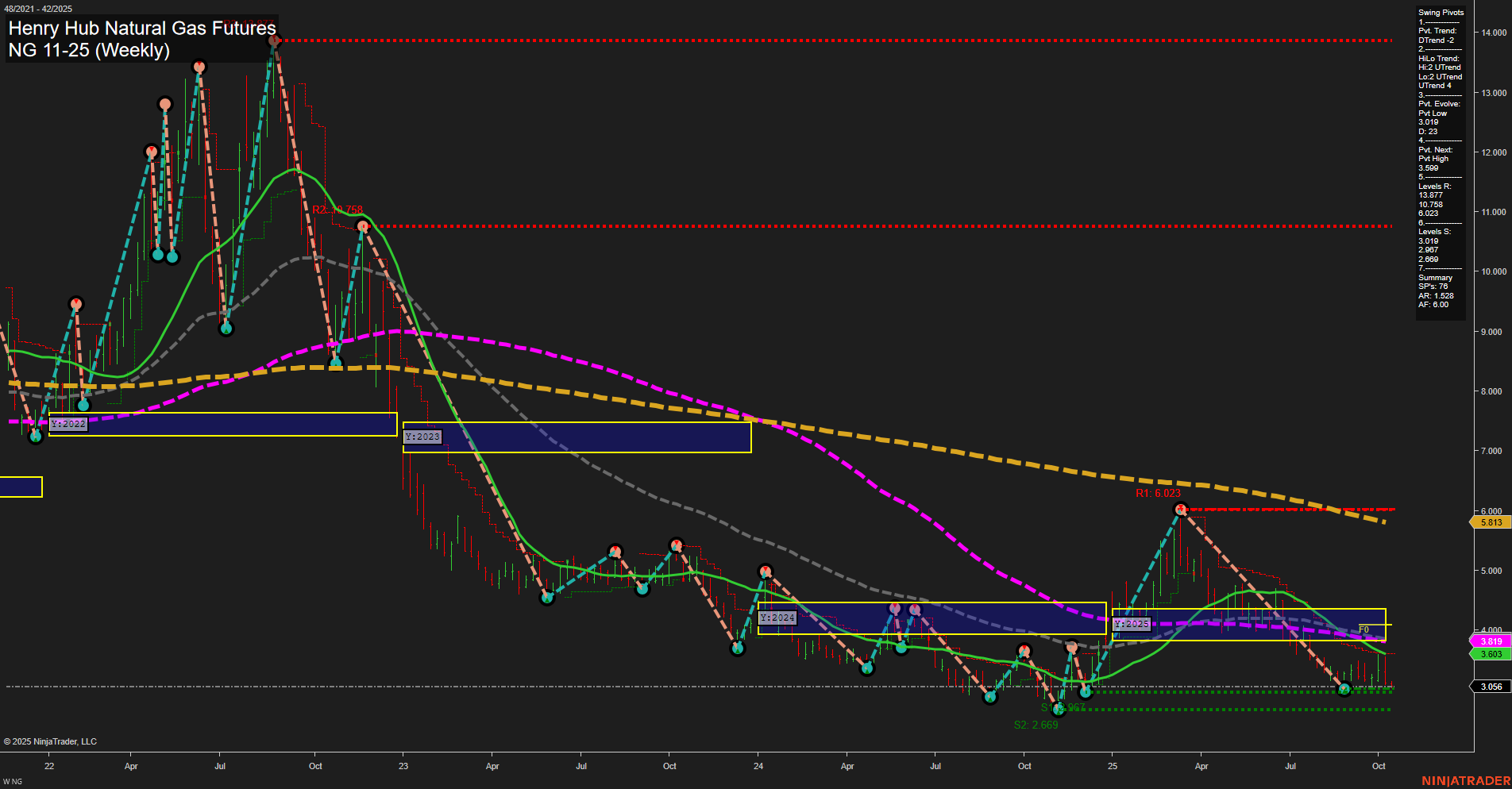

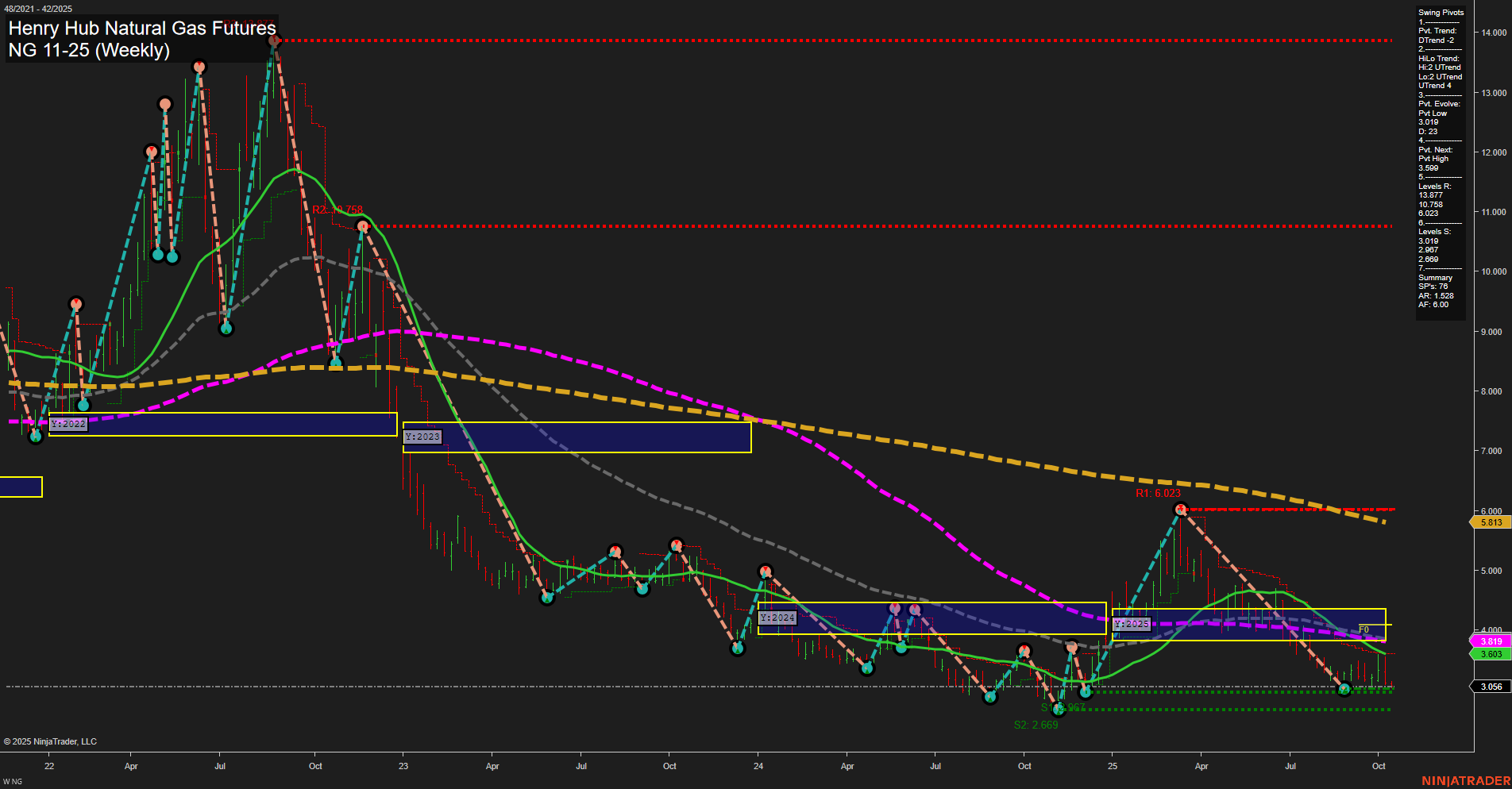

NG Henry Hub Natural Gas Futures Weekly Chart Analysis: 2025-Oct-14 07:13 CT

Price Action

- Last: 3.056,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 3.109,

- 4. Pvt. Next: Pvt high 3.693,

- 5. Levels R: 13.877, 10.758, 6.023,

- 6. Levels S: 3.097, 2.687, 2.669.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: [Not shown] [Trend not shown],

- (Intermediate-Term) 10 Week: [Not shown] [Trend not shown],

- (Long-Term) 20 Week: 3.819 Down Trend,

- (Long-Term) 55 Week: 4.693 Down Trend,

- (Long-Term) 100 Week: 5.811 Down Trend,

- (Long-Term) 200 Week: [Not shown] [Trend not shown].

Recent Trade Signals

- 14 Oct 2025: Short NG 11-25 @ 3.055 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Natural gas futures are currently trading at 3.056, with price action characterized by small bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend is down, supported by a recent short signal, while the intermediate-term HiLo trend remains up, suggesting some underlying support or potential for a bounce. However, all major long-term moving averages (20, 55, 100 week) are trending down, reinforcing a bearish long-term outlook. Price is consolidating near multi-year lows, with significant resistance overhead (notably at 3.693 and 6.023) and support levels just below current prices (3.097, 2.687, 2.669). The market appears to be in a prolonged downtrend, with recent action reflecting a period of consolidation or base-building after a sharp decline. No clear breakout or reversal pattern is evident, and the overall environment remains cautious, with the potential for further downside unless a sustained move above resistance pivots occurs.

Chart Analysis ATS AI Generated: 2025-10-14 07:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.