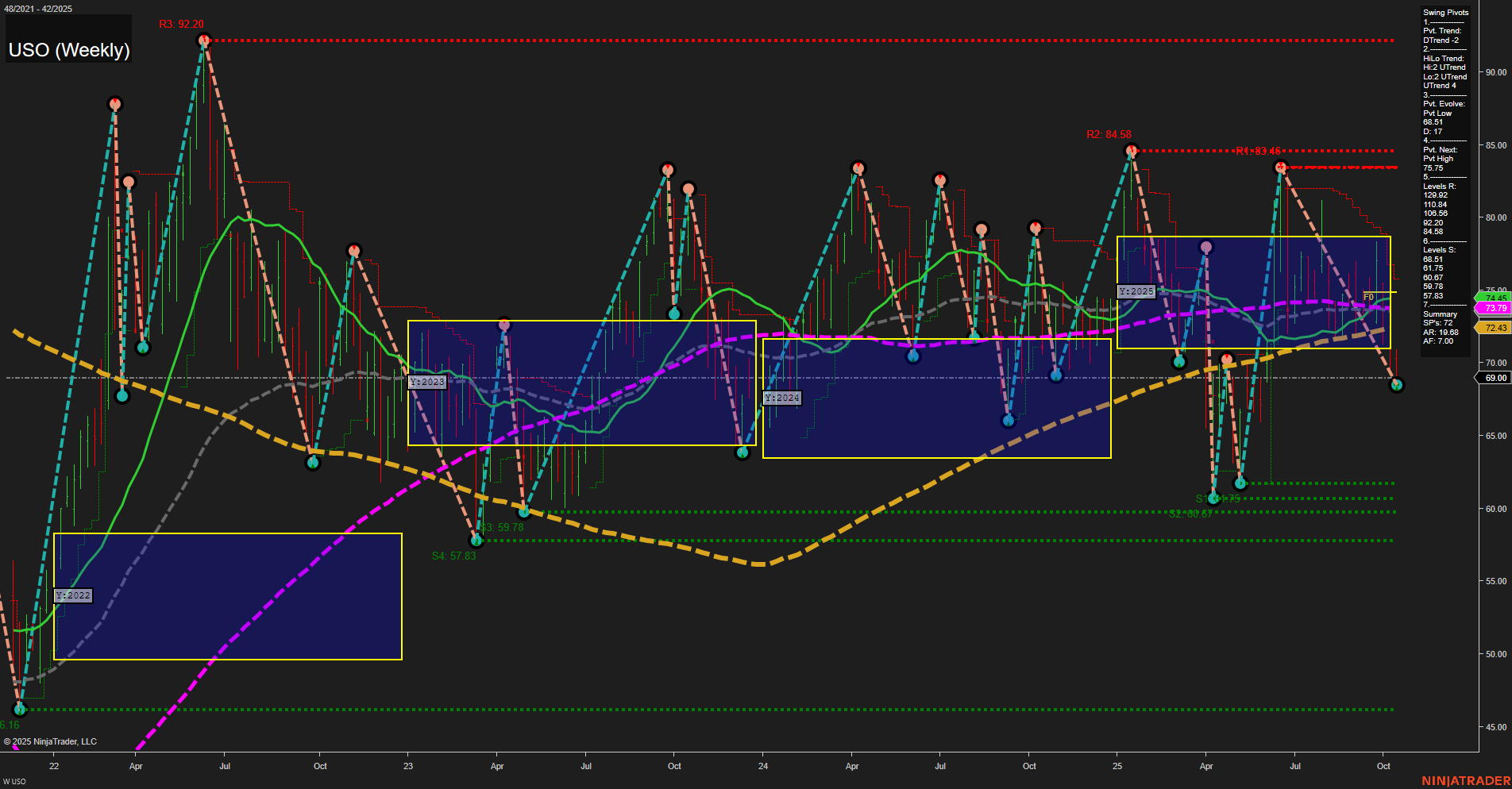

USO is currently trading at 69.00, with medium-sized weekly bars and slow momentum, indicating a lack of strong directional conviction. The price is situated within a neutral zone on the weekly, monthly, and yearly session fib grids, suggesting a consolidation phase rather than a trending environment. The short-term swing pivot trend is down, while the intermediate-term HiLo trend remains up, highlighting a divergence between short-term weakness and longer-term resilience. Multiple resistance levels cluster above, notably at 75.75, 83.45, 84.58, and 92.20, while support is layered below at 66.07, 60.67, 59.78, 57.83, and 56.16. All key moving averages (5, 10, 20, 55, 100 week) are trending down except the 200-week, which is still up, reinforcing a bearish short-term bias but a more neutral to slightly positive long-term structure. The overall environment is characterized by choppy, range-bound price action, with no clear breakout or breakdown, and the market appears to be digesting prior moves, awaiting a catalyst for the next directional leg. This setup is typical of a market in transition, with swing traders likely watching for either a decisive break of support or resistance to define the next major move.