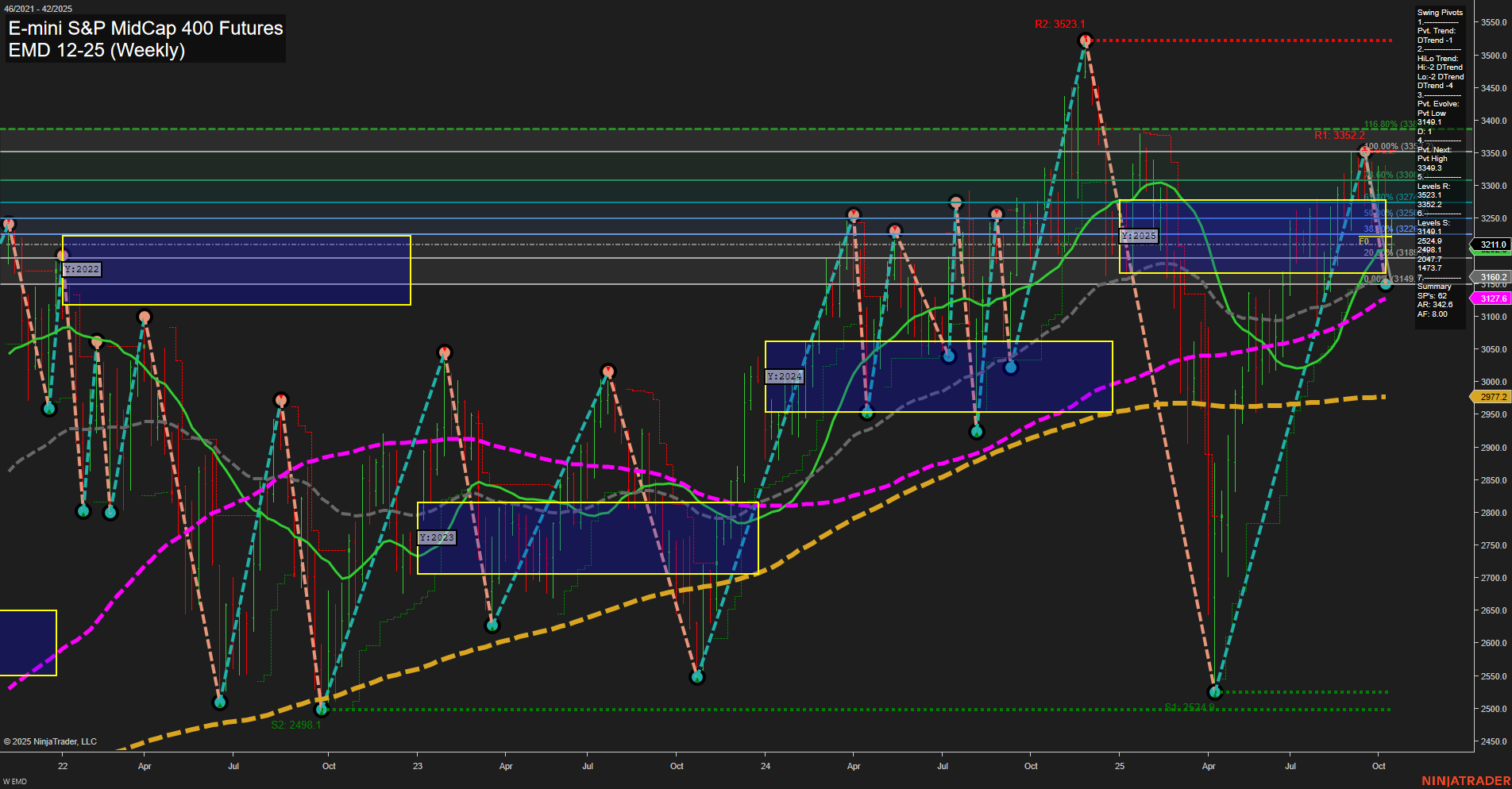

The EMD futures market is currently experiencing high volatility, as indicated by large bars and fast momentum. Short-term price action is bearish, with the swing pivot trend and HiLo trend both pointing down, and the last price sitting just above a key support at 3149.0. The Weekly Session Fib Grid (WSFG) shows an uptrend with price above the NTZ center, but this is contradicted by the swing pivots and recent short-term trade signals, suggesting a possible short-term pullback or correction within a broader range. Intermediate-term signals are bearish, with both the Monthly Session Fib Grid (MSFG) and moving averages (5 and 10 week) trending down, and price below their respective NTZ centers. The long-term outlook is more neutral, as the Yearly Session Fib Grid (YSFG) trend is down but the 55, 100, and 200 week moving averages remain in uptrends, indicating underlying support and a lack of decisive breakdown. Resistance levels are clustered between 3292.4 and 3523.1, while support is found at 3149.0 and further below at 2977.2. The market appears to be in a corrective phase after a strong rally, with potential for further downside testing of support before any sustained recovery. Recent trade signals reflect this choppy environment, with both long and short entries triggered in quick succession. Overall, the market is in a consolidation phase with a bearish short- and intermediate-term bias, but long-term structure remains intact above major support.