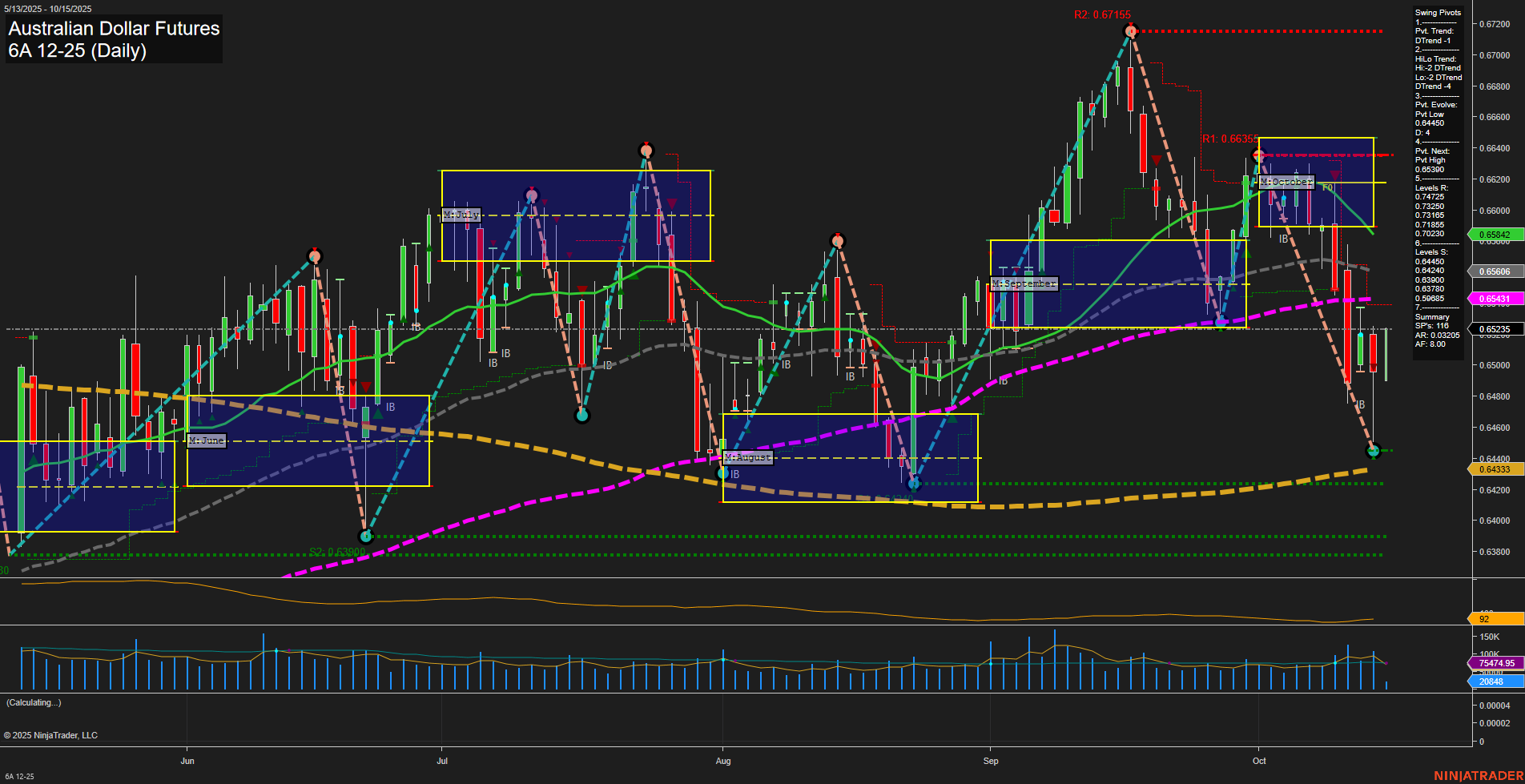

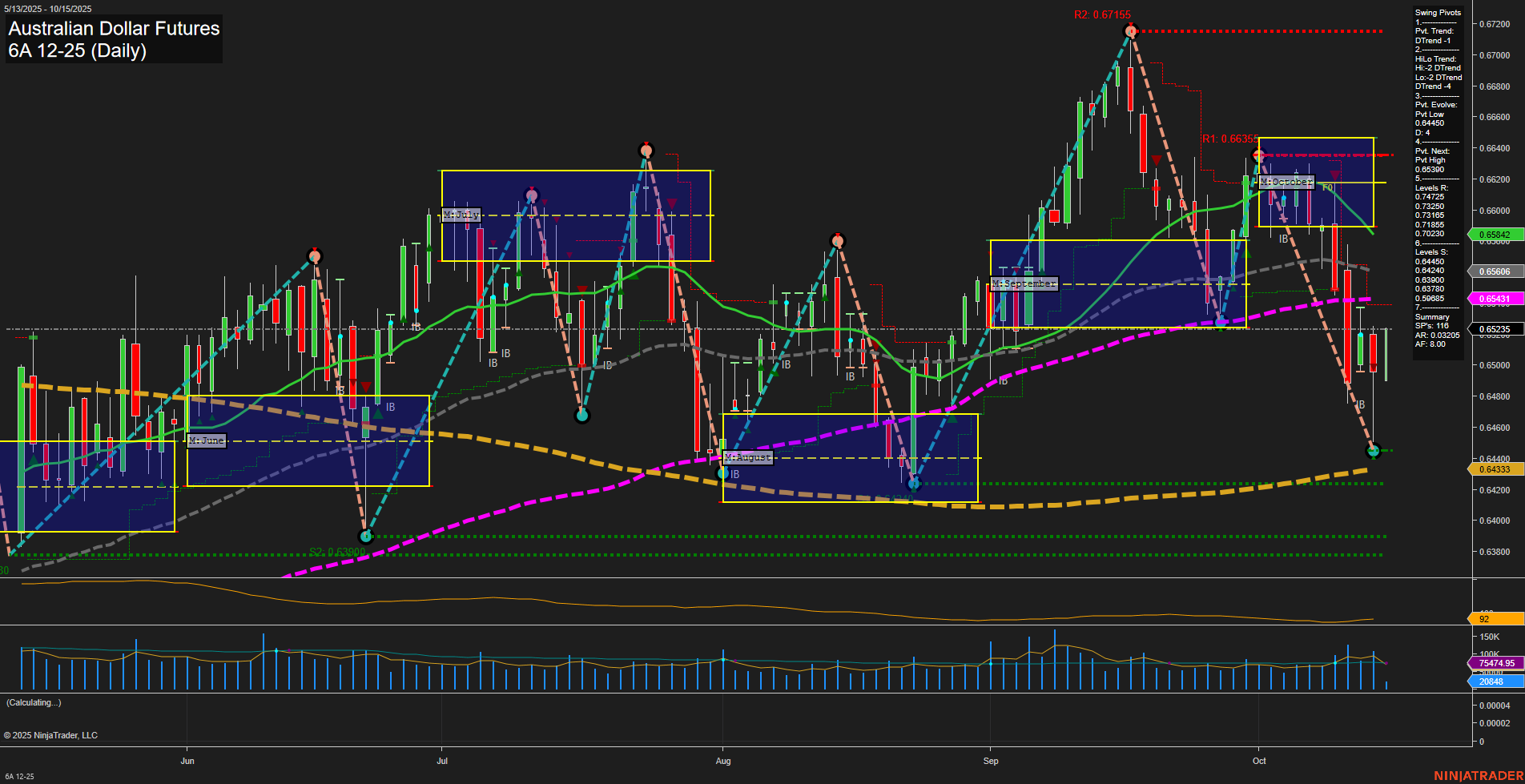

6A Australian Dollar Futures Daily Chart Analysis: 2025-Oct-15 07:00 CT

Price Action

- Last: 0.65235,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.65235,

- 4. Pvt. Next: Pvt high 0.65943,

- 5. Levels R: 0.67155, 0.66356, 0.65943, 0.65725, 0.65506,

- 6. Levels S: 0.64333.

Daily Benchmarks

- (Short-Term) 5 Day: 0.65506 Down Trend,

- (Short-Term) 10 Day: 0.65725 Down Trend,

- (Intermediate-Term) 20 Day: 0.65431 Down Trend,

- (Intermediate-Term) 55 Day: 0.65846 Down Trend,

- (Long-Term) 100 Day: 0.66431 Down Trend,

- (Long-Term) 200 Day: 0.64333 Up Trend.

Additional Metrics

Recent Trade Signals

- 15 Oct 2025: Long 6A 12-25 @ 0.6518 Signals.USAR.TR120

- 15 Oct 2025: Long 6A 12-25 @ 0.6519 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The Australian Dollar Futures (6A) daily chart as of mid-October 2025 shows a market in a corrective phase, with price action characterized by medium-sized bars and slow momentum. Both the short-term and intermediate-term swing pivot trends are down, confirmed by a series of lower highs and a recent pivot low at 0.65235. All key moving averages (5, 10, 20, 55, 100-day) are trending down, reinforcing the prevailing bearish sentiment, while the 200-day MA remains upward, suggesting longer-term structural support near 0.64333. The price is currently consolidating just above this major support, with resistance levels stacked above at 0.65506, 0.65725, 0.65943, 0.66356, and 0.67155. The ATR indicates moderate volatility, and volume remains steady. Recent trade signals have triggered long entries, hinting at a potential short-term bounce or mean reversion attempt, but the broader context remains bearish until a clear reversal above resistance pivots is established. The market is in a wait-and-see mode, with traders watching for either a breakdown below major support or a reversal signal to challenge the downtrend.

Chart Analysis ATS AI Generated: 2025-10-15 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.