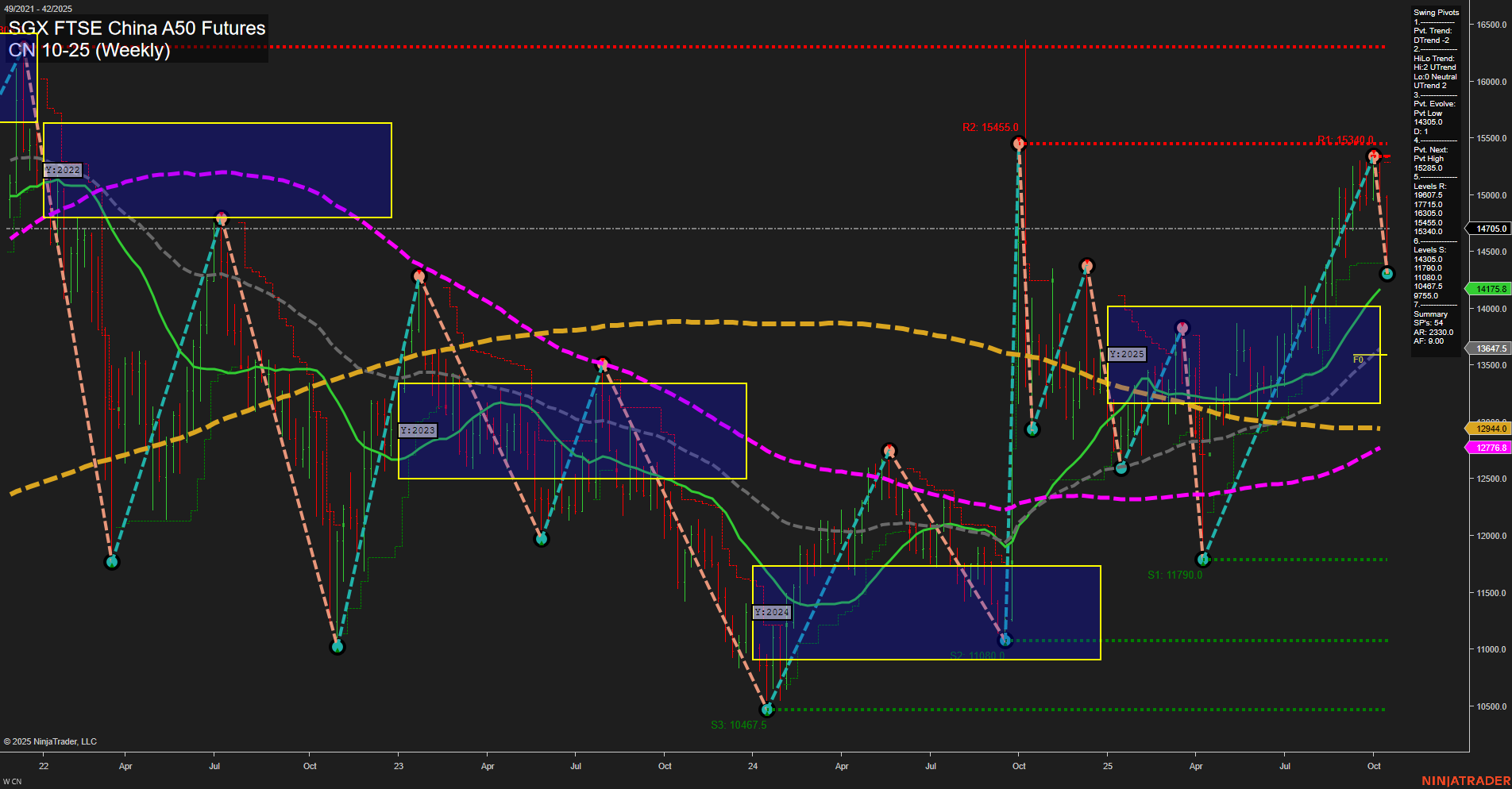

The CN SGX FTSE China A50 Futures weekly chart shows a recent sharp reversal from a swing high at 15,455, with large, fast-moving bars indicating heightened volatility and momentum to the downside. Both short-term and intermediate-term swing pivot trends have shifted to downtrends, with the most recent pivot low at 14,305 now acting as the nearest support. Resistance is stacked above at 15,285, 15,455, and 15,930, suggesting overhead supply zones. The 5- and 10-week moving averages have turned down, reinforcing the bearish tone in the short and intermediate term, while the 20- and 55-week moving averages remain in uptrends, providing some longer-term support. However, the 100- and 200-week moving averages are still in downtrends, reflecting a broader, unresolved long-term structure. The price is currently within the yearly NTZ, with all session fib grid trends neutral, indicating a lack of clear directional conviction on the higher timeframes. The market appears to be in a corrective phase after a strong rally, with potential for further downside retests of support levels if momentum persists. The overall structure suggests a transitionary period, with traders watching for either a continuation of the pullback or signs of stabilization and renewed upside.