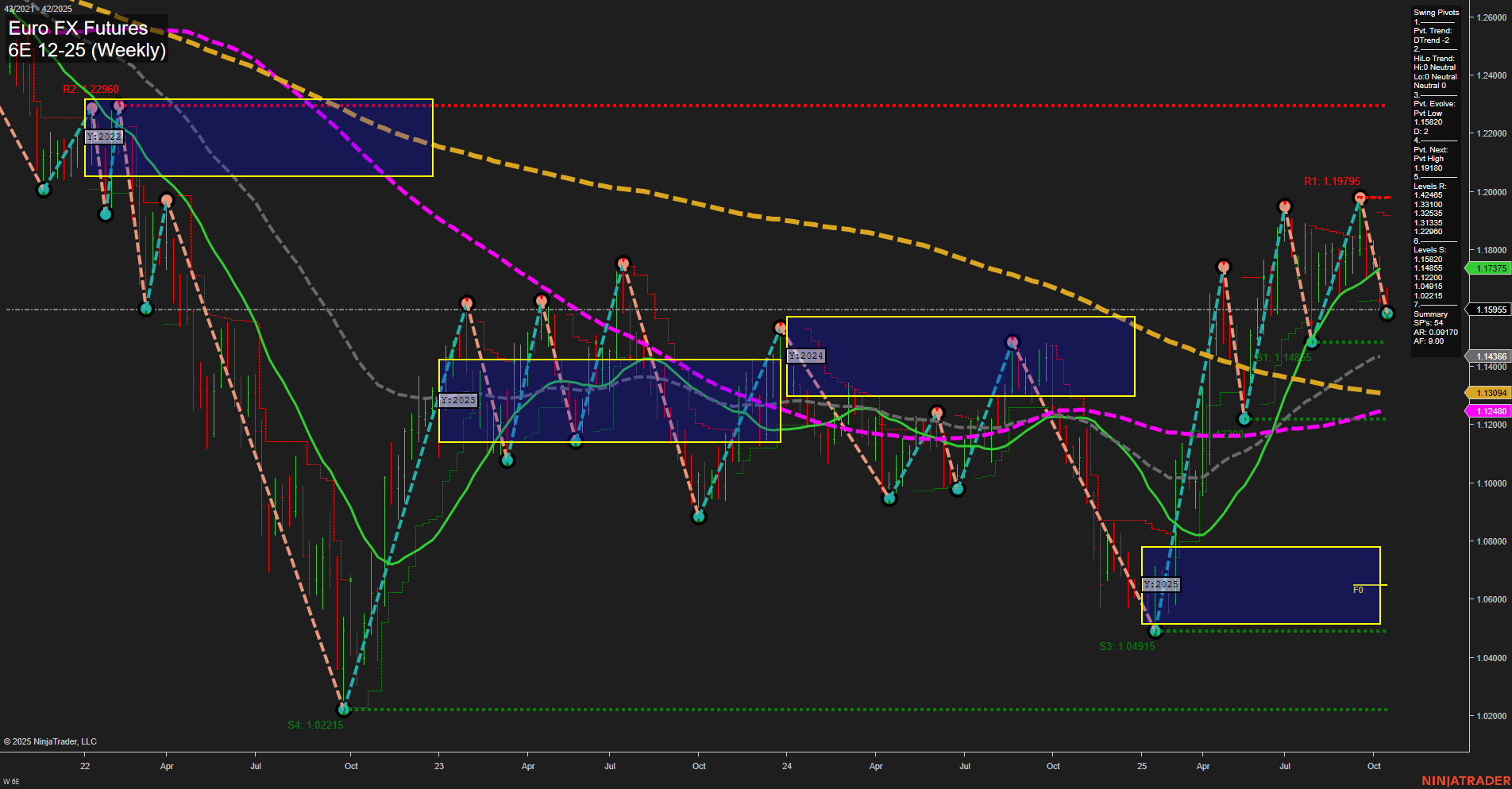

The 6E Euro FX Futures weekly chart shows a clear divergence between short/intermediate-term and long-term trends. Price action is currently below both the weekly and monthly session fib grid NTZs, with momentum at an average pace and medium-sized bars, indicating a steady but not extreme move lower. Both the short-term and intermediate-term swing pivot trends are down, supported by recent short trade signals and the position of price below key resistance levels. The 5- and 10-week moving averages are trending down, reinforcing the bearish tone for swing traders in the near term. However, the long-term picture remains constructive, with the yearly session fib grid showing price well above its NTZ and all major long-term moving averages (20, 55, 100, 200 week) trending up. This suggests that while the market is experiencing a corrective phase or pullback within a broader uptrend, the underlying bullish structure is intact. Key support levels to watch are 1.15922 and 1.14465, while resistance is stacked above at 1.19183 and 1.19795. The market is currently in a retracement phase, with potential for further downside in the short run, but the long-term uptrend could reassert itself if support holds and momentum shifts. This environment is typical of a corrective pullback within a larger bullish cycle, with swing traders likely to focus on short setups until signs of reversal or support stabilization emerge.