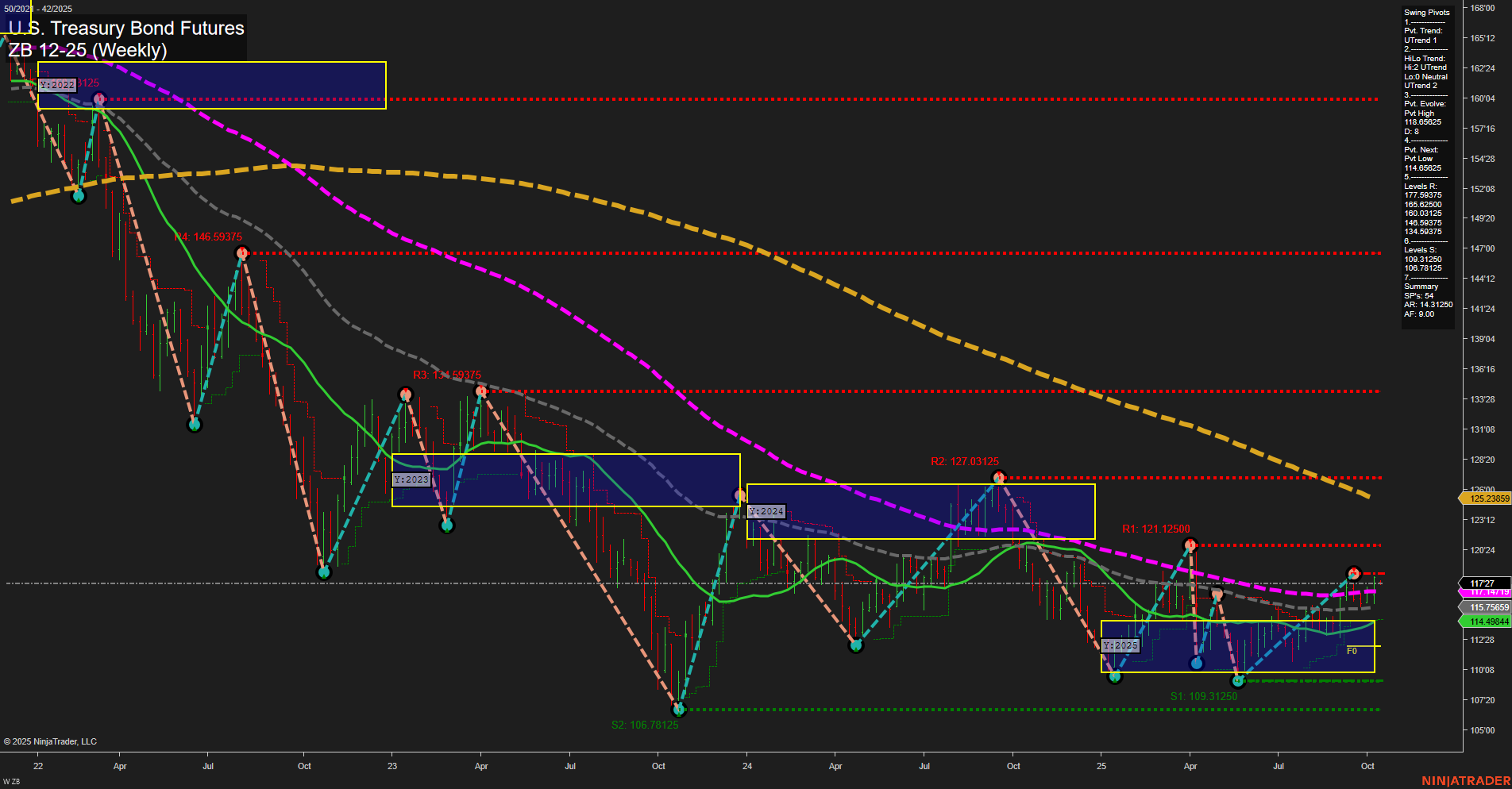

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has shifted to an average momentum phase with medium-sized bars, indicating a move away from the previous high volatility. Both short-term and intermediate-term swing pivot trends have turned upward, supported by a series of higher lows and a recent pivot high at 118.09375. The price is currently above the 5, 10, and 20-week moving averages, all of which are trending up, reinforcing the bullish tone in the short and intermediate timeframes. However, the longer-term moving averages (55, 100, and 200 weeks) remain in a downtrend, highlighting that the broader trend is still bearish and the current rally is counter-trend in nature. Resistance levels are stacked above at 121.12500, 127.03125, and higher, while support is found at 114.06225 and 109.31250. The market is consolidating within the yearly NTZ, with no clear breakout yet, and the overall technical structure suggests a potential for further upside in the short to intermediate term, but with significant overhead resistance and a dominant long-term bearish backdrop. This environment is typical of a market in a corrective phase within a larger downtrend, where swing traders may see opportunities for both trend continuation and mean reversion plays depending on timeframe.