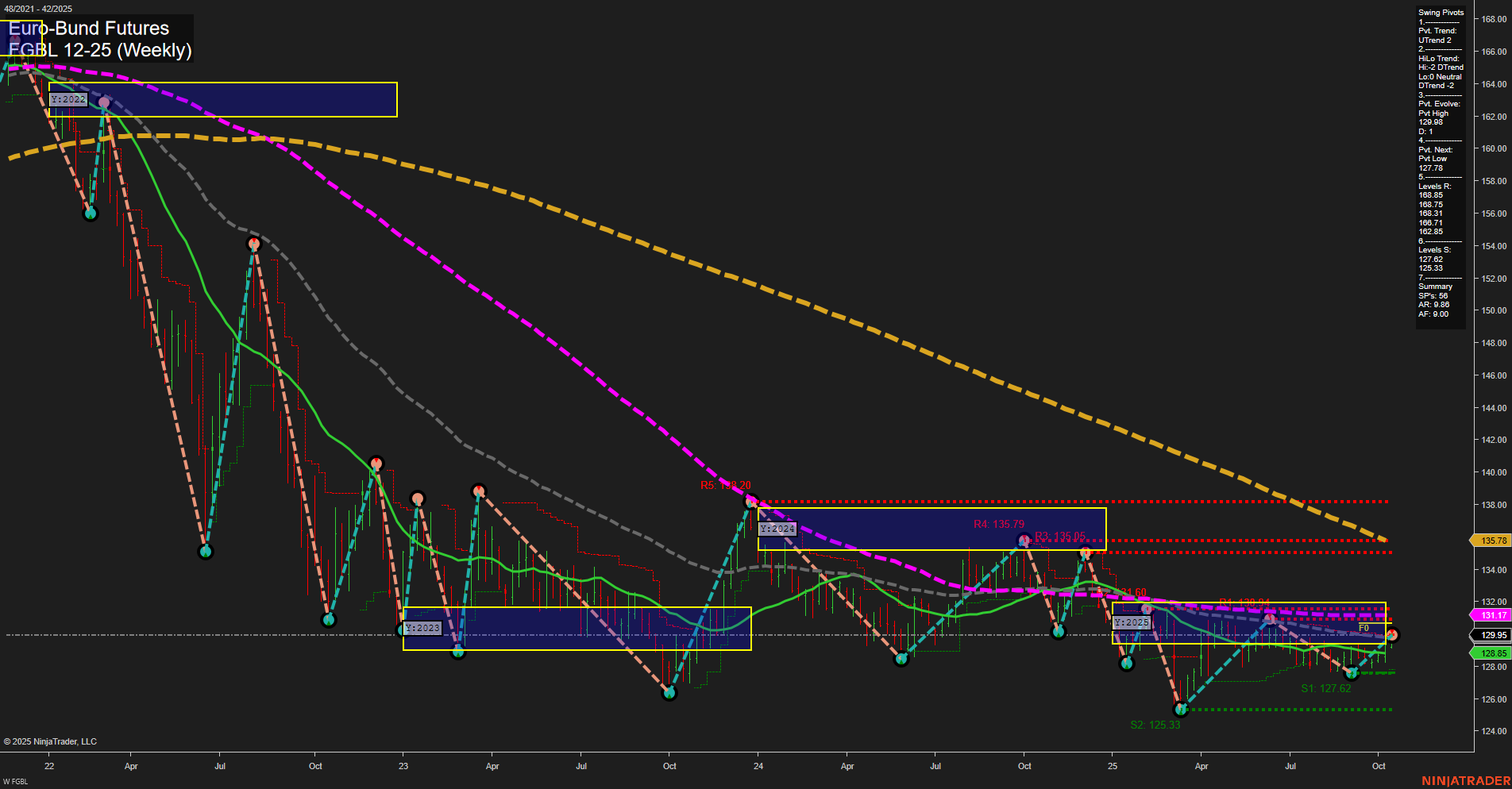

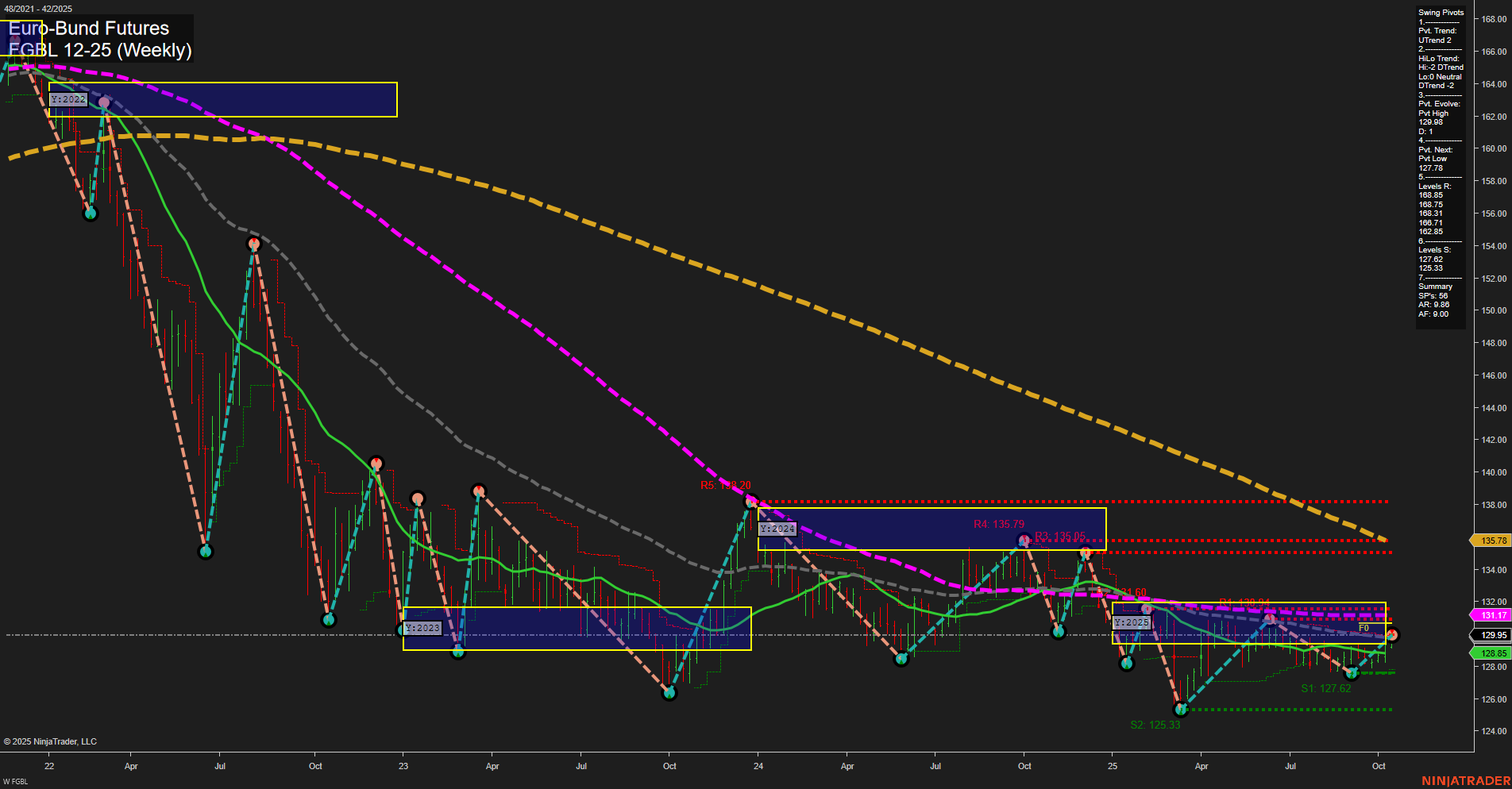

FGBL Euro-Bund Futures Weekly Chart Analysis: 2025-Oct-15 07:10 CT

Price Action

- Last: 129.95,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 79%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 84%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -6%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 129.98,

- 4. Pvt. Next: Pvt low 127.83,

- 5. Levels R: 135.79, 135.05, 131.71, 130.17, 129.98,

- 6. Levels S: 127.83, 127.62, 125.33.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 128.85 Up Trend,

- (Intermediate-Term) 10 Week: 128.93 Up Trend,

- (Long-Term) 20 Week: 129.44 Up Trend,

- (Long-Term) 55 Week: 131.17 Down Trend,

- (Long-Term) 100 Week: 135.05 Down Trend,

- (Long-Term) 200 Week: 135.76 Down Trend.

Recent Trade Signals

- 13 Oct 2025: Long FGBL 12-25 @ 129.44 Signals.USAR-WSFG

- 10 Oct 2025: Long FGBL 12-25 @ 128.8 Signals.USAR-MSFG

- 08 Oct 2025: Long FGBL 12-25 @ 128.93 Signals.USAR.TR720

- 08 Oct 2025: Long FGBL 12-25 @ 128.85 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The FGBL Euro-Bund Futures weekly chart shows a notable shift in short-term momentum, with price action breaking above the weekly and monthly session fib grid (WSFG, MSFG) NTZ zones, supported by a series of recent long signals and a clear uptrend in the 5, 10, and 20-week moving averages. The short-term swing pivot trend is up, but the intermediate-term HiLo trend remains down, reflecting a market in transition. Resistance is layered above at 129.98, 130.17, 131.71, and up to 135.79, while support is established at 127.83 and 125.33. The long-term trend, as indicated by the yearly session fib grid and the 55, 100, and 200-week moving averages, remains bearish, with price still below these key benchmarks. This suggests that while a short-term rally is underway, the broader context is still defined by a longer-term downtrend, and the market is currently testing a potential reversal zone. The environment is characterized by average momentum and medium-sized bars, indicating a steady but not explosive move. The overall structure points to a short-term bullish bias, a neutral intermediate-term outlook as the market consolidates, and a bearish long-term backdrop.

Chart Analysis ATS AI Generated: 2025-10-15 07:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.