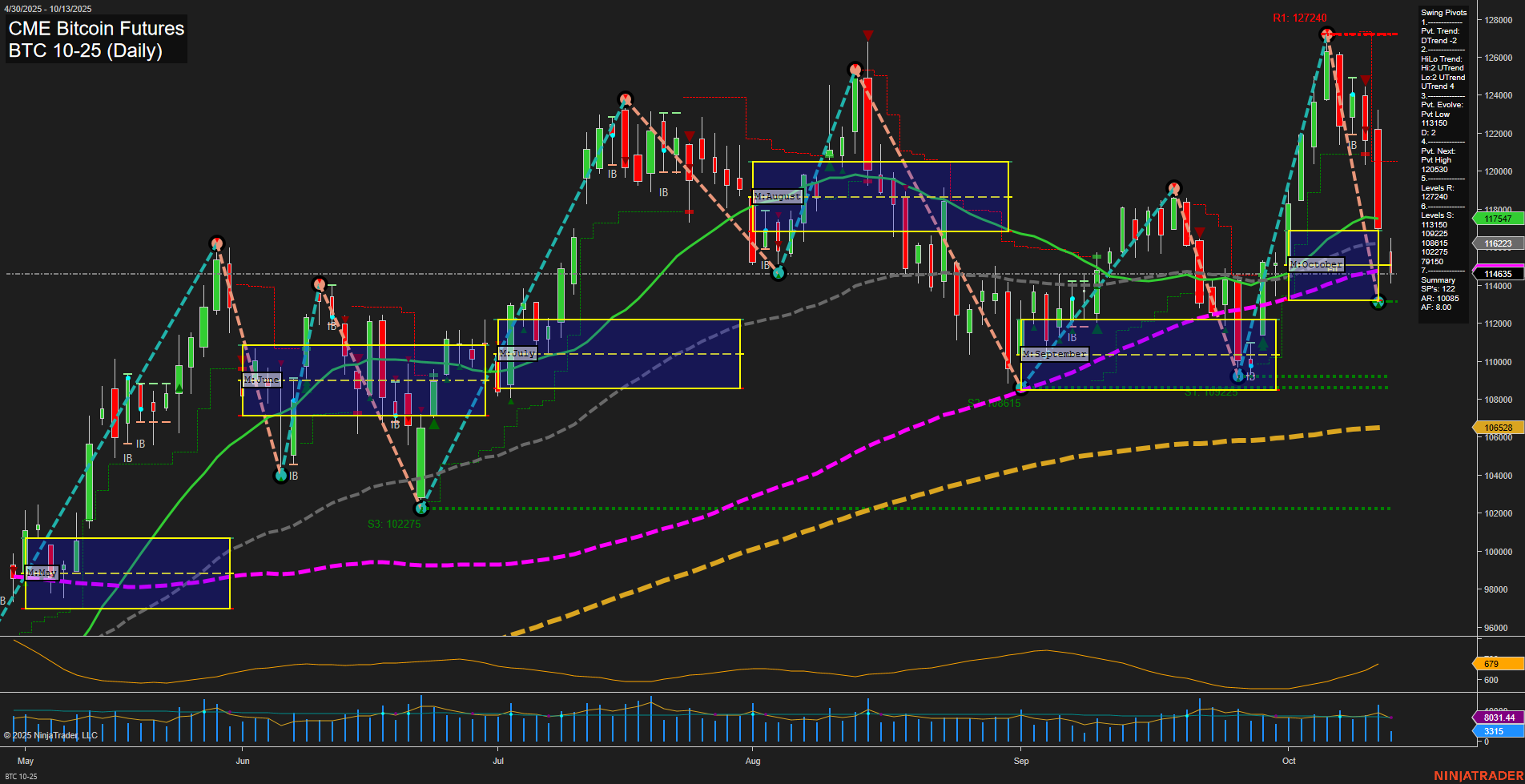

The current daily chart for CME Bitcoin Futures shows a strong short-term bearish momentum, with price action marked by large bars and fast momentum to the downside. Both the weekly and monthly session fib grids (WSFG and MSFG) indicate price is below their respective NTZ centers, confirming a downward trend in the short and intermediate timeframes. The swing pivot structure has shifted to a short-term downtrend, with the most recent pivot low at 113100 and the next potential reversal at 120530, while intermediate pivots still reflect an uptrend, suggesting a possible divergence or a developing consolidation phase. All short and intermediate-term moving averages (5, 10, 20, 55, 100 day) are trending down, reinforcing the bearish short-term outlook, while the 200-day MA remains in an uptrend, supporting a longer-term bullish structure. The ATR is elevated, indicating increased volatility, and volume remains robust, suggesting active participation during this move. Recent trade signals show both long and short entries in close succession, highlighting the choppy and volatile nature of the current market environment. Overall, the short-term outlook is bearish with potential for further downside or consolidation, while the long-term trend remains intact to the upside. Swing traders should be attentive to potential reversal signals near key support levels and watch for confirmation of trend continuation or a shift in the intermediate-term structure.