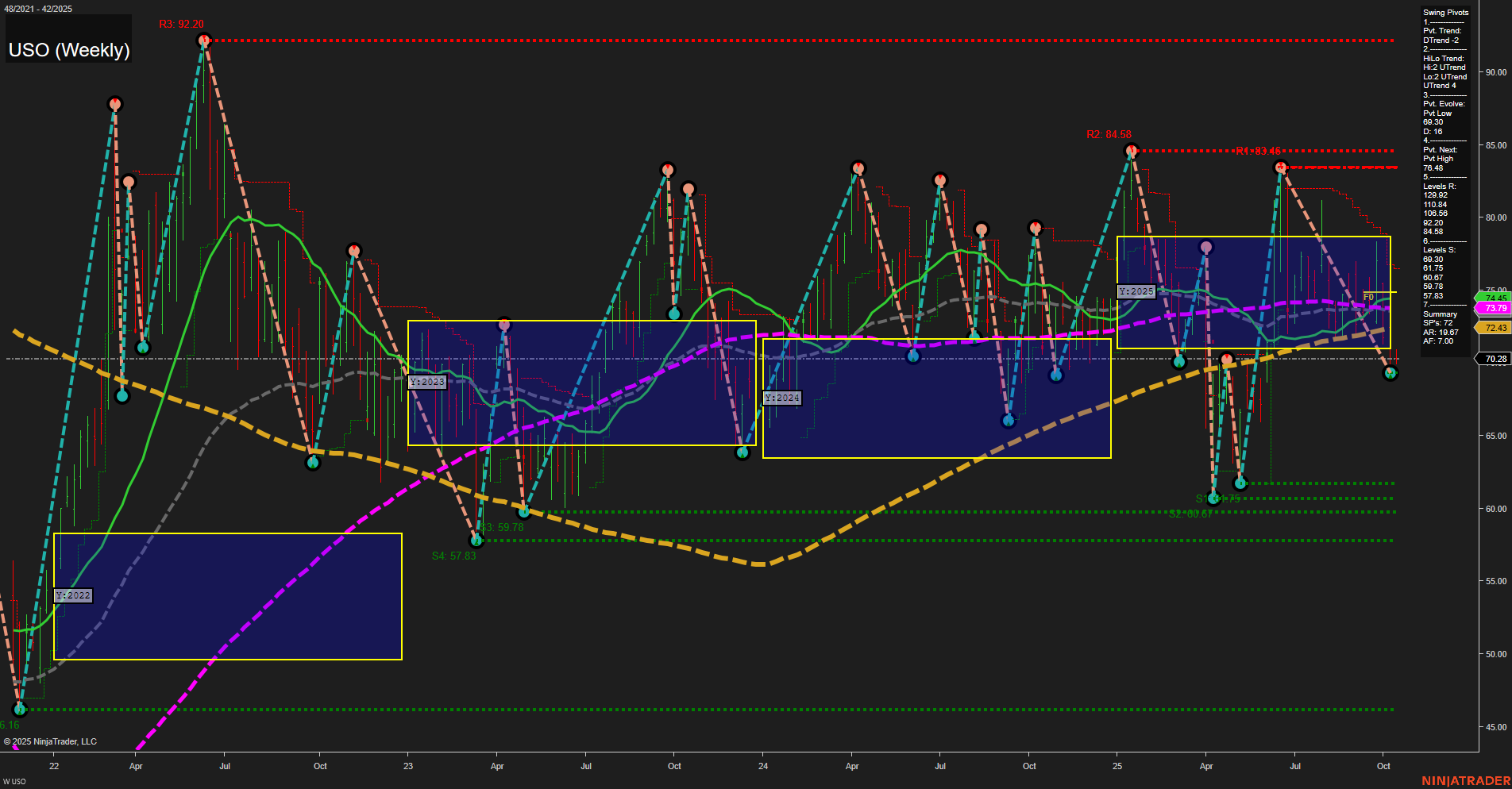

USO is currently exhibiting a slow momentum pullback with price action sitting at 70.28, just above the 200-week moving average, which is the only benchmark showing an uptrend. All other key moving averages (5, 10, 20, 55, 100 week) are trending down, confirming a prevailing bearish bias in the short-term. The most recent swing pivot is a low, with the next anticipated pivot being a high at 75.48, suggesting a possible short-term bounce or retracement attempt. However, the overall structure remains range-bound and neutral in the intermediate and long-term, as indicated by the flat WSFG, MSFG, and YSFG trends and the clustering of price within the NTZ (neutral zone) of the yearly session fib grid. Resistance levels are stacked well above current price, while support levels are layered below, highlighting a broad consolidation range. The intermediate-term HiLo trend remains up, but with the short-term pivot trend down, the market is in a corrective phase within a larger sideways structure. Volatility has contracted compared to previous swings, and the chart shows a series of lower highs and higher lows, typical of a choppy, consolidating market. No clear breakout or breakdown is evident, and the technicals suggest a wait-and-see approach as the market digests prior moves and awaits a catalyst for directional conviction.