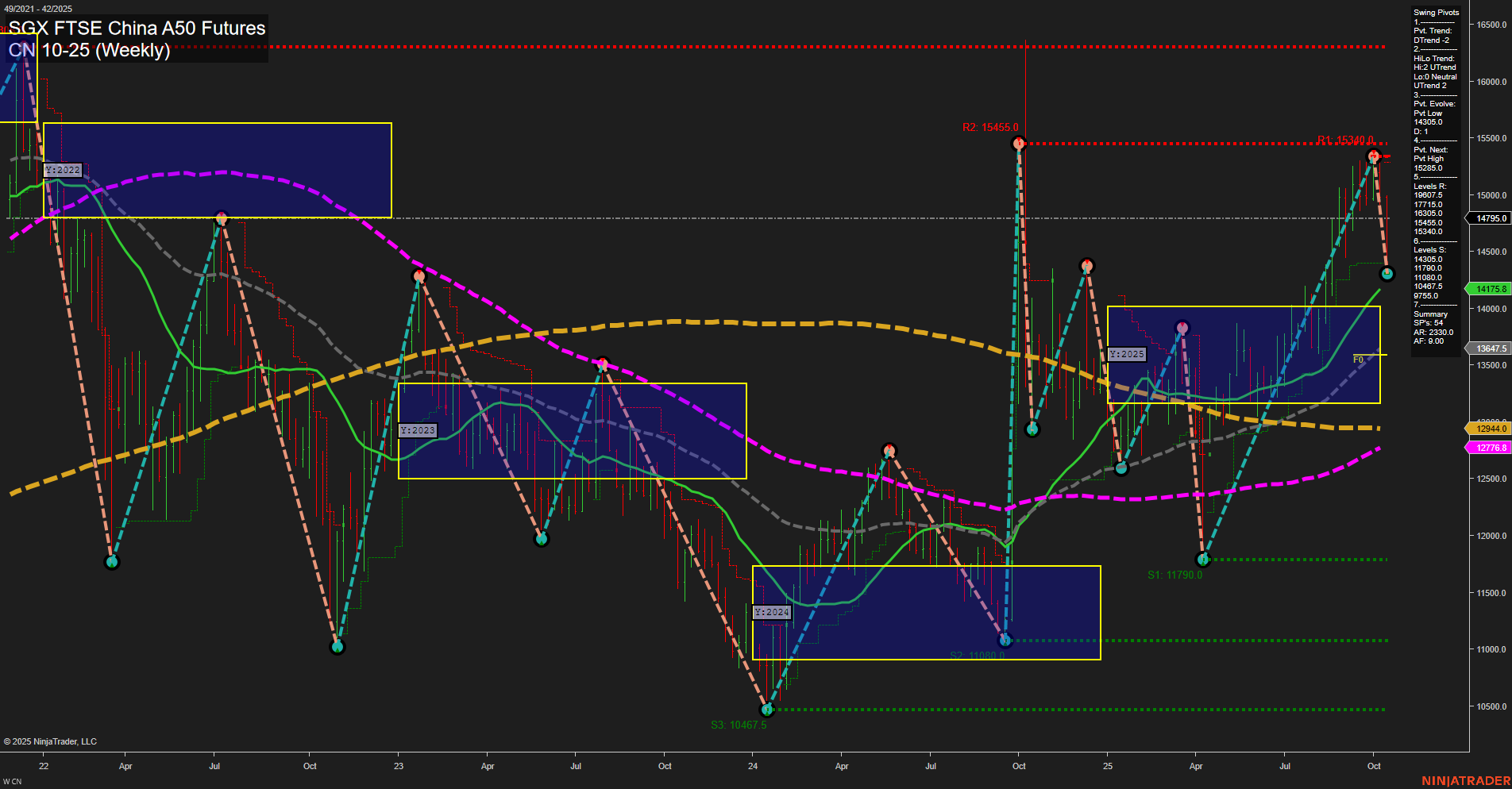

The CN SGX FTSE China A50 Futures weekly chart shows a recent sharp pullback from the swing high at 15,455, with price currently at 14,795. The large bars and fast momentum indicate heightened volatility and a strong reaction after a significant rally. Short-term swing pivot trend has turned bearish, suggesting a corrective phase or profit-taking after the recent highs. However, intermediate-term HiLo trend remains upward, reflecting underlying strength from the prior rally. Key resistance levels are clustered near recent highs (15,930, 15,455), while support is found at 14,305 and further below at 13,405 and 11,790, highlighting a wide trading range. All visible weekly moving averages (5, 10, 20, 55) are in uptrends, supporting a constructive medium-term outlook, but the 100 and 200 week MAs remain in downtrends, signaling that the long-term structure is still in transition. The neutral bias across all session fib grids (weekly, monthly, yearly) suggests the market is at a potential inflection point, consolidating gains and awaiting new catalysts. Overall, the short-term outlook is bearish due to the recent reversal, but the intermediate and long-term trends are neutral, with the potential for further consolidation or a retest of support before the next directional move.