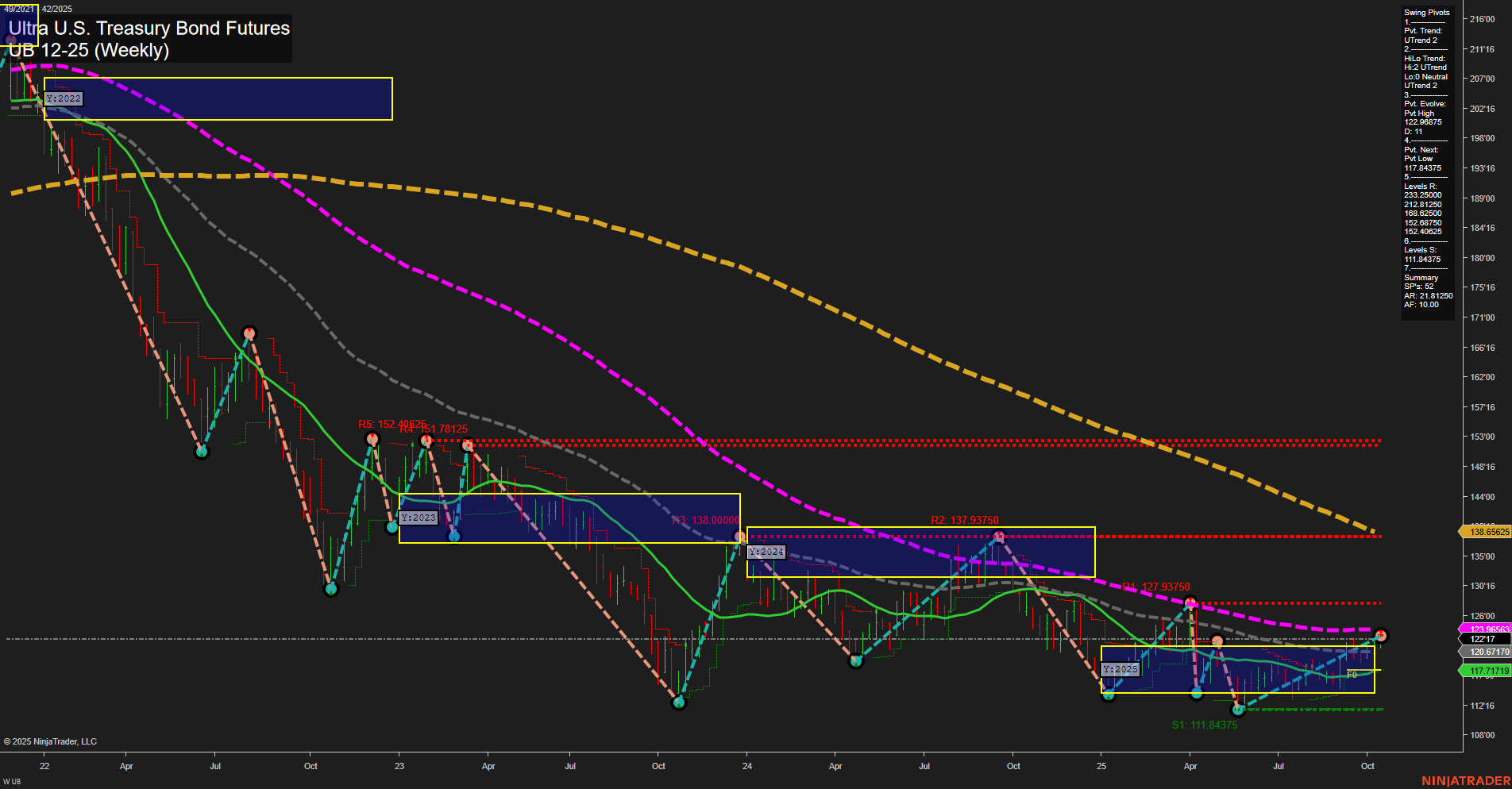

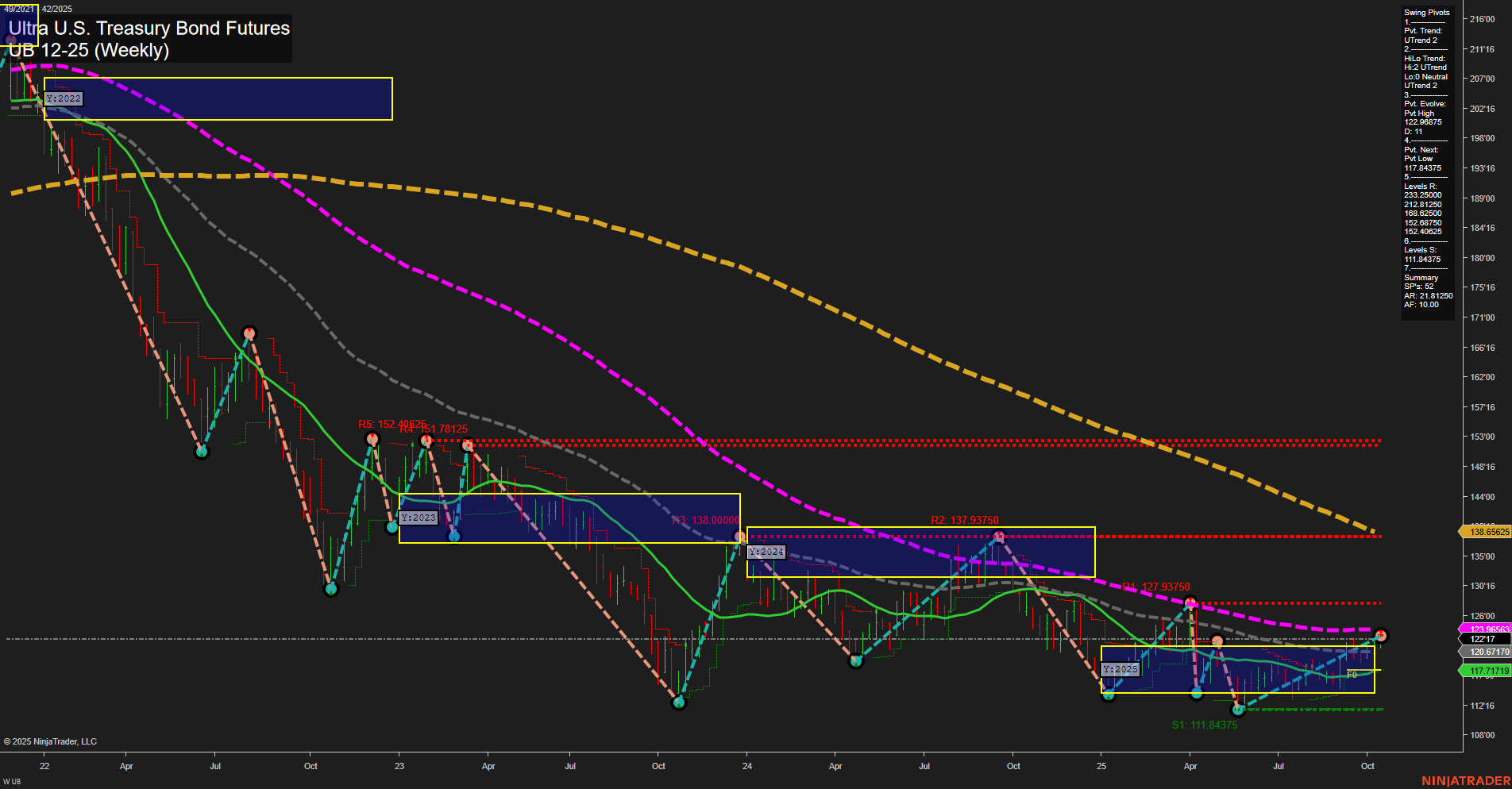

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Oct-15 07:19 CT

Price Action

- Last: 122'17,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 23%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 45%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 13%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 122.96875,

- 4. Pvt. Next: Pvt low 117.84375,

- 5. Levels R: 152.40625, 151.78125, 138.0000, 137.93750, 127.93750, 123.96875,

- 6. Levels S: 117.84375, 111.84375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 120.6171 Up Trend,

- (Intermediate-Term) 10 Week: 122.171 Up Trend,

- (Long-Term) 20 Week: 123.8953 Up Trend,

- (Long-Term) 55 Week: 138.6525 Down Trend,

- (Long-Term) 100 Week: 152.8750 Down Trend,

- (Long-Term) 200 Week: 211.8125 Down Trend.

Recent Trade Signals

- 14 Oct 2025: Long UB 12-25 @ 122.40625 Signals.USAR-WSFG

- 10 Oct 2025: Long UB 12-25 @ 120.84375 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart is showing a notable shift in momentum, with both short-term and intermediate-term trends turning bullish as indicated by the upward direction of the WSFG and MSFG grids, and confirmed by recent long trade signals. Price is currently above the NTZ center (F0%) across all session grids, reinforcing the bullish bias. Swing pivots show an uptrend in both short and intermediate timeframes, with the most recent pivot high at 122.96875 and next support at 117.84375. Resistance levels are stacked above, with significant long-term resistance at 138.0000 and 152.40625, while support is firm at 117.84375 and 111.84375. The 5, 10, and 20 week moving averages are all trending up, supporting the bullish case in the near to intermediate term, though the 55, 100, and 200 week MAs remain in a downtrend, suggesting the long-term trend is still neutral and has not fully reversed. The chart reflects a recovery phase, with price action showing higher lows and a breakout above key short-term resistance, but the market remains below major long-term resistance levels, indicating a transition from a prolonged downtrend to a potential base-building or early uptrend phase.

Chart Analysis ATS AI Generated: 2025-10-15 07:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.