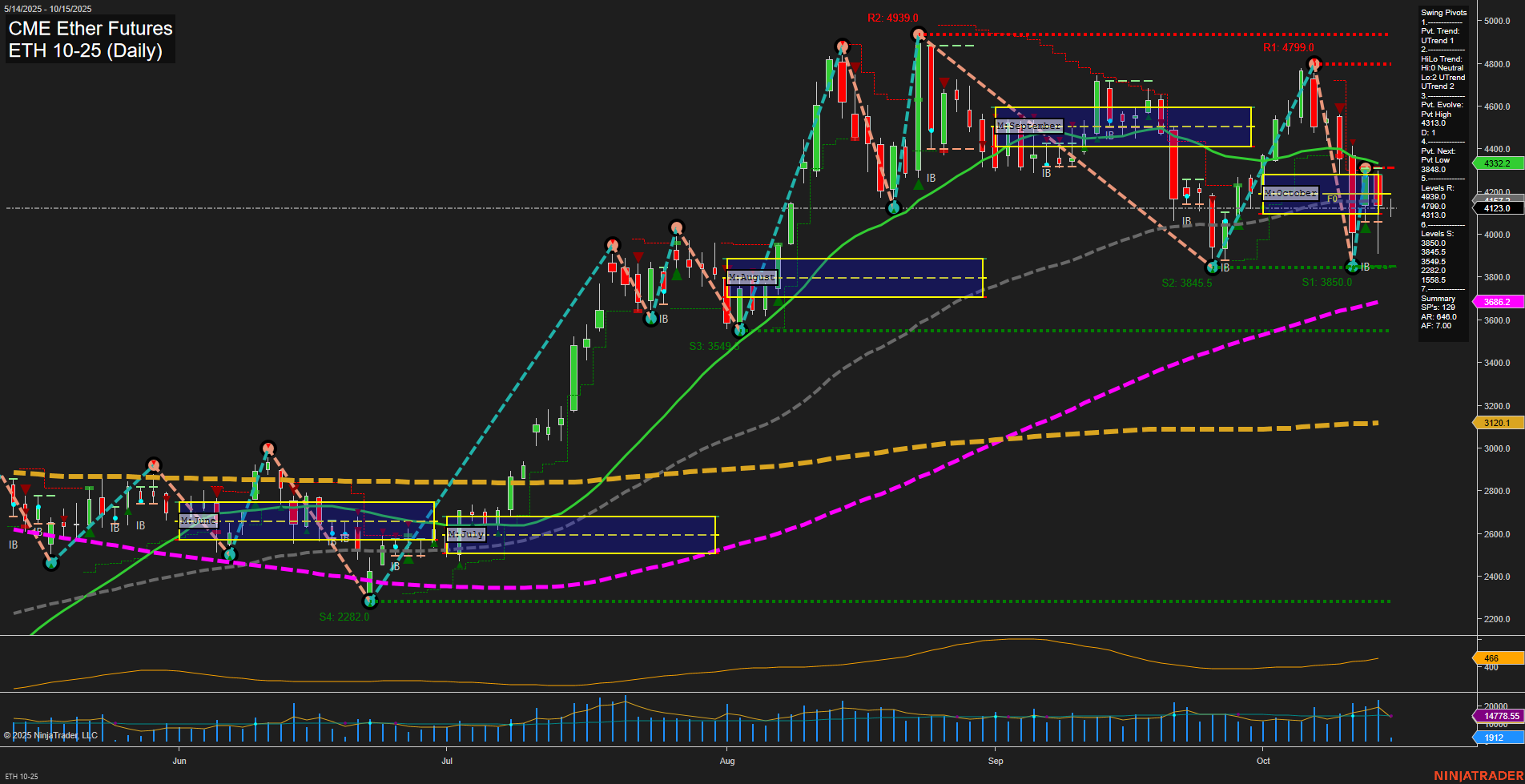

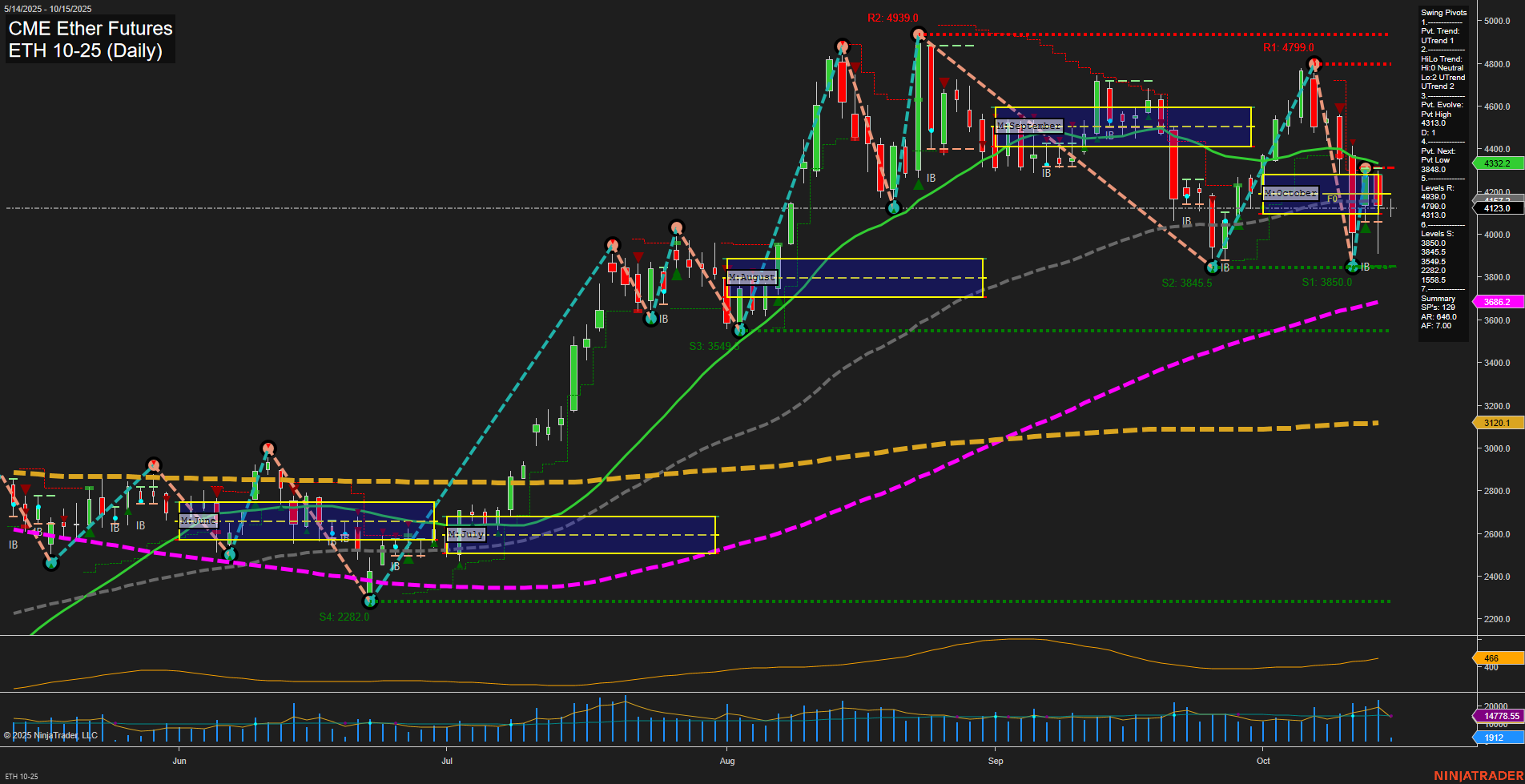

ETH CME Ether Futures Daily Chart Analysis: 2025-Oct-15 07:08 CT

Price Action

- Last: 4123.0,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 39%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -4%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 23%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 4313.0,

- 4. Pvt. Next: Pvt Low 3848.0,

- 5. Levels R: 4939.0, 4799.0, 4313.0,

- 6. Levels S: 3850.0, 3845.5, 3549.0, 2282.0.

Daily Benchmarks

- (Short-Term) 5 Day: 4126.0 Down Trend,

- (Short-Term) 10 Day: 4191.0 Down Trend,

- (Intermediate-Term) 20 Day: 4317.0 Down Trend,

- (Intermediate-Term) 55 Day: 4266.0 Down Trend,

- (Long-Term) 100 Day: 3686.2 Up Trend,

- (Long-Term) 200 Day: 3120.1 Up Trend.

Additional Metrics

Recent Trade Signals

- 14 Oct 2025: Short ETH 10-25 @ 4026 Signals.USAR-WSFG

- 13 Oct 2025: Long ETH 10-25 @ 4273 Signals.USAR-MSFG

- 13 Oct 2025: Long ETH 10-25 @ 4217.5 Signals.USAR.TR120

- 10 Oct 2025: Short ETH 10-25 @ 4115.5 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The current ETH CME Ether Futures daily chart reflects a market in transition. Price action shows medium-sized bars and average momentum, with the last price at 4123.0. Short-term signals and benchmarks are leaning bearish, as indicated by the downtrend in the 5, 10, 20, and 55-day moving averages, and a short-term swing pivot trend (DTrend). The weekly session fib grid (WSFG) is up, but the monthly session fib grid (MSFG) is down, highlighting a divergence between short and intermediate-term trends. Intermediate-term swing pivots remain in an uptrend, while long-term yearly fib grid and major moving averages (100/200 day) are still bullish, suggesting underlying strength. Recent trade signals show both long and short entries, reflecting choppy, two-way action and possible range-bound conditions. Volatility remains elevated (ATR 431), and volume is robust. The market is currently testing support levels near 3850–3845, with resistance overhead at 4313 and higher. This environment is characterized by counter-trend pullbacks within a broader uptrend, with potential for further consolidation or a breakout as the market digests recent moves.

Chart Analysis ATS AI Generated: 2025-10-15 07:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.