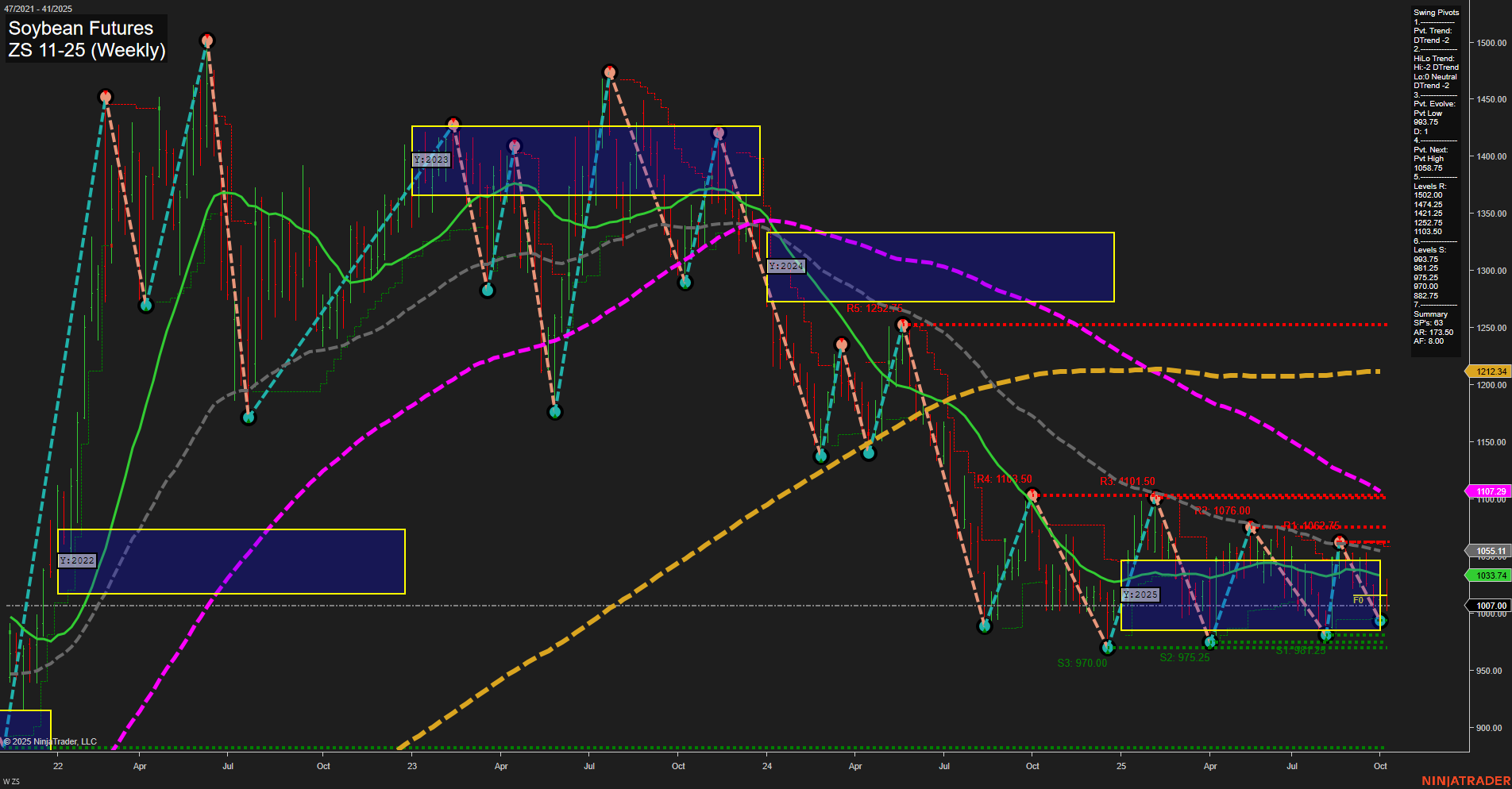

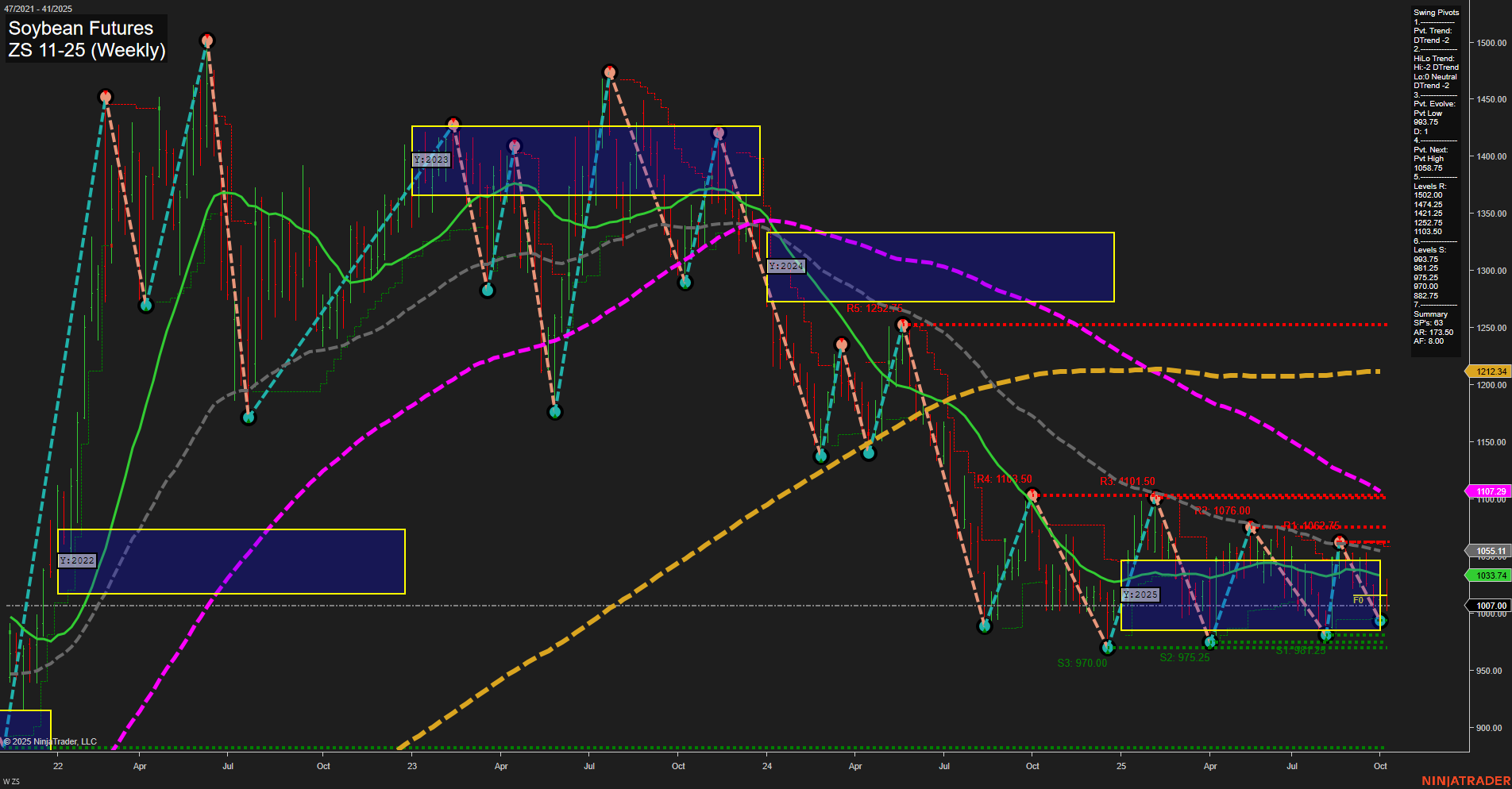

ZS Soybean Futures Weekly Chart Analysis: 2025-Oct-12 18:16 CT

Price Action

- Last: 1007.00,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -36%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 18%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 5. Levels R: 1252.75, 1201.50, 1147.25, 1101.50, 1076.00, 1055.75,

- 6. Levels S: 975.25, 970.00, 882.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1033.74 Down Trend,

- (Intermediate-Term) 10 Week: 1055.11 Down Trend,

- (Long-Term) 20 Week: 1107.29 Down Trend,

- (Long-Term) 55 Week: 1212.34 Down Trend,

- (Long-Term) 100 Week: 0.00,

- (Long-Term) 200 Week: 0.00.

Recent Trade Signals

- 10 Oct 2025: Short ZS 11-25 @ 1013.75 Signals.USAR-WSFG

- 10 Oct 2025: Short ZS 11-25 @ 1017 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Soybean futures continue to exhibit a dominant bearish structure across all timeframes. Price action remains subdued, with slow momentum and medium-sized bars reflecting a lack of strong directional conviction. The weekly session fib grid (WSFG) and yearly session fib grid (YSFG) both show price below their respective NTZ centers, confirming persistent downward pressure. Swing pivot analysis highlights a prevailing downtrend in both short- and intermediate-term trends, with resistance levels stacked well above current price and support levels clustered near recent lows. All visible benchmark moving averages (5, 10, 20, 55 week) are trending down, reinforcing the broader negative bias. Recent trade signals have triggered new short entries, aligning with the prevailing trend. The market appears to be in a prolonged corrective or distribution phase, with no clear signs of reversal or strong buying interest. Volatility remains contained, and the price is consolidating near support, suggesting the potential for further tests of lower levels unless a significant catalyst emerges.

Chart Analysis ATS AI Generated: 2025-10-12 18:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.