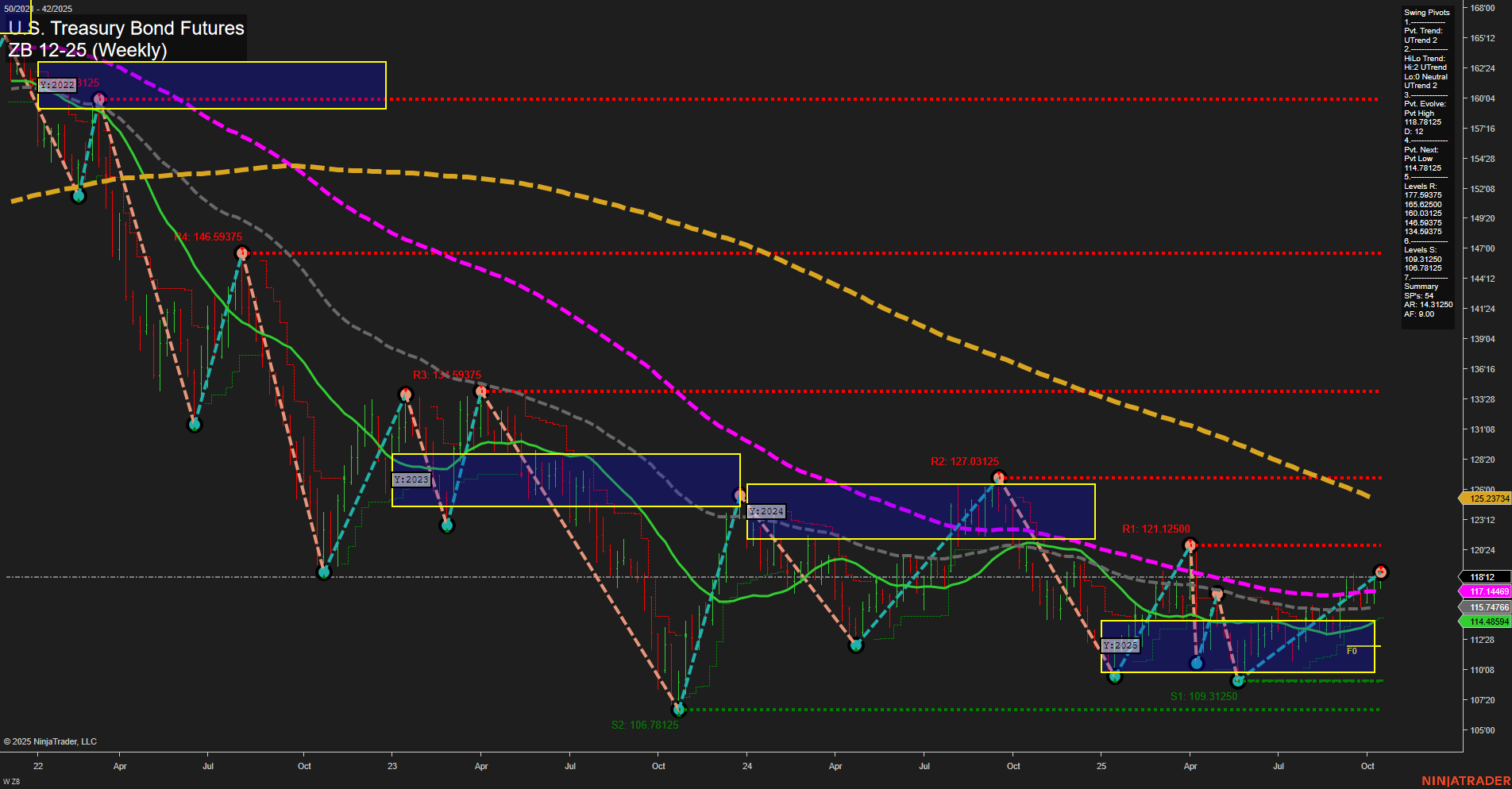

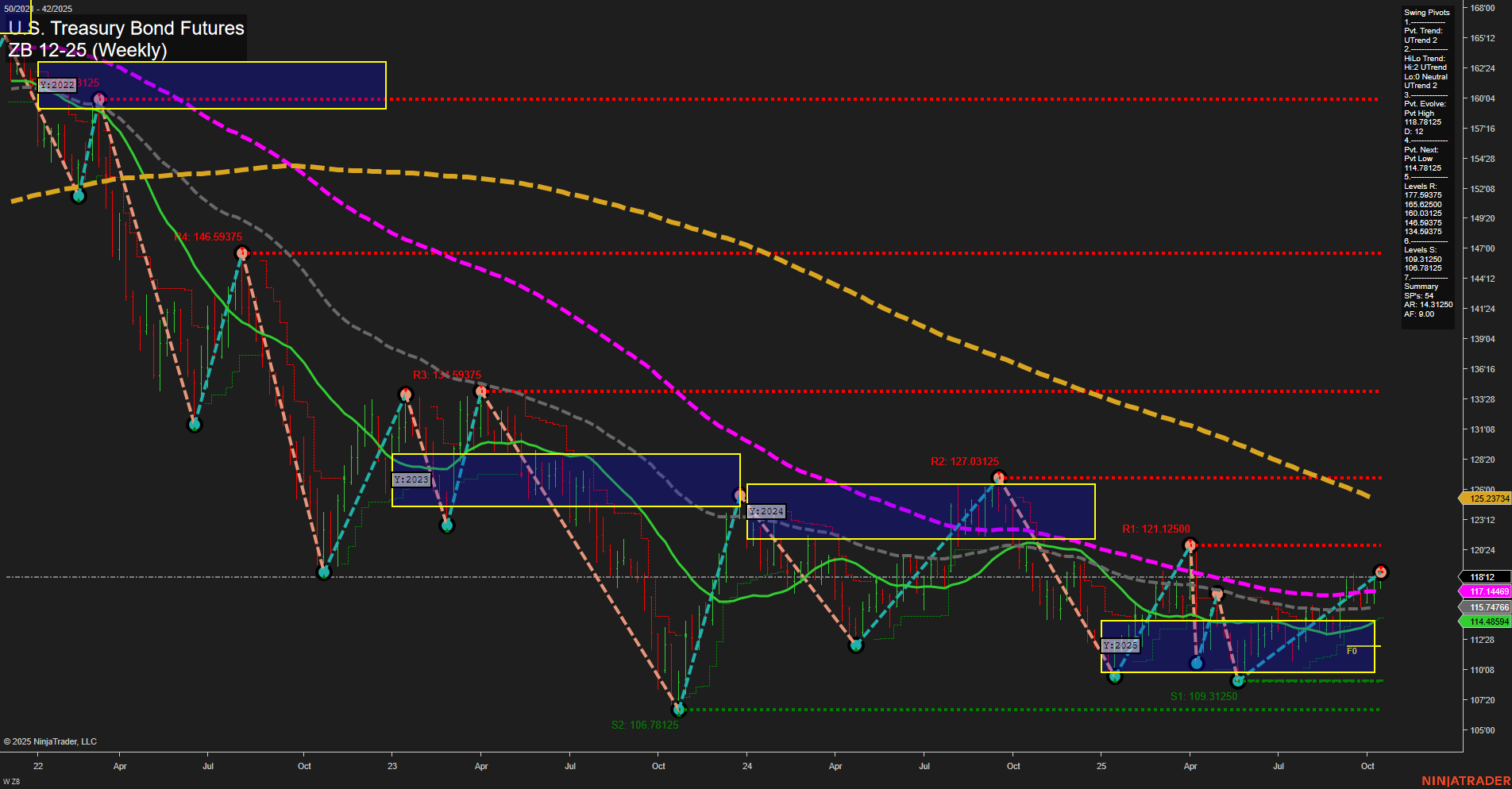

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Oct-14 07:23 CT

Price Action

- Last: 125.23743,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend 2,

- (Intermediate-Term) 2. HiLo Trend: UTrend 2,

- 3. Pvt. Evolve: Pvt High 118.7125,

- 4. Pvt. Next: Pvt Low 111.78125,

- 5. Levels R: 177.59375, 165.03125, 160.03125, 154.59375, 146.59375, 134.59375, 127.03125, 121.125,

- 6. Levels S: 109.3125, 106.78125, 100.78125.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 118.11 Up Trend,

- (Intermediate-Term) 10 Week: 117.14469 Up Trend,

- (Long-Term) 20 Week: 115.47566 Up Trend,

- (Long-Term) 55 Week: 114.48594 Up Trend,

- (Long-Term) 100 Week: 127.03125 Down Trend,

- (Long-Term) 200 Week: 146.59375 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a notable shift in momentum, with price action currently at 125.23743 and medium-sized bars reflecting average momentum. Both short-term and intermediate-term swing pivot trends have turned upward, supported by a series of higher lows and a recent pivot high at 118.7125. The price is trading above all key short- and intermediate-term moving averages, which are in uptrends, indicating sustained buying interest and a constructive technical backdrop. However, the long-term moving averages (100 and 200 week) remain in downtrends, suggesting that the broader bearish structure is not yet fully reversed. Resistance levels are stacked above, with the nearest significant resistance at 127.03125 and 121.125 recently tested, while support is well-defined at 109.3125 and 106.78125. The overall environment is transitioning from a prolonged downtrend to a more neutral-to-bullish stance, with the potential for further upside if price can clear overhead resistance and maintain above the rising short- and intermediate-term averages. The chart reflects a market in recovery mode, with consolidation and base-building giving way to a possible trend continuation if current momentum persists.

Chart Analysis ATS AI Generated: 2025-10-14 07:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.