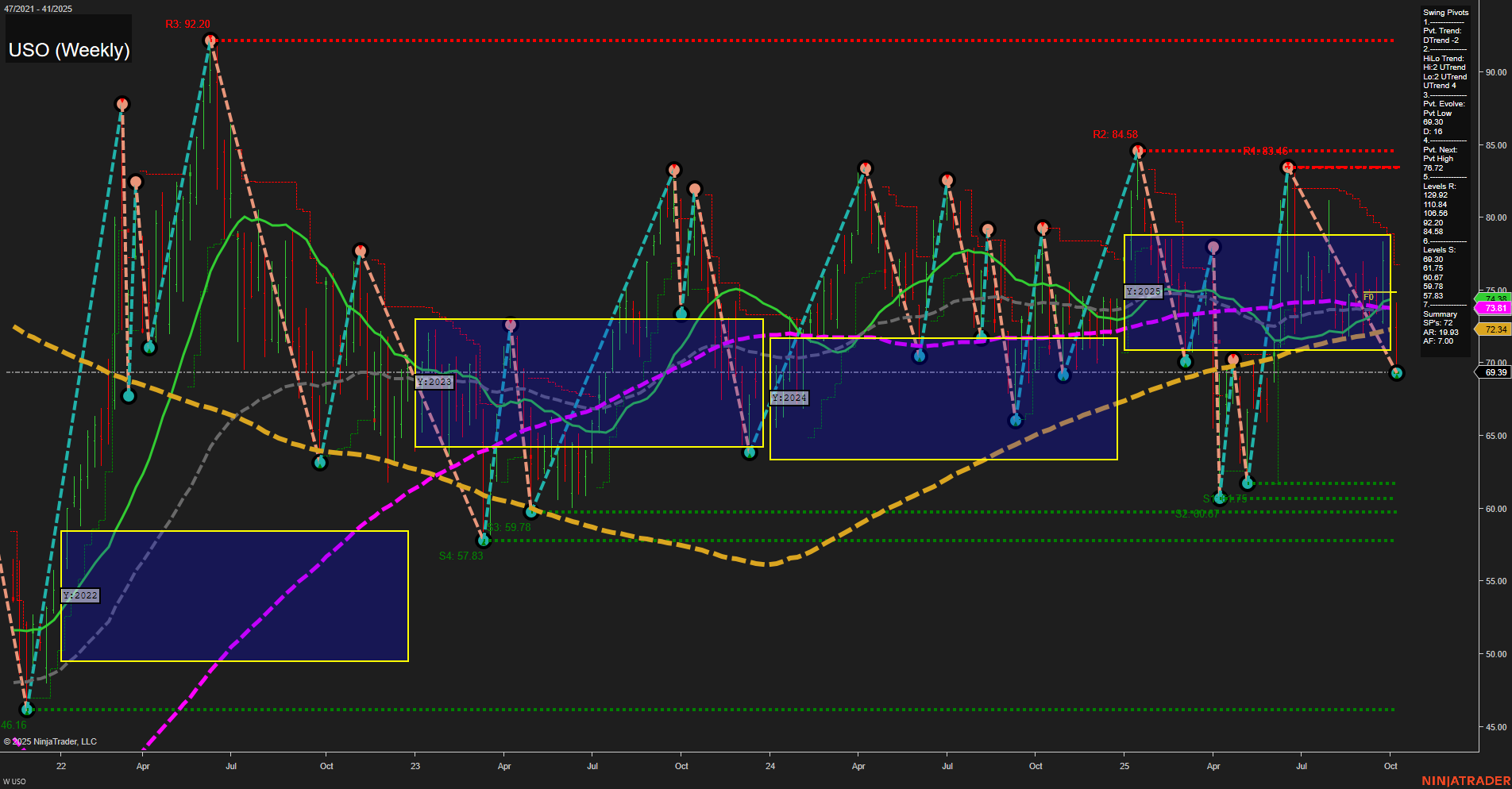

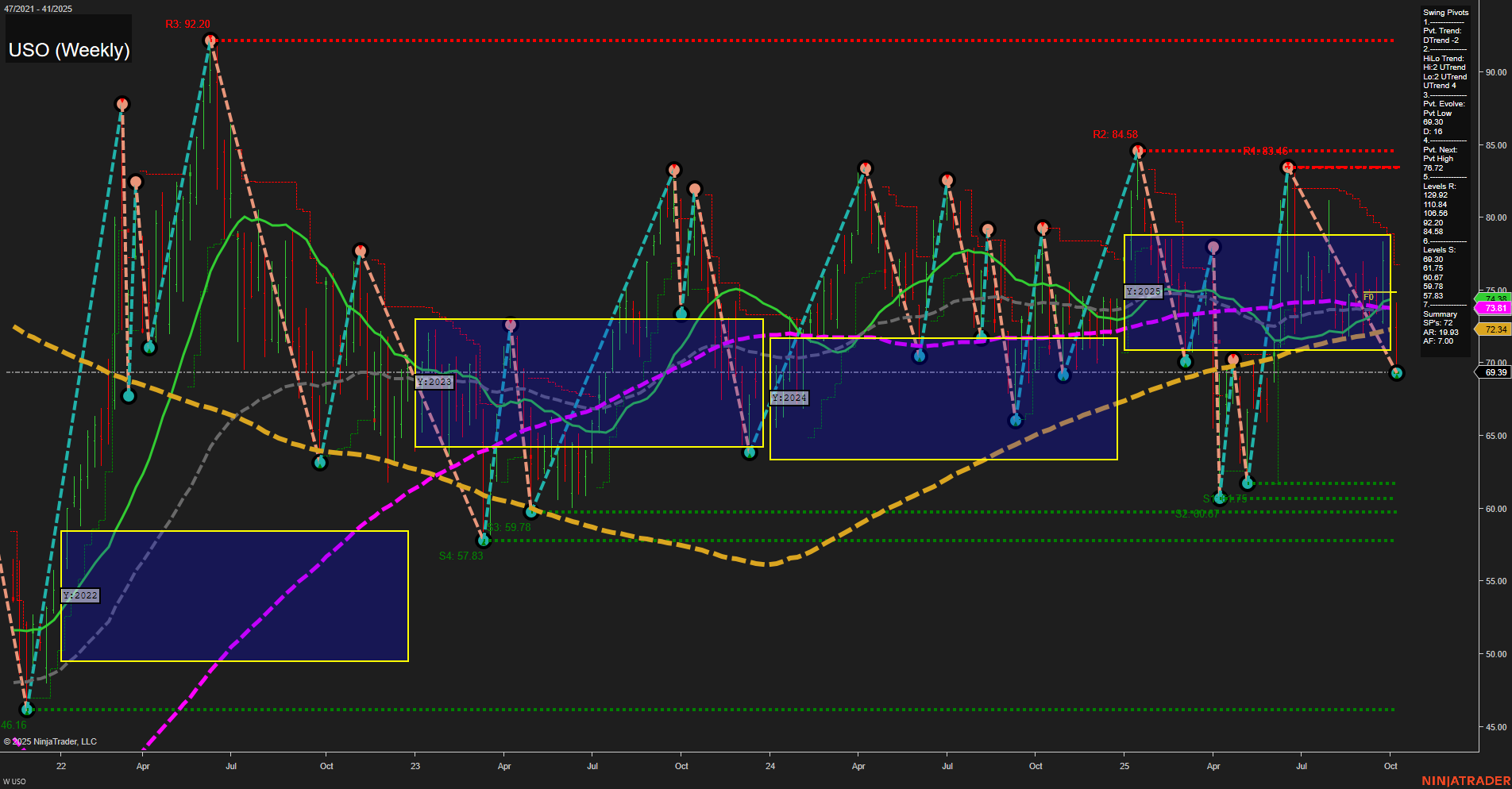

USO United States Oil Fund LP Weekly Chart Analysis: 2025-Oct-12 18:14 CT

Price Action

- Last: 69.39,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 69.07,

- 4. Pvt. Next: Pvt High 83.46,

- 5. Levels R: 92.20, 84.58, 83.46,

- 6. Levels S: 69.07, 57.83, 46.16.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 73.81 Down Trend,

- (Intermediate-Term) 10 Week: 72.34 Down Trend,

- (Long-Term) 20 Week: 72.04 Down Trend,

- (Long-Term) 55 Week: 70.00 Down Trend,

- (Long-Term) 100 Week: 75.06 Down Trend,

- (Long-Term) 200 Week: 61.07 Up Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

USO is currently exhibiting a slow momentum pullback with medium-sized weekly bars, and the last price is sitting just above a recent swing low support at 69.07. The short-term swing pivot trend is down, while the intermediate-term HiLo trend remains up, indicating a mixed environment with potential for mean reversion or range-bound action. All key weekly moving averages (5, 10, 20, 55, 100) are trending down, reinforcing a bearish short-term bias, but the 200-week MA remains in an uptrend, suggesting longer-term structural support. Price is consolidating within the yearly NTZ, with no clear directional bias from the session fib grids, and is trading below several major resistance levels (83.46, 84.58, 92.20). The overall structure points to a market in consolidation after a recent sell-off, with volatility compressing and no clear breakout or breakdown yet. Swing traders may observe for further confirmation of trend continuation or reversal, as the market is at a technical crossroads between support and resistance, with the potential for choppy or sideways price action in the near term.

Chart Analysis ATS AI Generated: 2025-10-12 18:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.