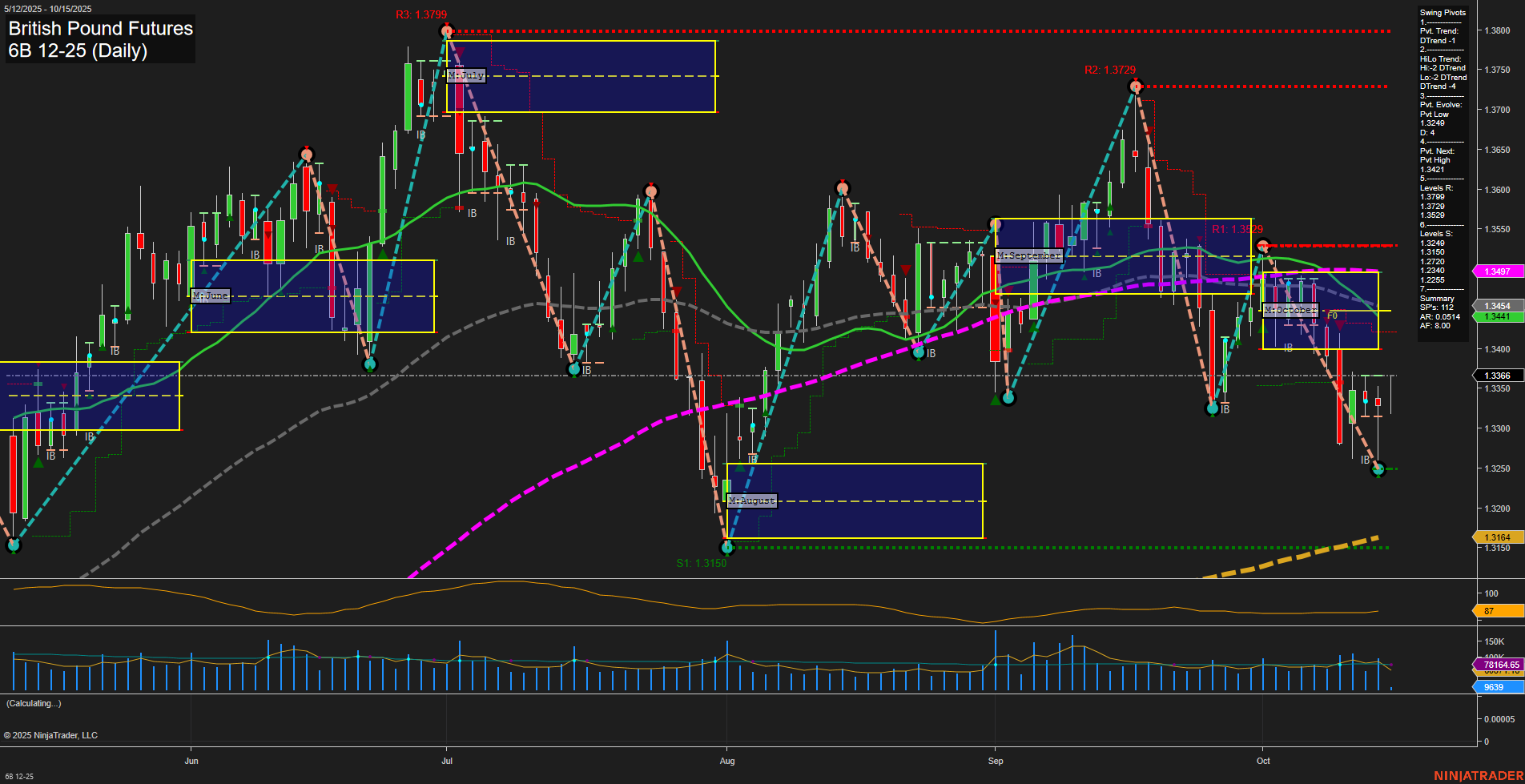

The British Pound Futures (6B) daily chart as of mid-October 2025 shows a market in transition. Short-term and intermediate-term trends are both bearish, as indicated by the downward direction of the swing pivots, HiLo trend, and all key moving averages except the 200-day, which remains in a long-term uptrend. Price is currently below the monthly session fib grid (MSFG) neutral zone, reinforcing the intermediate-term downside bias, while the weekly session fib grid (WSFG) still shows a slight upward bias, suggesting some residual support from higher timeframes. Recent price action has been characterized by medium-sized bars and slow momentum, with volatility (ATR) and volume (VOLMA) at moderate levels. The market has recently triggered multiple short signals, aligning with the prevailing downtrend in the short and intermediate timeframes. Key resistance levels are clustered above at 1.3421, 1.3539, and higher, while support is found at 1.3240 and 1.3150, marking potential areas for price reaction or consolidation. Despite the long-term uptrend, the current environment is dominated by corrective or retracement activity, with the potential for further downside unless a significant reversal occurs at support. The overall structure suggests a market in a corrective phase within a larger bullish cycle, with traders watching for signs of exhaustion in the downtrend or a possible bounce from key support levels.