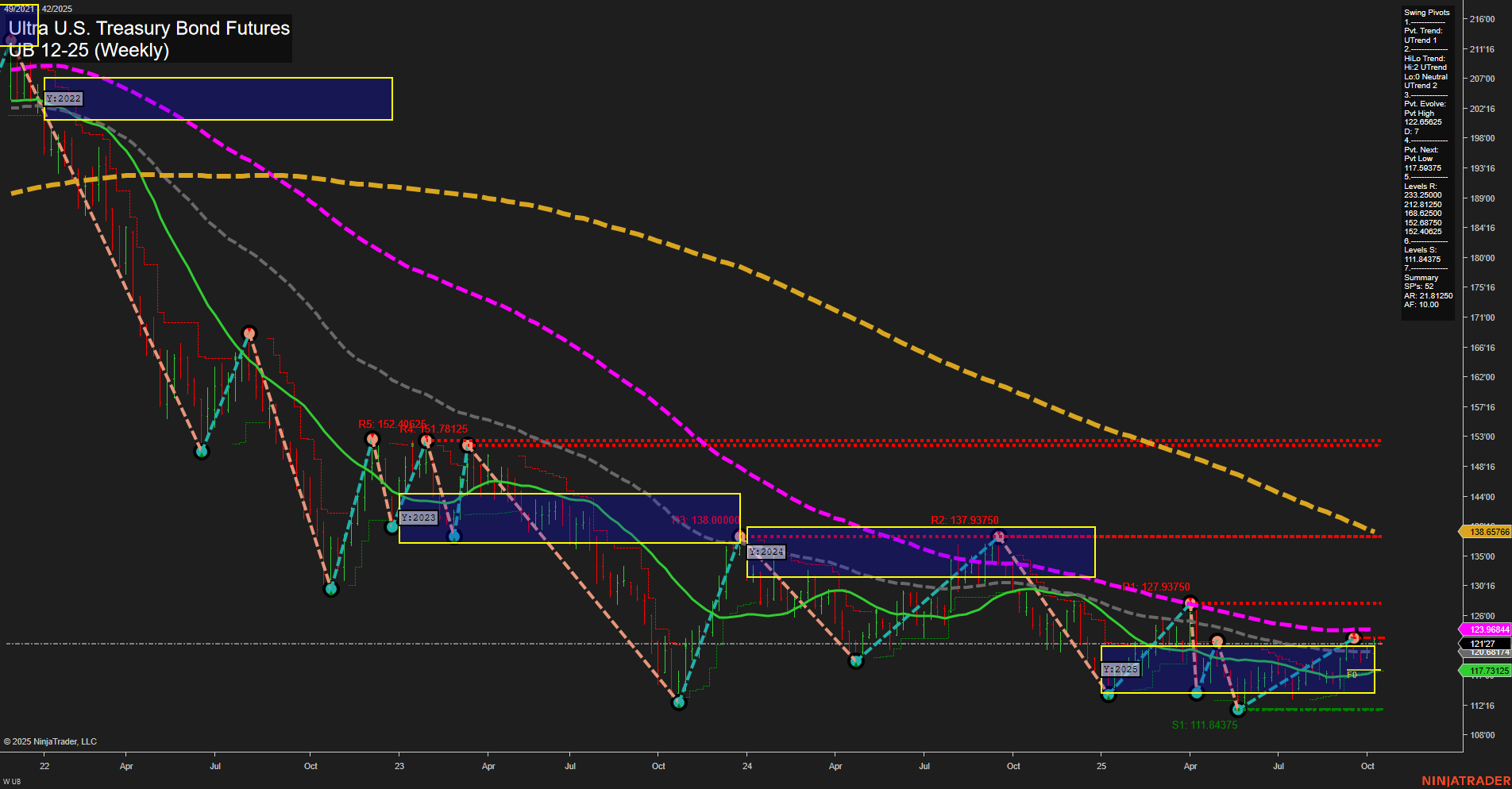

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Short-term price action is neutral, with average momentum and medium-sized bars, reflecting a period of consolidation after recent volatility. The Weekly Session Fib Grid (WSFG) trend remains down, with price below the NTZ center, indicating lingering short-term weakness. However, both the Monthly (MSFG) and Yearly (YSFG) Session Fib Grids are trending up, with price above their respective NTZ centers, suggesting a shift toward intermediate and long-term recovery. Swing pivot analysis highlights an evolving uptrend in both short- and intermediate-term trends, with the most recent pivot high at 122'06.25 and key support at 117'73.125 and 111'84.375. Resistance levels are stacked well above current price, indicating significant overhead supply zones that could cap rallies. Benchmark moving averages paint a mixed picture: the 10-week MA is trending up, but all other key MAs (5, 20, 55, 100, 200 week) are in downtrends, reinforcing the idea that the broader long-term trend remains bearish despite recent upward momentum. Recent trade signals have triggered long entries, aligning with the intermediate-term bullish bias. Overall, the market is in a corrective phase within a larger downtrend, with signs of a potential intermediate-term reversal. Price is testing key resistance and support levels, and the interplay between short-term consolidation and intermediate-term bullish signals will be critical in determining the next major move. The environment is characterized by choppy, range-bound action with the potential for breakout attempts as the market seeks direction.