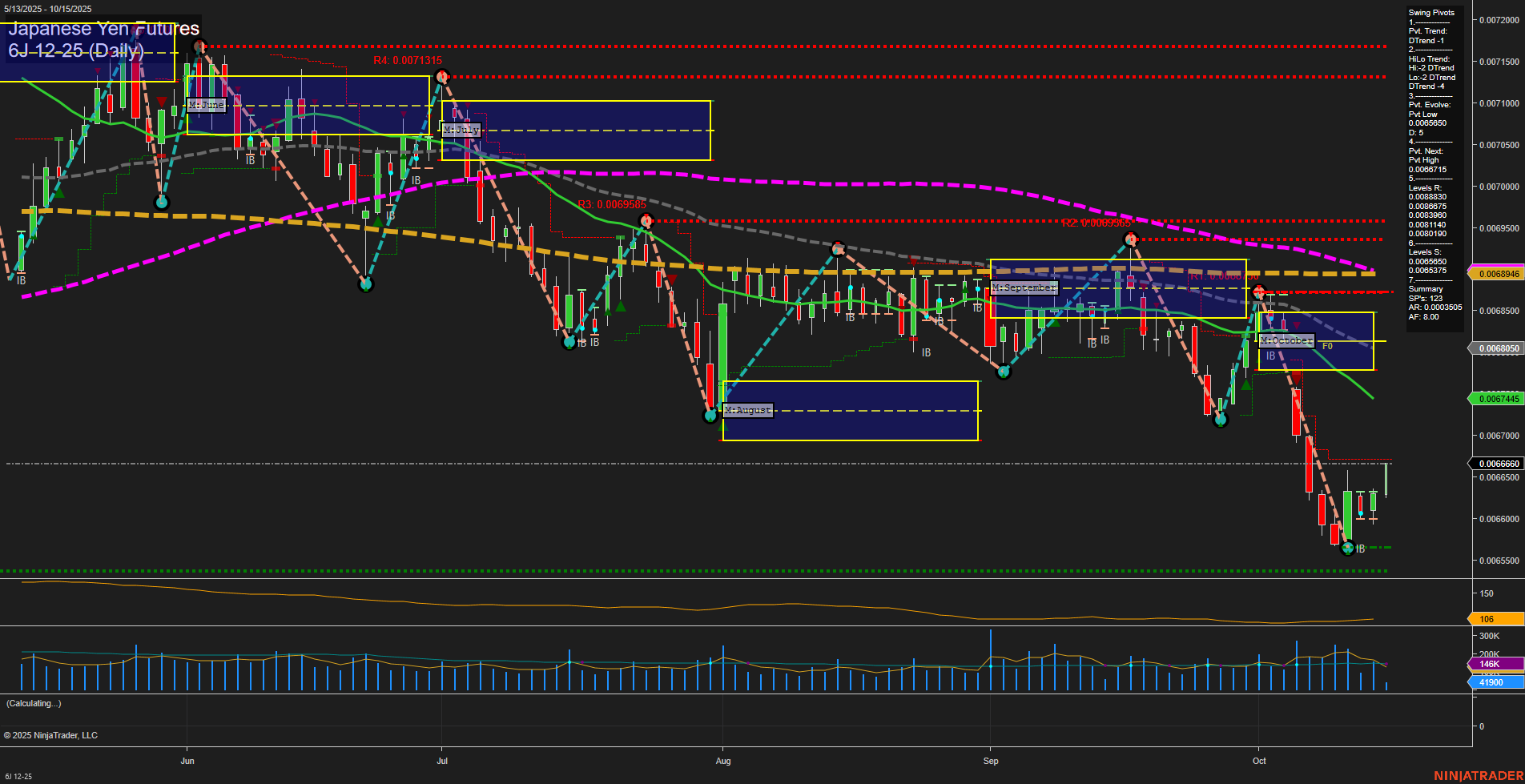

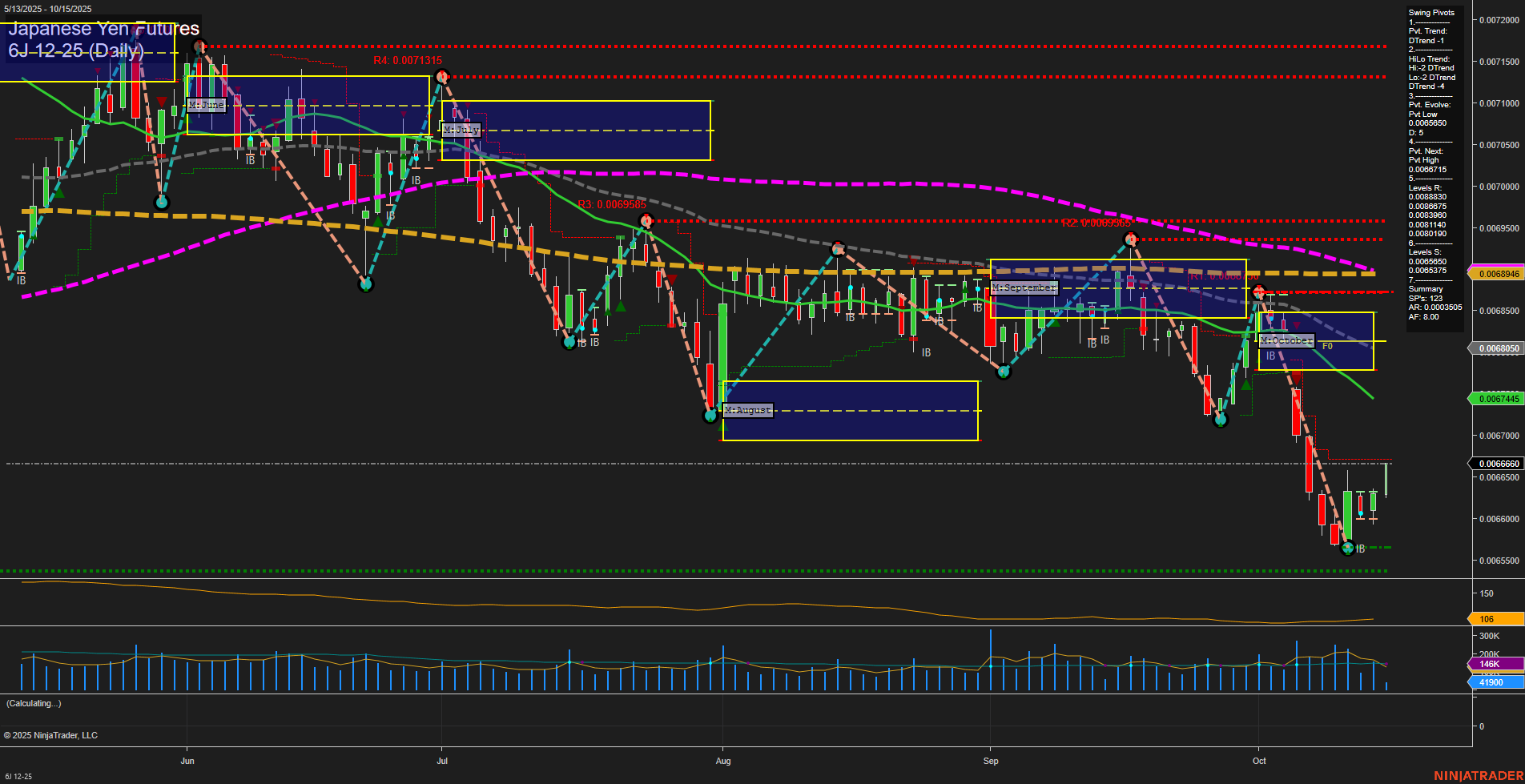

6J Japanese Yen Futures Daily Chart Analysis: 2025-Oct-15 07:03 CT

Price Action

- Last: 0.0066535,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -65%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.0065715,

- 4. Pvt. Next: Pvt high 0.0068946,

- 5. Levels R: 0.0072000, 0.0071500, 0.0071000, 0.0070000, 0.0069585, 0.0068950, 0.0068946, 0.0068810,

- 6. Levels S: 0.0065715, 0.0065375.

Daily Benchmarks

- (Short-Term) 5 Day: 0.0066080 Down Trend,

- (Short-Term) 10 Day: 0.0066440 Down Trend,

- (Intermediate-Term) 20 Day: 0.0067445 Down Trend,

- (Intermediate-Term) 55 Day: 0.0068946 Down Trend,

- (Long-Term) 100 Day: 0.0069585 Down Trend,

- (Long-Term) 200 Day: 0.0071315 Down Trend.

Additional Metrics

Recent Trade Signals

- 15 Oct 2025: Long 6J 12-25 @ 0.0066535 Signals.USAR-WSFG

- 10 Oct 2025: Long 6J 12-25 @ 0.006626 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The 6J Japanese Yen Futures daily chart shows a market in a corrective phase after a pronounced downtrend. Price action is currently consolidating near recent swing lows, with slow momentum and medium-sized bars, suggesting a pause after a sharp selloff. The short-term WSFG trend is up, but this is countered by the intermediate-term MSFG trend, which remains decisively down, and the long-term YSFG trend, which is up but with little conviction. Swing pivot analysis confirms a dominant downtrend in both short- and intermediate-term trends, with resistance levels stacked above and only two support levels below, indicating limited downside buffer. All benchmark moving averages across timeframes are trending down, reinforcing the prevailing bearish structure. Recent trade signals have triggered long entries, hinting at a potential short-term bounce or mean reversion, but the broader context remains bearish. Volatility (ATR) is elevated, and volume is above average, reflecting heightened activity during this phase. Overall, the market is in a potential transition zone: short-term signals suggest a possible relief rally, but the weight of evidence from pivots and moving averages keeps the intermediate and long-term outlooks bearish. Swing traders should be attentive to whether this bounce develops into a sustained reversal or stalls beneath key resistance levels.

Chart Analysis ATS AI Generated: 2025-10-15 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.