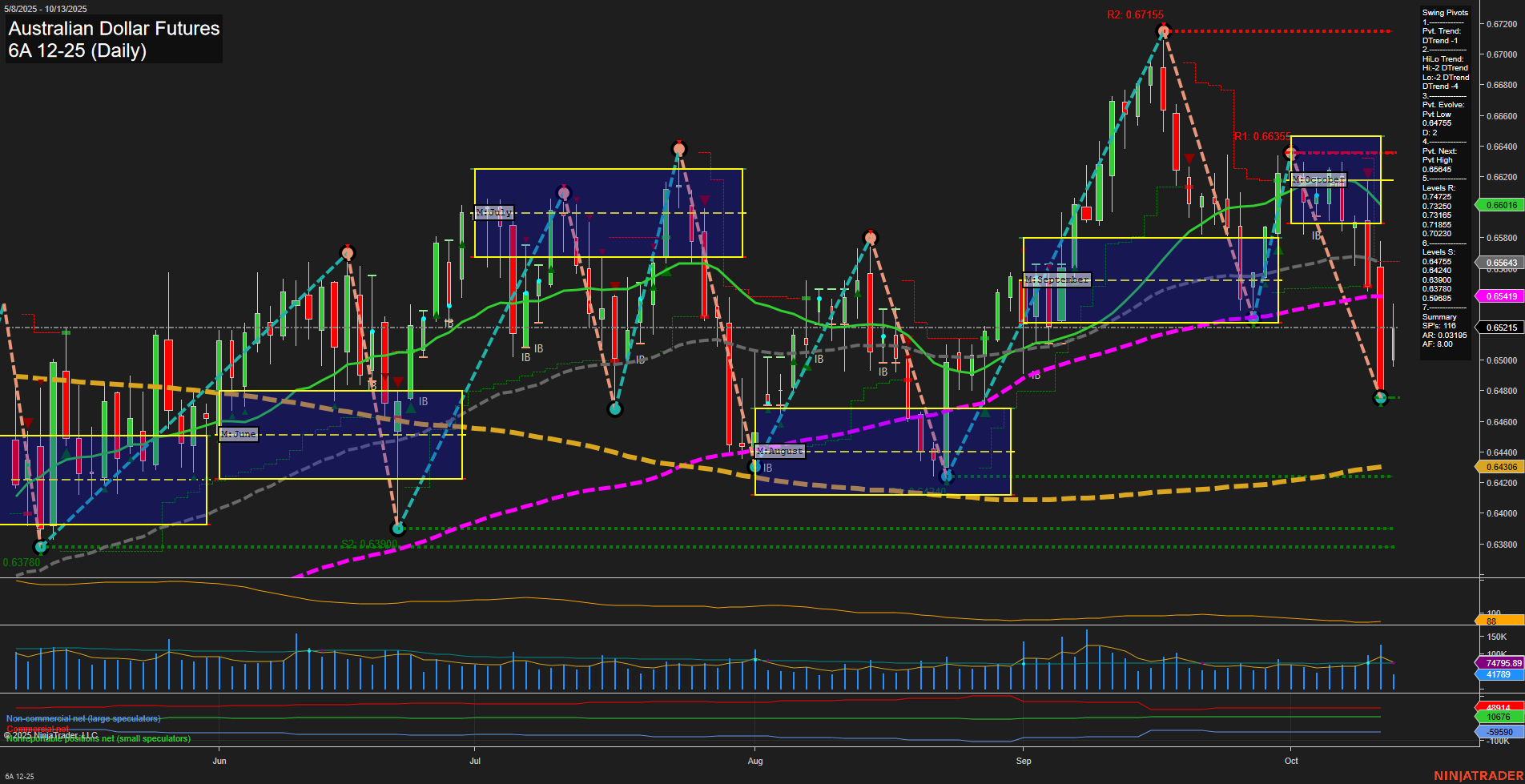

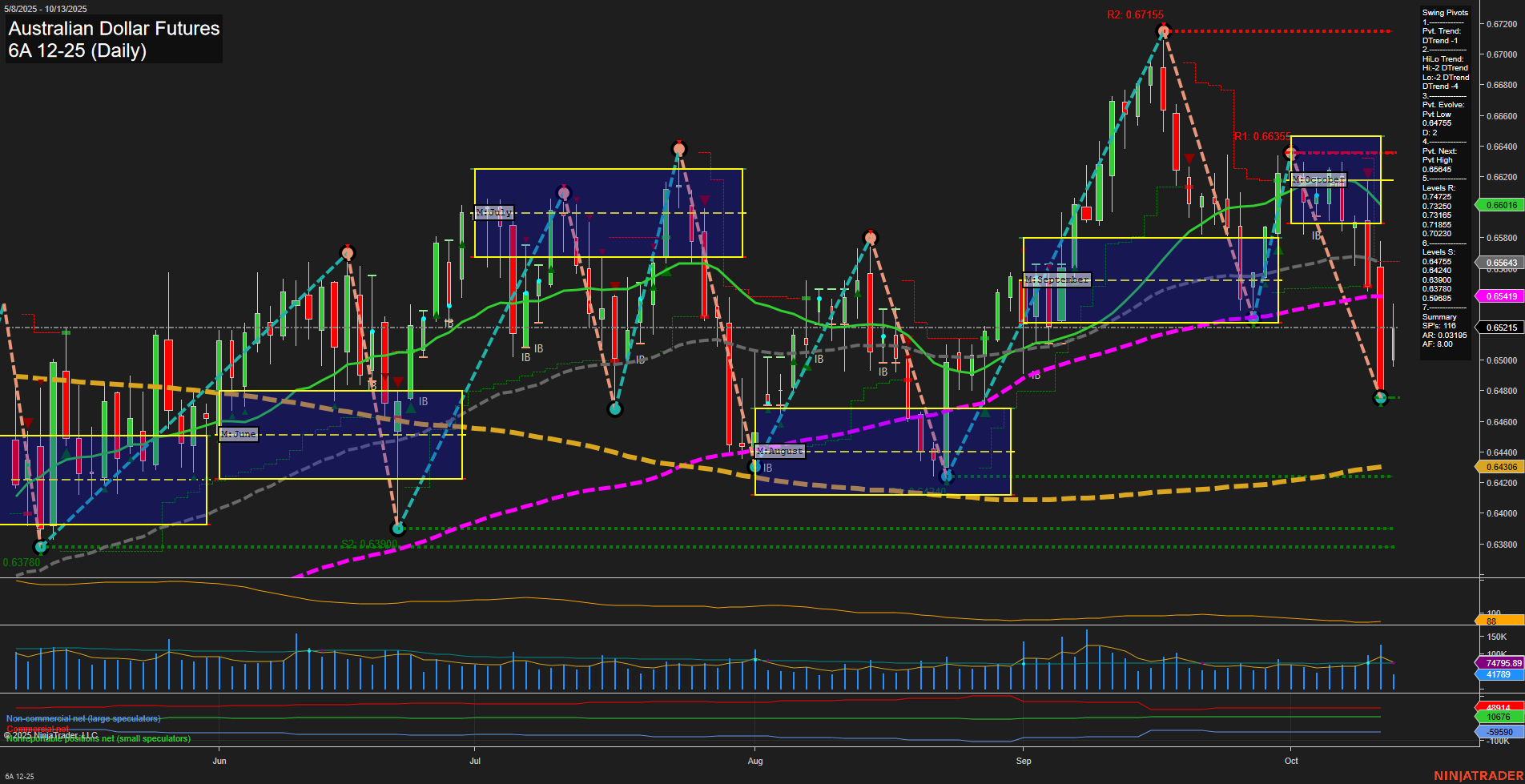

6A Australian Dollar Futures Daily Chart Analysis: 2025-Oct-13 07:00 CT

Price Action

- Last: 0.65215,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.65215,

- 4. Pvt. Next: Pvt high 0.66536,

- 5. Levels R: 0.66536, 0.67155,

- 6. Levels S: 0.65215, 0.64306, 0.63780.

Daily Benchmarks

- (Short-Term) 5 Day: 0.6586 Down Trend,

- (Short-Term) 10 Day: 0.6589 Down Trend,

- (Intermediate-Term) 20 Day: 0.6591 Down Trend,

- (Intermediate-Term) 55 Day: 0.6542 Down Trend,

- (Long-Term) 100 Day: 0.6541 Down Trend,

- (Long-Term) 200 Day: 0.6430 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The Australian Dollar Futures (6A) daily chart shows a pronounced shift to the downside, with a fast momentum move and large bars indicating strong selling pressure. Both short-term and intermediate-term swing pivot trends are in a clear downtrend, with the most recent pivot low established at 0.65215 and resistance levels above at 0.66536 and 0.67155. All key moving averages (5, 10, 20, 55, 100-day) are trending down, reinforcing the bearish bias, though the 200-day MA remains in an uptrend, suggesting the longer-term structure is still neutral. The ATR is elevated, reflecting increased volatility, while volume remains robust. The market is currently testing support at the recent swing low, with further support at 0.64306 and 0.63780. The overall environment is characterized by a strong bearish impulse in the short and intermediate term, with the potential for further downside if support levels fail, while the long-term trend remains neutral as price is still above the 200-day MA. No clear reversal signals are present, and the market is in a momentum-driven phase following a breakdown from the October range.

Chart Analysis ATS AI Generated: 2025-10-13 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.