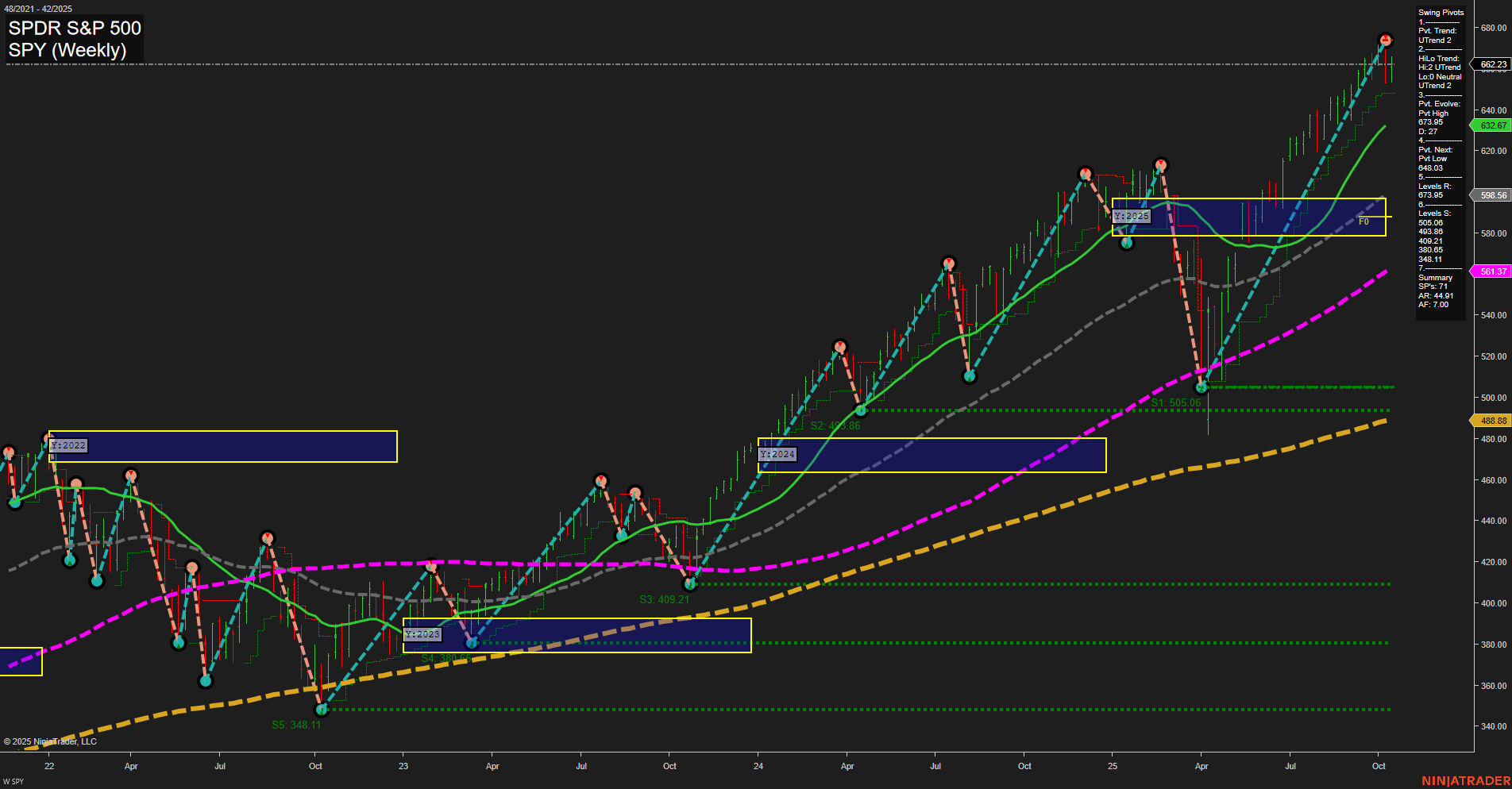

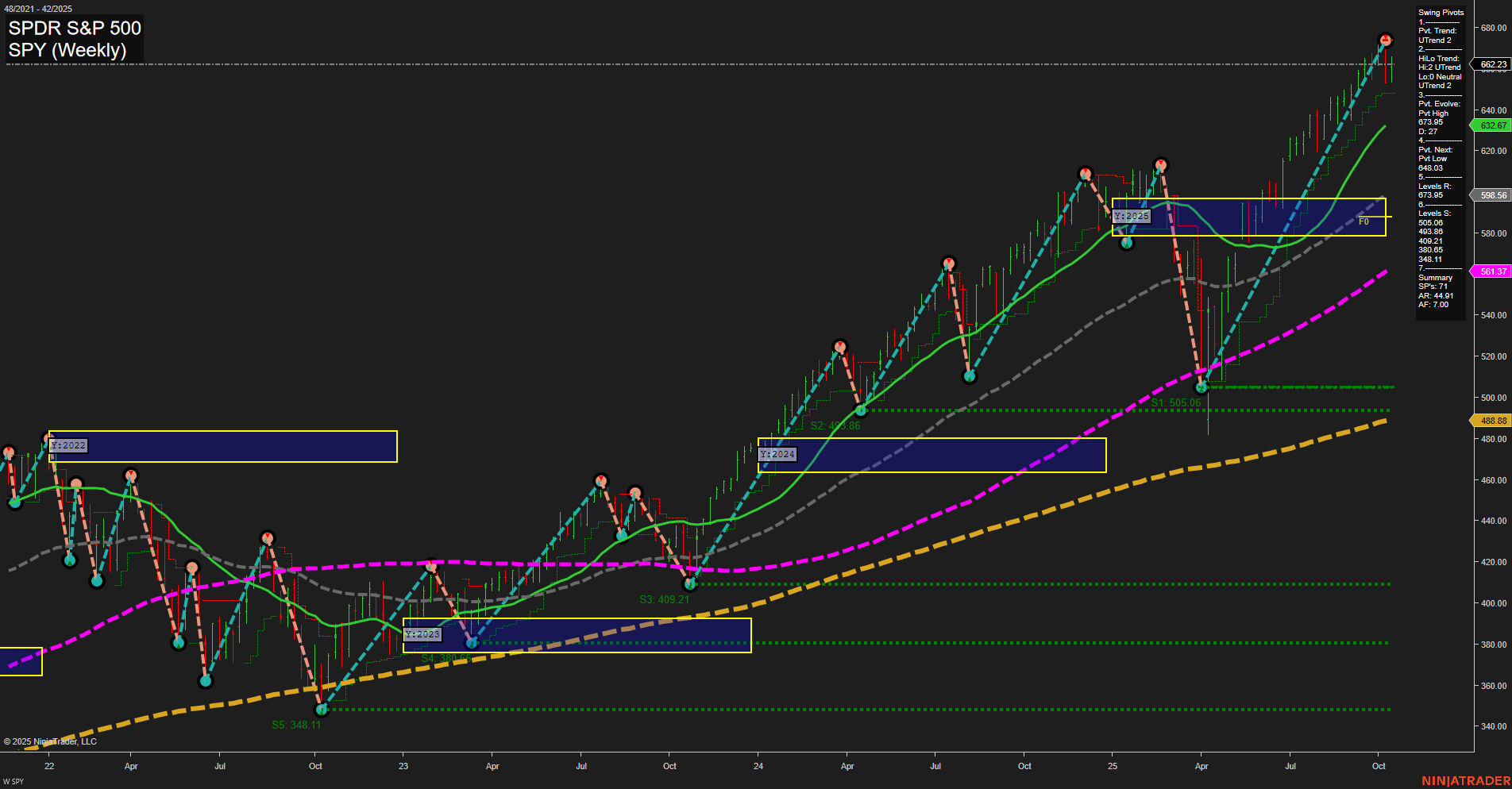

SPY SPDR S&P 500 Weekly Chart Analysis: 2025-Oct-15 07:18 CT

Price Action

- Last: 662.23,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend 2,

- (Intermediate-Term) 2. HiLo Trend: UTrend 2,

- 3. Pvt. Evolve: Pvt high 639.63,

- 4. Pvt. Next: Pvt low 632.67,

- 5. Levels R: 662.23, 639.63, 598.56,

- 6. Levels S: 561.37, 505.06, 488.88, 409.21, 348.11.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 632.67 Up Trend,

- (Intermediate-Term) 10 Week: 598.56 Up Trend,

- (Long-Term) 20 Week: 561.37 Up Trend,

- (Long-Term) 55 Week: 505.06 Up Trend,

- (Long-Term) 100 Week: 488.88 Up Trend,

- (Long-Term) 200 Week: 409.21 Up Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPY weekly chart shows a strong, persistent uptrend across all timeframes, with price currently at all-time highs (662.23) and well above all major moving averages. Swing pivots confirm an upward trend, with the most recent pivot high at 639.63 and next support at 632.67, indicating a series of higher highs and higher lows. All benchmark moving averages (from 5-week to 200-week) are trending upward, reinforcing the bullish structure. Resistance is defined at the current high and previous swing highs, while support levels are layered below, providing a cushion for potential pullbacks. The neutral bias in the session fib grids suggests price is consolidating near highs, possibly digesting gains after a strong rally. Volatility appears moderate, with no signs of major reversal patterns. The overall technical landscape remains constructive for swing traders, with the trend favoring continuation unless a significant breakdown below key support levels occurs.

Chart Analysis ATS AI Generated: 2025-10-15 07:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.