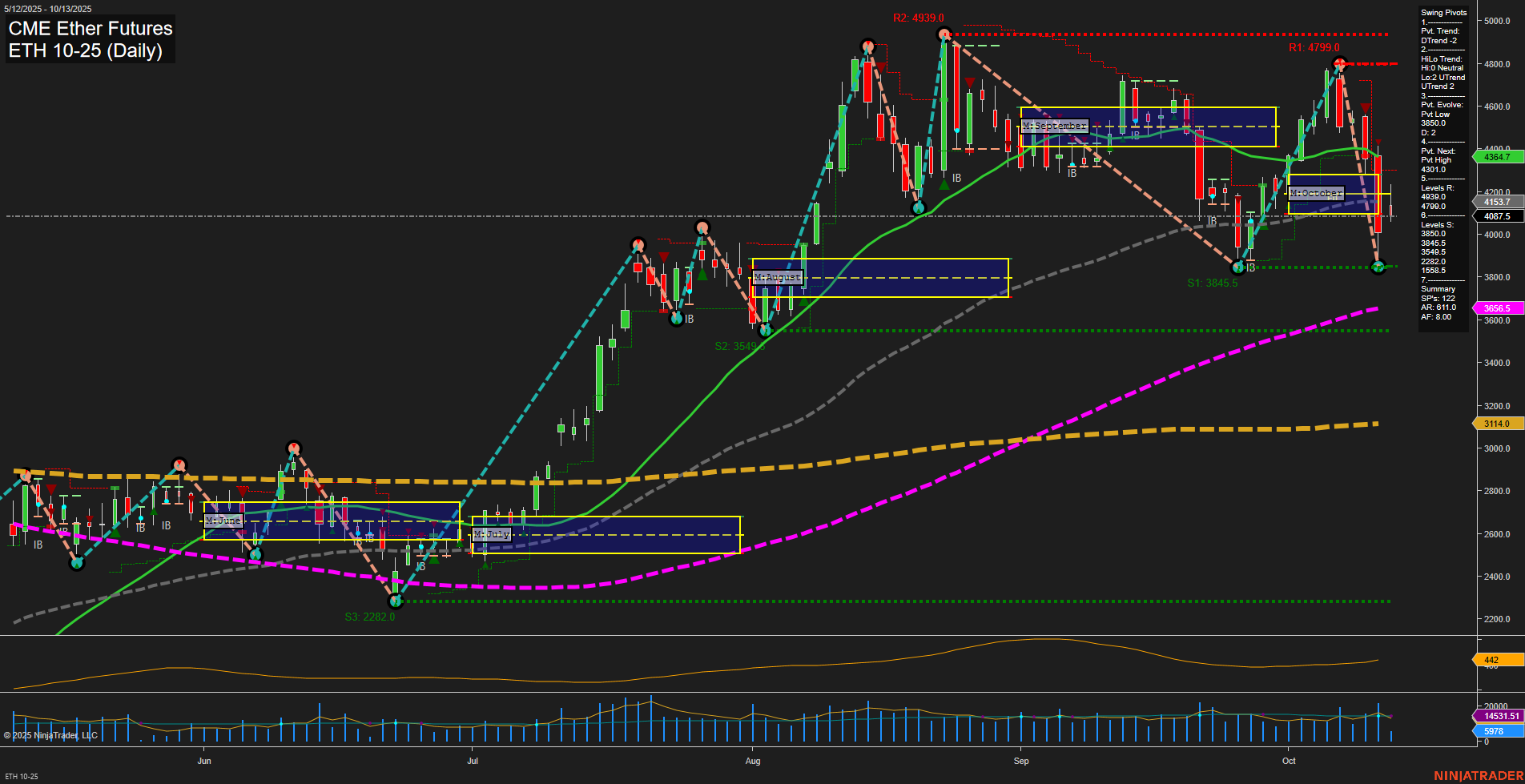

The current ETH CME Ether Futures daily chart reflects a market in transition. Price action has been volatile, with large bars and fast momentum, indicating heightened activity and possible liquidation or aggressive repositioning. Short-term and intermediate-term session fib grids (WSFG, MSFG) both show price below their respective NTZ centers and are trending down, confirming a bearish short-term environment. The swing pivot trend is down in the short-term, but the intermediate-term HiLo trend remains up, suggesting a possible larger timeframe support or a developing base. Recent price has bounced off a swing low at 3845.5, with the next key resistance at 4301.0 and major resistance at 4799.0 and 4939.0. Support levels are layered below, with 4087.5 as immediate support, followed by 3845.5 and deeper levels at 3549.5 and 2282.0. All short and intermediate-term moving averages are trending down, reinforcing the current bearish bias, while long-term MAs (100/200 day) remain in uptrends, indicating the broader bull cycle is intact. ATR and volume metrics are elevated, reflecting increased volatility and participation. Recent trade signals show a mix of short and long entries, highlighting the choppy, two-way nature of the current market. Overall, the short-term outlook is bearish, the intermediate-term is neutral as the market tests support and seeks direction, and the long-term remains bullish, with the uptrend in higher timeframes still valid. This environment is characterized by sharp pullbacks, potential for mean reversion bounces, and a need to watch for confirmation of either a trend continuation or a reversal at key levels.