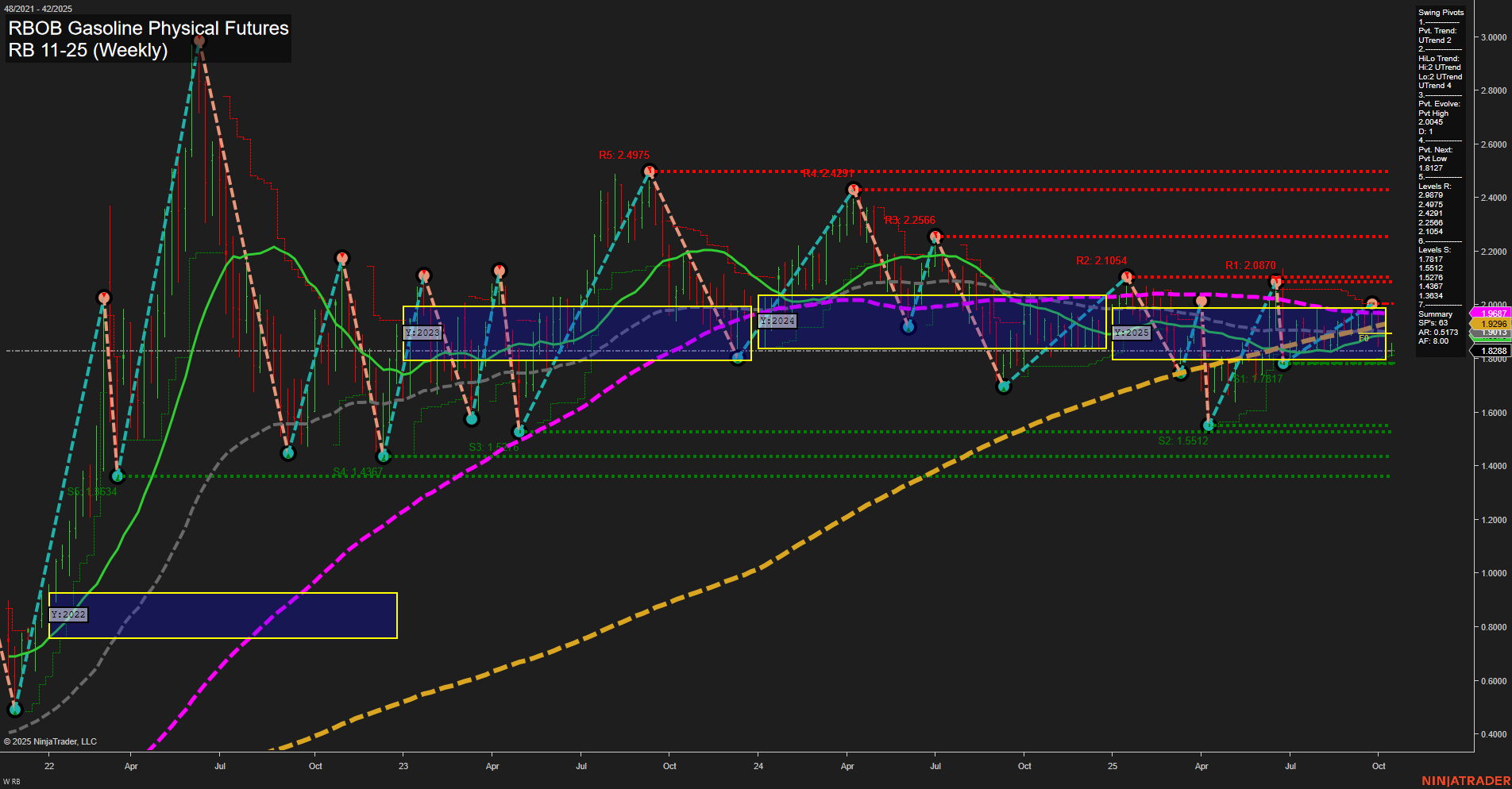

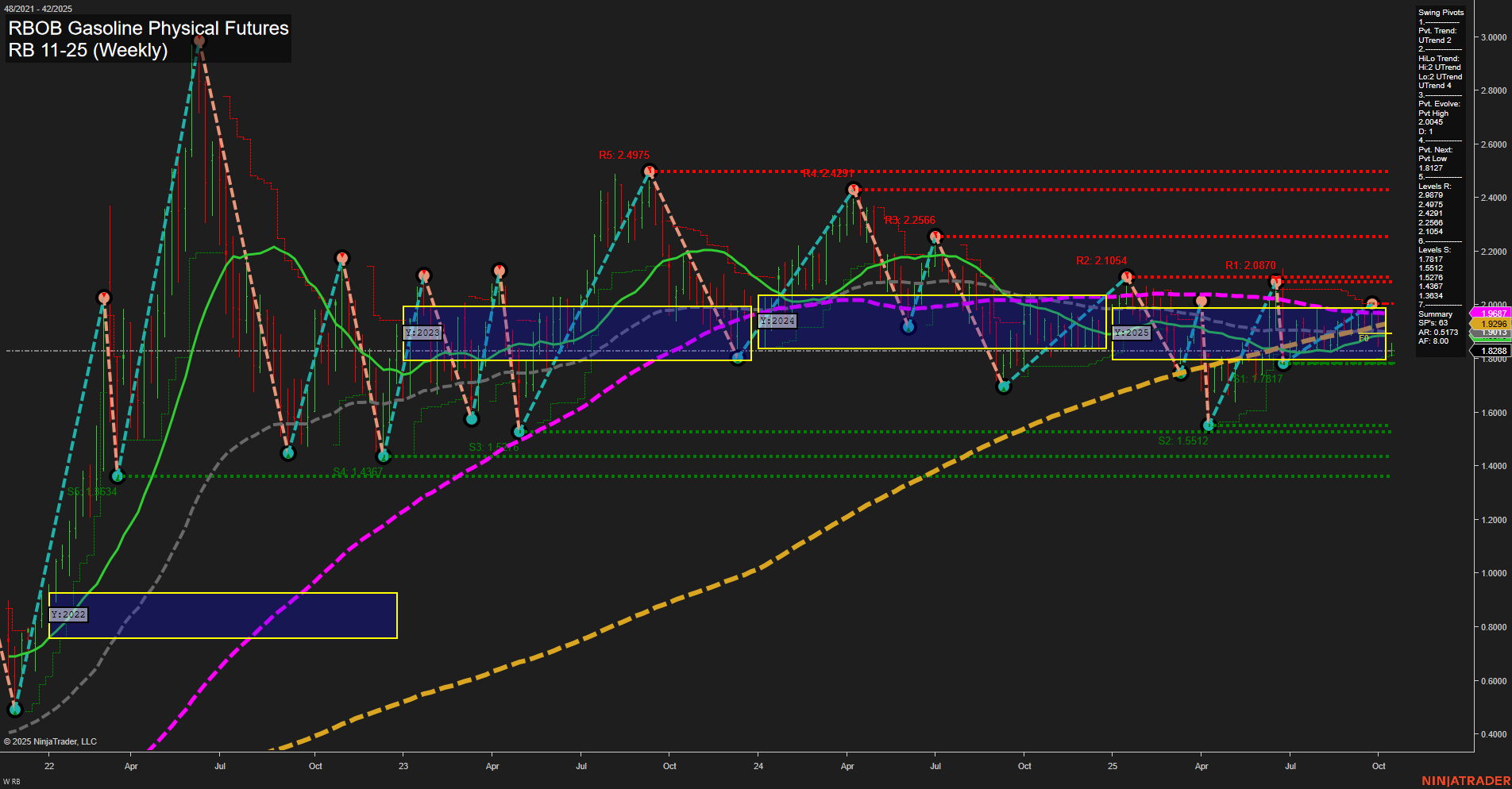

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Oct-15 07:15 CT

Price Action

- Last: 1.9296,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 19%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -45%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -6%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 2.0485,

- 4. Pvt. Next: Pvt low 1.8127,

- 5. Levels R: 2.4975, 2.4297, 2.2566, 2.1054, 2.0870,

- 6. Levels S: 1.8171, 1.6527, 1.4367, 1.3437, 1.2334.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.9192 Up Trend,

- (Intermediate-Term) 10 Week: 1.8928 Up Trend,

- (Long-Term) 20 Week: 1.9967 Down Trend,

- (Long-Term) 55 Week: 1.8288 Up Trend,

- (Long-Term) 100 Week: 1.9927 Down Trend,

- (Long-Term) 200 Week: 1.6020 Up Trend.

Recent Trade Signals

- 13 Oct 2025: Long RB 11-25 @ 1.8483 Signals.USAR.TR120

- 10 Oct 2025: Short RB 11-25 @ 1.8756 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The RBOB Gasoline futures market is currently showing a mixed technical landscape. Short-term momentum is positive, with price action above the weekly session fib grid center and both 5- and 10-week moving averages trending up, supported by a recent long signal. However, intermediate- and long-term trends remain under pressure, as indicated by the monthly and yearly fib grid trends both pointing down and price trading below their respective NTZ centers. The 20- and 100-week moving averages are also in a downtrend, reinforcing the broader bearish bias. Swing pivots highlight an upward trend in the short term, but the next key support is not far below, and resistance levels remain overhead. The market appears to be in a consolidation phase with choppy, range-bound action, as evidenced by the clustering of swing highs and lows and the proximity of major moving averages. This environment suggests a tug-of-war between short-term bullish attempts and persistent longer-term resistance, with volatility likely to persist as the market tests key support and resistance levels.

Chart Analysis ATS AI Generated: 2025-10-15 07:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.