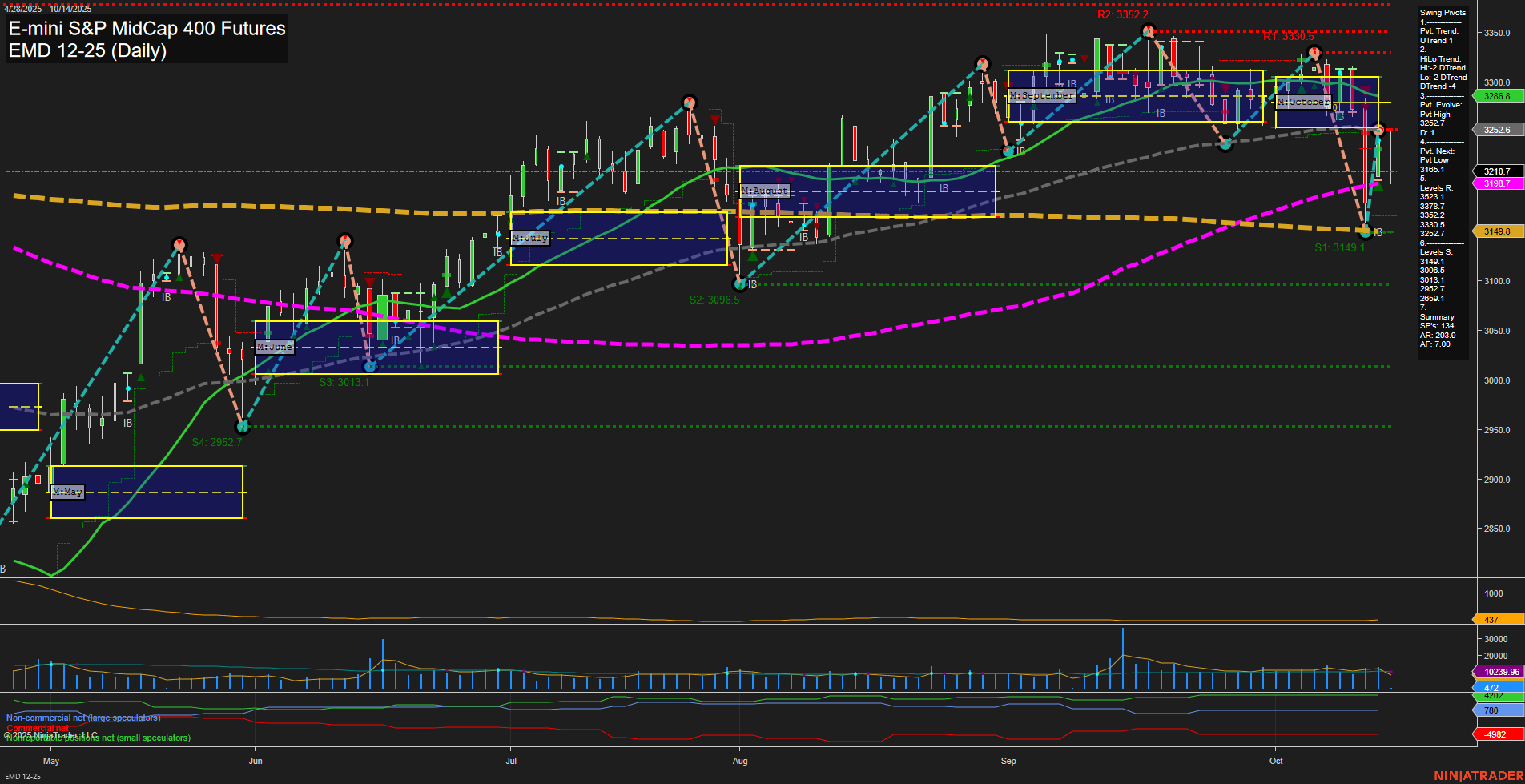

EMD E-mini S&P MidCap 400 Futures Daily Chart Analysis: 2025-Oct-14 07:05 CT

Price Action

- Last: 3256.2,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: 53%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -36%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -2%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 3210.7,

- 4. Pvt. Next: Pvt High 3326.7,

- 5. Levels R: 3326.7, 3350.5, 3352.2,

- 6. Levels S: 3210.7, 3149.8, 3096.5, 3013.1, 2952.7.

Daily Benchmarks

- (Short-Term) 5 Day: 3239.9 Down Trend,

- (Short-Term) 10 Day: 3278.7 Down Trend,

- (Intermediate-Term) 20 Day: 3286.6 Down Trend,

- (Intermediate-Term) 55 Day: 3198.7 Up Trend,

- (Long-Term) 100 Day: 3149.8 Up Trend,

- (Long-Term) 200 Day: 3378.2 Down Trend.

Additional Metrics

Recent Trade Signals

- 13 Oct 2025: Long EMD 12-25 @ 3217.2 Signals.USAR-WSFG

- 10 Oct 2025: Short EMD 12-25 @ 3213.1 Signals.USAR.TR720

- 09 Oct 2025: Short EMD 12-25 @ 3275.3 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The EMD futures daily chart shows a recent sharp move with large bars and fast momentum, indicating heightened volatility and active price swings. The short-term WSFG trend is up, but both the monthly (MSFG) and yearly (YSFG) session fib grids are trending down, with price currently below their respective NTZ/F0% levels, suggesting intermediate and long-term weakness. Swing pivot analysis confirms a dominant downtrend in both short- and intermediate-term, with the most recent pivot low at 3210.7 and resistance clustered near 3326–3352. Support levels are layered below, with 3149.8 and 3096.5 as key downside references. Daily benchmarks show most moving averages in a downtrend, except for the 55 and 100-day, which are still up but could be at risk if selling persists. The ATR and VOLMA values reflect increased volatility and active participation. Recent trade signals have flipped between short and long, highlighting a choppy environment with potential for both sharp reversals and trend continuations. Overall, the technical landscape is bearish across all timeframes, with the market under pressure and rallies likely to face resistance until a clear reversal or consolidation emerges.

Chart Analysis ATS AI Generated: 2025-10-14 07:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.