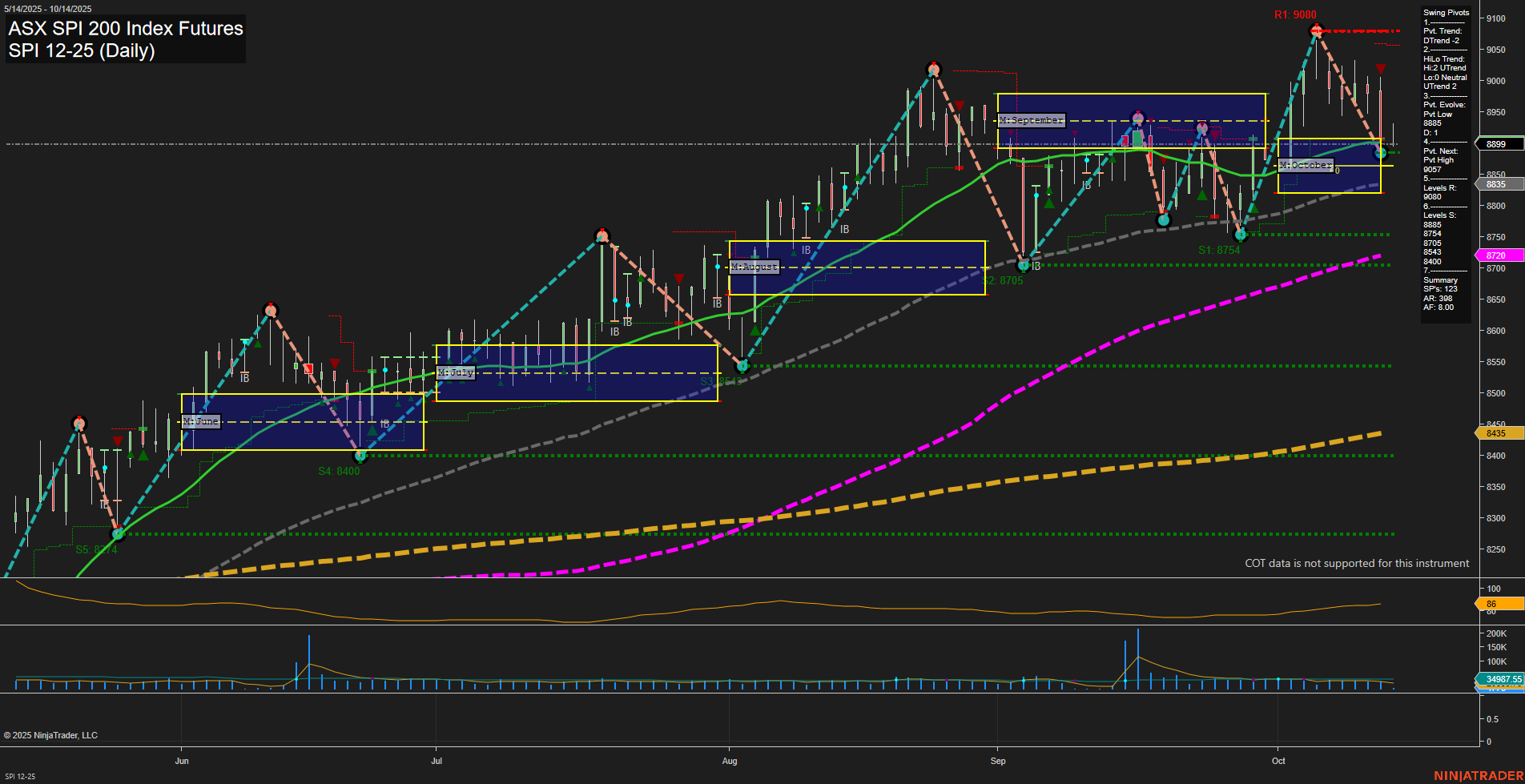

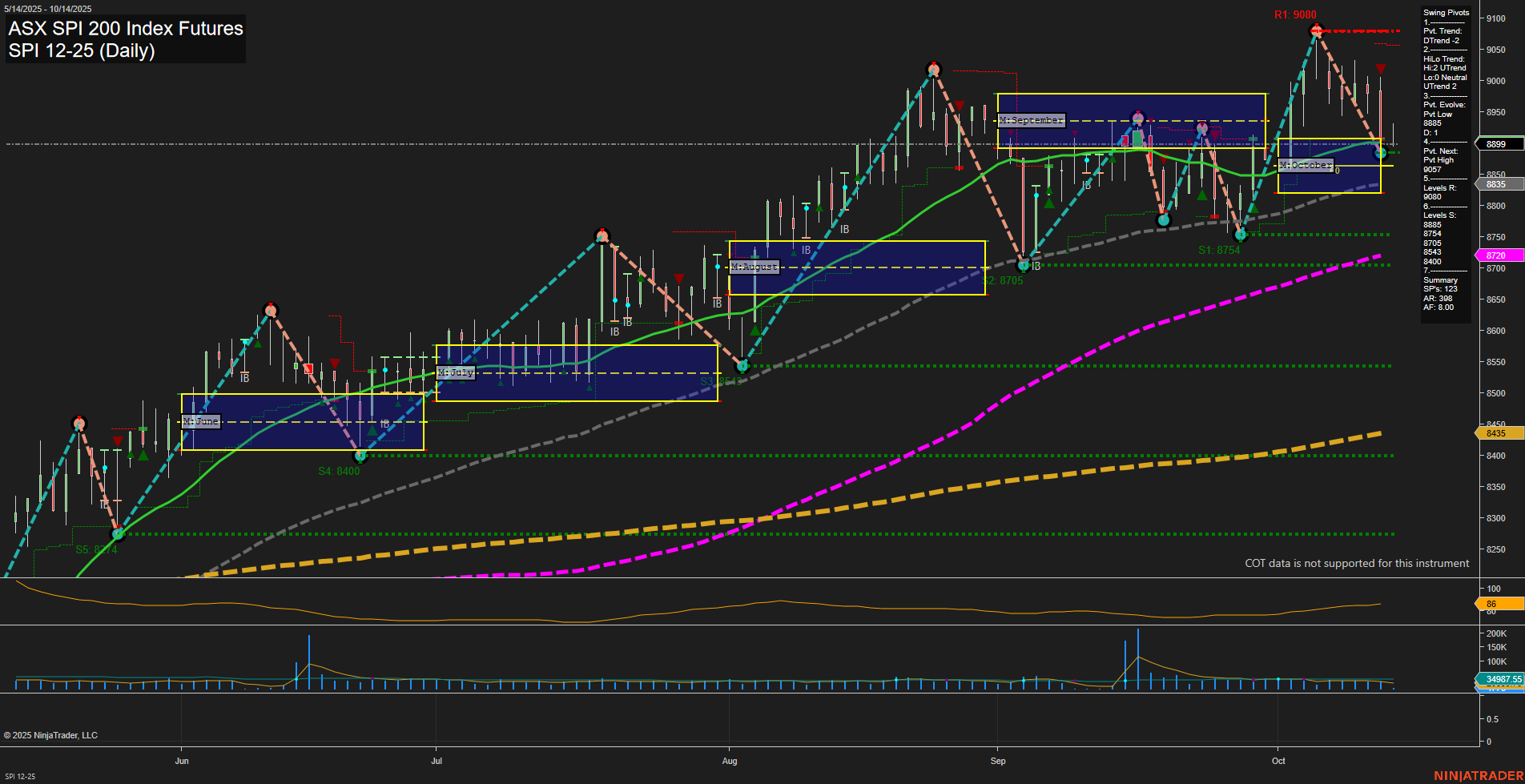

SPI ASX SPI 200 Index Futures Daily Chart Analysis: 2025-Oct-13 07:16 CT

Price Action

- Last: 8999,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 9080,

- 4. Pvt. Next: Pvt low 8754,

- 5. Levels R: 9080, 8985, 8905, 8835,

- 6. Levels S: 8754, 8705, 8605, 8400.

Daily Benchmarks

- (Short-Term) 5 Day: 8995 Down Trend,

- (Short-Term) 10 Day: 9027 Down Trend,

- (Intermediate-Term) 20 Day: 8970 Down Trend,

- (Intermediate-Term) 55 Day: 8720 Up Trend,

- (Long-Term) 100 Day: 8750 Up Trend,

- (Long-Term) 200 Day: 8435 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The SPI 200 futures daily chart currently reflects a market in transition. Short-term momentum has shifted to the downside, as indicated by the DTrend in swing pivots and all short-term moving averages (5, 10, 20 day) trending lower. The most recent swing pivot is a high at 9080, with the next key support at 8754, suggesting the market is in a corrective phase after a strong rally. Intermediate-term structure remains neutral, with the 55 and 100 day moving averages still trending up, supporting a longer-term bullish bias. Price is consolidating within the monthly and weekly session fib grids, with no clear directional bias from these frameworks. Volatility is moderate (ATR 96), and volume remains steady. The market is digesting recent gains, with a potential for further pullback or sideways action before the next directional move. Swing traders should note the proximity to key support and resistance levels, and the overall context of a long-term uptrend despite short-term weakness.

Chart Analysis ATS AI Generated: 2025-10-13 07:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.